The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Novautek Technologies Group Limited (HKG:519) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

What Is Novautek Technologies Group's Debt?

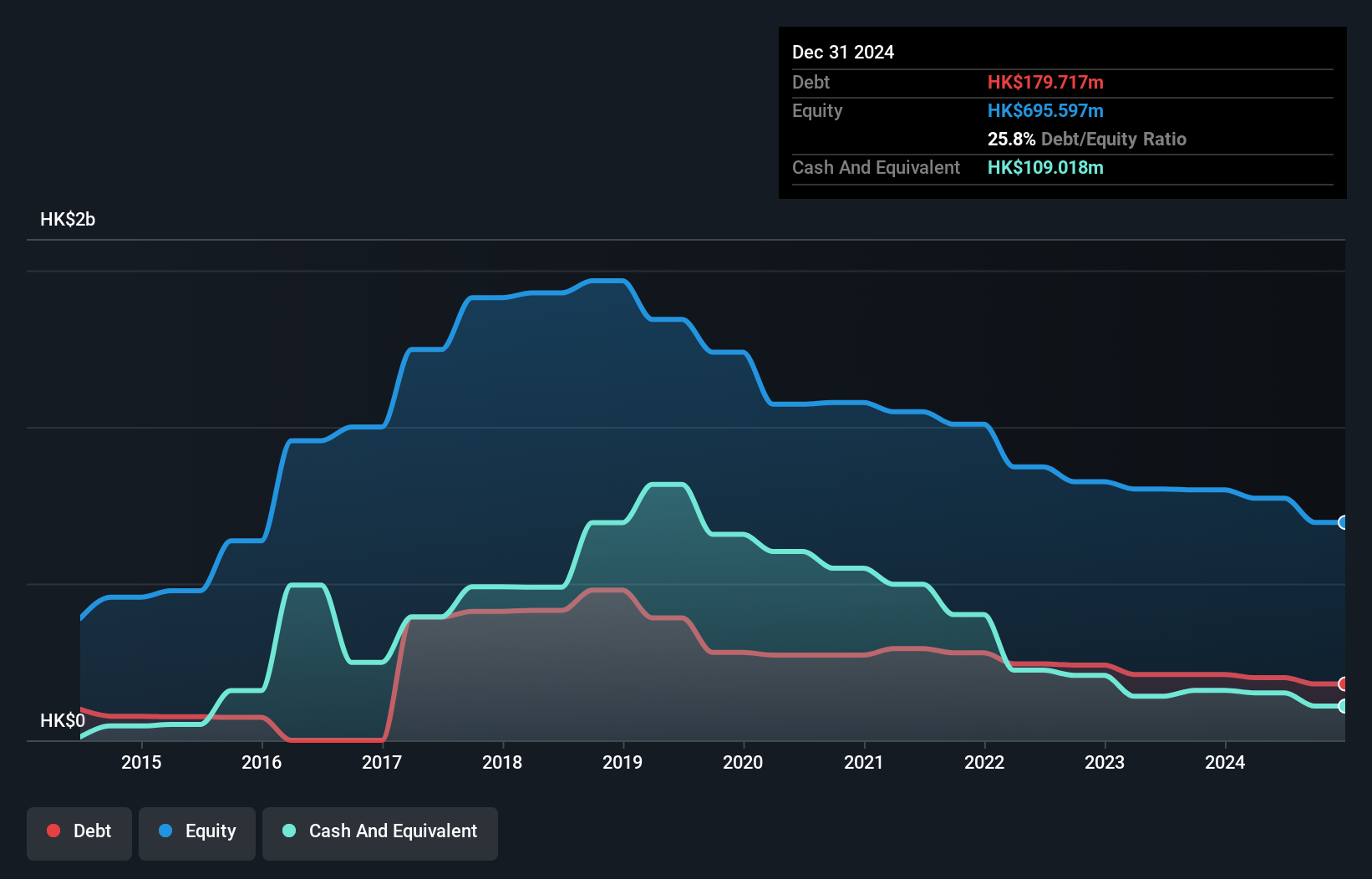

As you can see below, Novautek Technologies Group had HK$179.7m of debt at December 2024, down from HK$210.1m a year prior. However, it does have HK$109.0m in cash offsetting this, leading to net debt of about HK$70.7m.

How Strong Is Novautek Technologies Group's Balance Sheet?

The latest balance sheet data shows that Novautek Technologies Group had liabilities of HK$377.9m due within a year, and liabilities of HK$97.2m falling due after that. On the other hand, it had cash of HK$109.0m and HK$27.1m worth of receivables due within a year. So its liabilities total HK$338.9m more than the combination of its cash and short-term receivables.

When you consider that this deficiency exceeds the company's HK$271.9m market capitalization, you might well be inclined to review the balance sheet intently. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Novautek Technologies Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

See our latest analysis for Novautek Technologies Group

Given it has no significant operating revenue at the moment, shareholders will be hoping Novautek Technologies Group can make progress and gain better traction for the business, before it runs low on cash.

Caveat Emptor

While Novautek Technologies Group's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost HK$7.3m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through HK$19m in negative free cash flow over the last year. That means it's on the risky side of things. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 2 warning signs for Novautek Technologies Group that you should be aware of before investing here.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Valuation is complex, but we're here to simplify it.

Discover if Novautek Technologies Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:519

Novautek Technologies Group

An investment holding company, engages in resort and property development, and property investment activities in the People’s Republic of China, Hong Kong, the Middle East, and Southeast Asia.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives