Stock Analysis

- Hong Kong

- /

- Semiconductors

- /

- SEHK:85

Exploring Hong Kong Dividend Stocks In June 2024

Reviewed by Simply Wall St

Amid fluctuating global markets, the Hang Seng Index in Hong Kong has shown resilience with a notable rise of 1.59%. This uptick reflects investor optimism potentially spurred by regional economic stimuli and market-specific dynamics. In this context, exploring dividend stocks in Hong Kong could offer insights into opportunities where steady income streams are a priority for investors navigating the current economic landscape.

Top 10 Dividend Stocks In Hong Kong

| Name | Dividend Yield | Dividend Rating |

| China Construction Bank (SEHK:939) | 7.77% | ★★★★★★ |

| Agricultural Bank of China (SEHK:1288) | 7.67% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 8.88% | ★★★★★★ |

| CITIC Telecom International Holdings (SEHK:1883) | 9.73% | ★★★★★★ |

| S.A.S. Dragon Holdings (SEHK:1184) | 9.21% | ★★★★★☆ |

| China Electronics Huada Technology (SEHK:85) | 7.66% | ★★★★★☆ |

| Bank of China (SEHK:3988) | 6.84% | ★★★★★☆ |

| China Mobile (SEHK:941) | 6.48% | ★★★★★☆ |

| Sinopharm Group (SEHK:1099) | 4.05% | ★★★★★☆ |

| International Housewares Retail (SEHK:1373) | 8.55% | ★★★★★☆ |

Click here to see the full list of 94 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Tsim Sha Tsui Properties (SEHK:247)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tsim Sha Tsui Properties Limited operates as an investment holding company, focusing on investing in, developing, managing, and trading properties primarily in Hong Kong, Mainland China, Singapore, and Australia with a market capitalization of approximately HK$38.18 billion.

Operations: Tsim Sha Tsui Properties Limited generates revenue through various segments, including HK$5.41 billion from property sales, HK$2.83 billion from property rentals, HK$1.29 billion from property management and other services, HK$923.34 million from hotel operations, HK$61.05 million from financing, and HK$45.33 million from investments in securities.

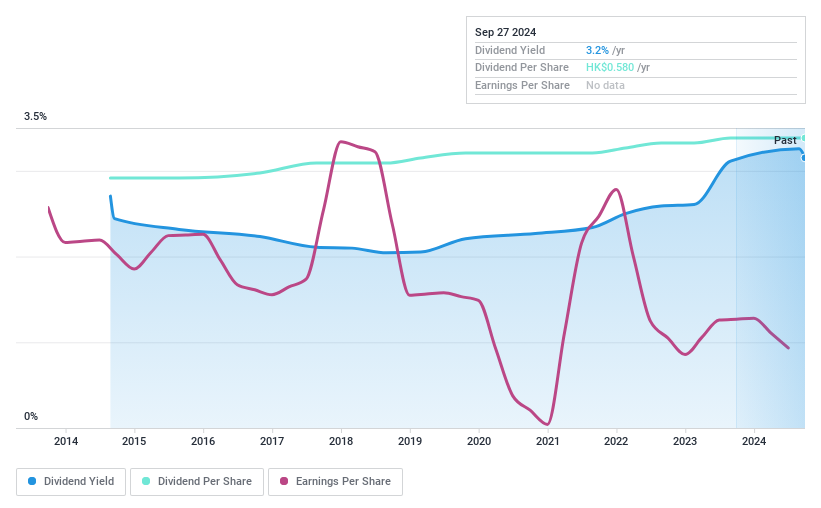

Dividend Yield: 3.2%

Tsim Sha Tsui Properties has shown a notable earnings growth of 53.2% over the past year, yet its dividend sustainability is under scrutiny. Despite a low payout ratio of 35.2%, indicating that dividends are well covered by earnings, the dividends are not supported by free cash flow and overall cash flows, posing potential risks for long-term sustainability. Additionally, while dividends have increased consistently over the past decade and have been reliable, the current yield of 3.22% remains relatively low compared to Hong Kong's top dividend payers at 7.64%.

- Click here to discover the nuances of Tsim Sha Tsui Properties with our detailed analytical dividend report.

- Our valuation report here indicates Tsim Sha Tsui Properties may be overvalued.

E-Star Commercial Management (SEHK:6668)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: E-Star Commercial Management Company Limited operates as an investment holding company, offering operational services for commercial properties to owners and tenants in the People's Republic of China, with a market capitalization of approximately HK$1.38 billion.

Operations: E-Star Commercial Management primarily generates revenue through the provision of operational services for commercial properties, totaling CN¥635.01 million.

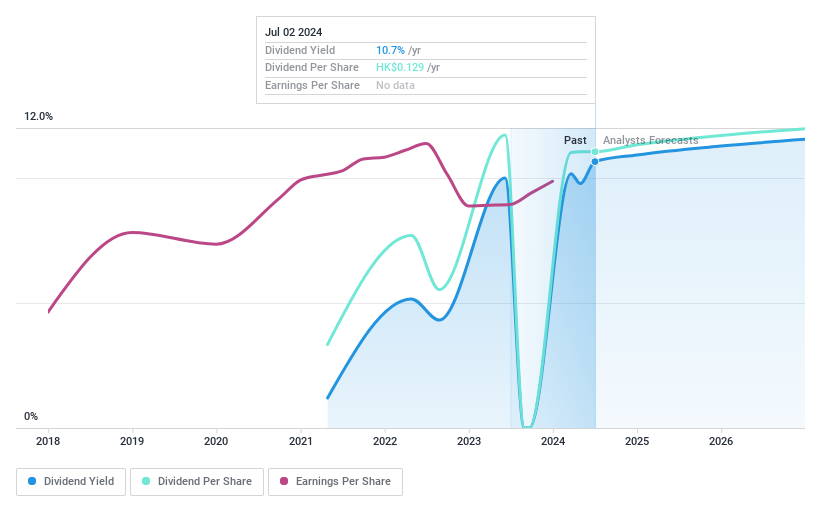

Dividend Yield: 9.5%

E-Star Commercial Management recently approved a final dividend of HK$0.13 per share, reflecting a stable payout with a 70.1% earnings coverage and 40.8% cash flow coverage, indicating sustainability. The company's earnings increased by 10.9% year-over-year to CNY 171.1 million, supporting its dividend commitments despite a volatile history over its short three-year dividend-paying span. However, trading at 78.1% below estimated fair value suggests potential undervaluation or underlying concerns about growth prospects and stability.

- Take a closer look at E-Star Commercial Management's potential here in our dividend report.

- According our valuation report, there's an indication that E-Star Commercial Management's share price might be on the cheaper side.

China Electronics Huada Technology (SEHK:85)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Electronics Huada Technology Company Limited operates as an investment holding company, focusing on the design, development, and sale of integrated circuit chips in the People’s Republic of China, with a market capitalization of approximately HK$2.76 billion.

Operations: China Electronics Huada Technology generates HK$3.02 billion from its core activity of designing and selling integrated circuit chips.

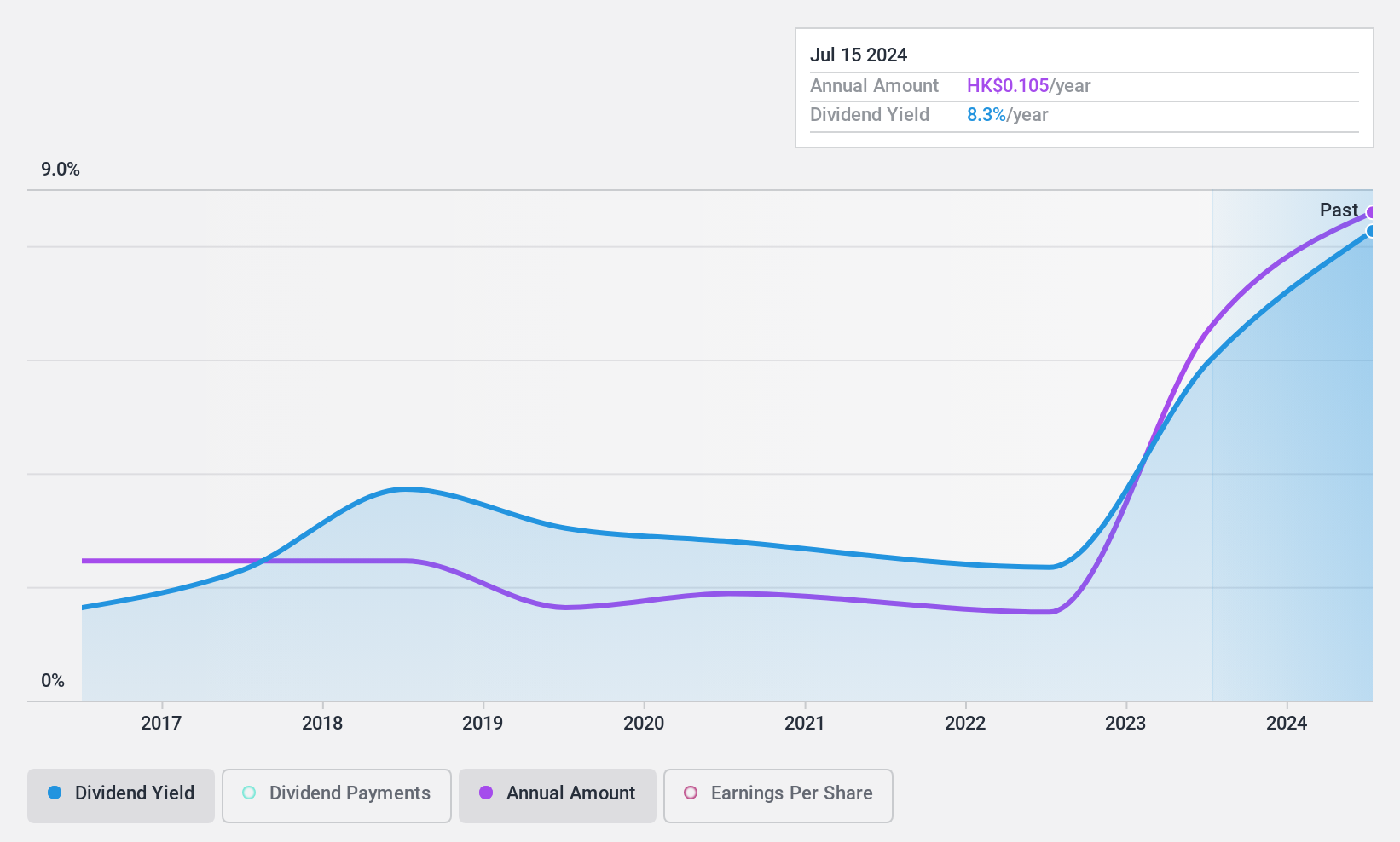

Dividend Yield: 7.7%

China Electronics Huada Technology announced a final dividend of HK$0.105 per share for 2023, with earnings growth of 29.2% year-over-year to HK$686.43 million, supporting this payout. Despite a low payout ratio of 31.1% and cash payout ratio of 26.5%, the company's dividend history remains volatile, lacking consistency over the past decade. Recent corporate governance updates include bylaw amendments and appointing Ms. Huang Yaping as an independent director, potentially impacting future financial strategies and stability.

- Dive into the specifics of China Electronics Huada Technology here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of China Electronics Huada Technology shares in the market.

Seize The Opportunity

- Get an in-depth perspective on all 94 Top Dividend Stocks by using our screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether China Electronics Huada Technology is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:85

China Electronics Huada Technology

An investment holding company, engages in the design, development, and sale of integrated circuit chips in the People’s Republic of China.

Flawless balance sheet with solid track record and pays a dividend.