- Hong Kong

- /

- Real Estate

- /

- SEHK:6049

Optimistic Investors Push Poly Property Services Co., Ltd. (HKG:6049) Shares Up 26% But Growth Is Lacking

Poly Property Services Co., Ltd. (HKG:6049) shareholders are no doubt pleased to see that the share price has bounced 26% in the last month, although it is still struggling to make up recently lost ground. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 41% over that time.

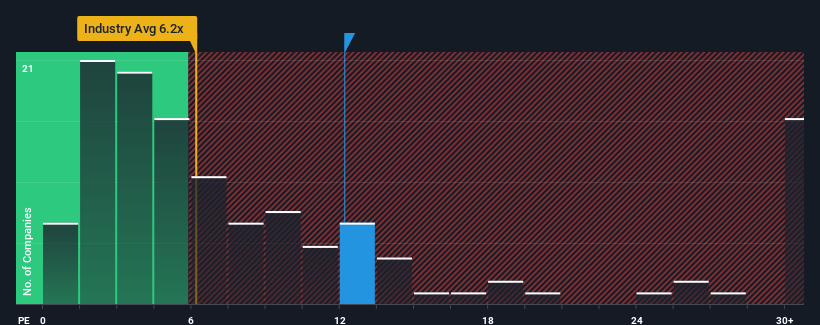

Following the firm bounce in price, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may consider Poly Property Services as a stock to potentially avoid with its 12.2x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

Poly Property Services certainly has been doing a good job lately as its earnings growth has been positive while most other companies have been seeing their earnings go backwards. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Poly Property Services

What Are Growth Metrics Telling Us About The High P/E?

Poly Property Services' P/E ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 27%. The strong recent performance means it was also able to grow EPS by 89% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 16% each year over the next three years. With the market predicted to deliver 16% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Poly Property Services' P/E sits above the majority of other companies. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Poly Property Services' P/E?

The large bounce in Poly Property Services' shares has lifted the company's P/E to a fairly high level. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Poly Property Services currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Poly Property Services with six simple checks will allow you to discover any risks that could be an issue.

If you're unsure about the strength of Poly Property Services' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6049

Poly Property Services

Operates as a property management service provider in China.

Flawless balance sheet and good value.

Market Insights

Community Narratives