- Hong Kong

- /

- Real Estate

- /

- SEHK:688

How Investors May Respond To China Overseas Land & Investment (SEHK:688) Leading Urban Renewal and Inventory Growth

Reviewed by Sasha Jovanovic

- Between January and October 2025, China Overseas Land & Investment secured the top position among major real estate companies for new added inventory value, driven by the acquisition of significant urban renewal projects in Shanghai.

- This achievement reflects a broader pickup in land acquisitions across the sector, with state-owned enterprises playing a leading role.

- We’ll explore how the company’s leadership in new inventory value and urban renewal activity shapes its overall investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is China Overseas Land & Investment's Investment Narrative?

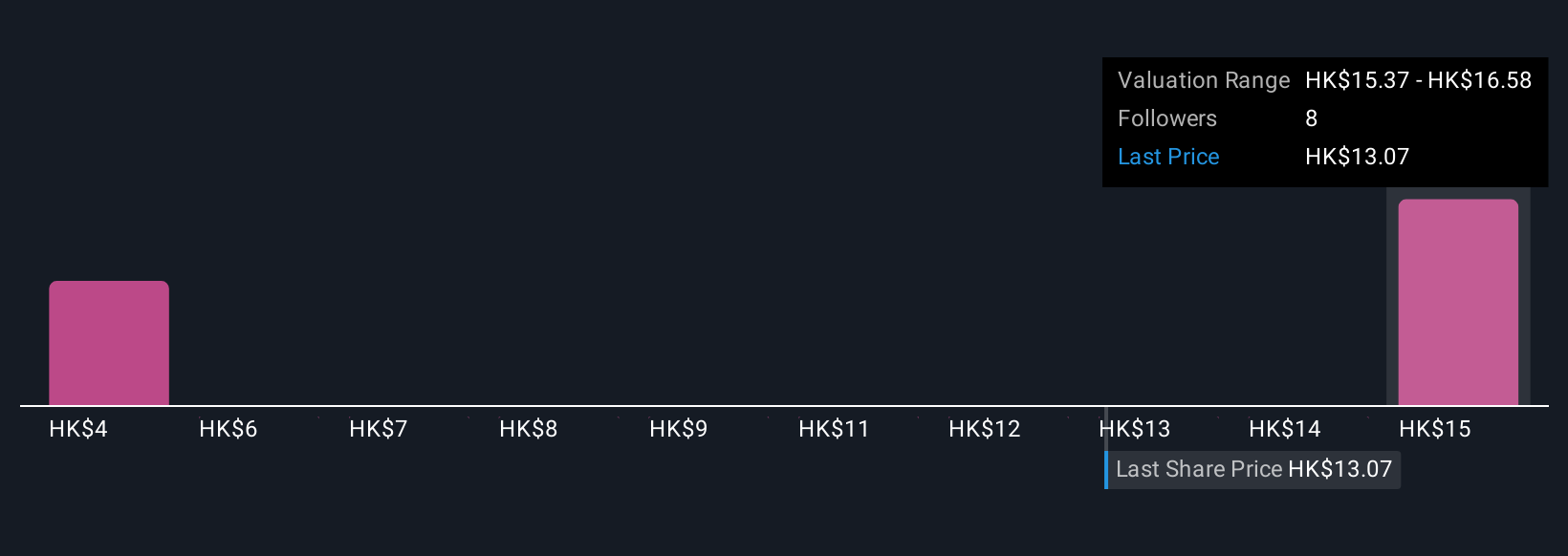

To be comfortable as a shareholder in China Overseas Land & Investment, you need to believe in the underlying value of its land bank and the company’s ability to capitalize on periods of renewed sector activity. The recent surge in new inventory through high-profile urban renewal projects in Shanghai stands out as a rare bright spot and could reinforce confidence in its short-term growth catalysts. This material boost in land acquisitions may ease concerns about slumping sales and declining earnings seen in recent results, especially given the broader industry’s cautious recovery. However, while state ownership and management experience offer some defensive qualities, the unstable dividend track record and historically lower profit growth compared to industry peers remain significant risks. The impact of this news could shift the narrative, at least temporarily, toward higher potential for value realization if momentum is sustained. Yet, higher inventory also raises concerns over future earnings quality in a slower market.

China Overseas Land & Investment's share price has been on the slide but might be dropping deeper into value territory. Find out whether it's a bargain at this price.Exploring Other Perspectives

Explore 2 other fair value estimates on China Overseas Land & Investment - why the stock might be worth less than half the current price!

Build Your Own China Overseas Land & Investment Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Overseas Land & Investment research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Overseas Land & Investment research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Overseas Land & Investment's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:688

China Overseas Land & Investment

An investment holding company, engages in the property development, commercial property operations, and other businesses in the People’s Republic of China and the United Kingdom.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives