Undiscovered Gems Three Small Cap Stocks With Strong Fundamentals

Reviewed by Simply Wall St

As global markets experience broad-based gains, with smaller-cap indexes notably outperforming large-caps, investor sentiment is buoyed by positive economic indicators such as the drop in U.S. initial jobless claims and rising home sales. In this environment of cautious optimism and macroeconomic stability, identifying small-cap stocks with strong fundamentals can offer unique opportunities for growth amid market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Watt's | 73.27% | 7.85% | -1.33% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Bhakti Multi Artha | 45.21% | 32.37% | -16.43% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

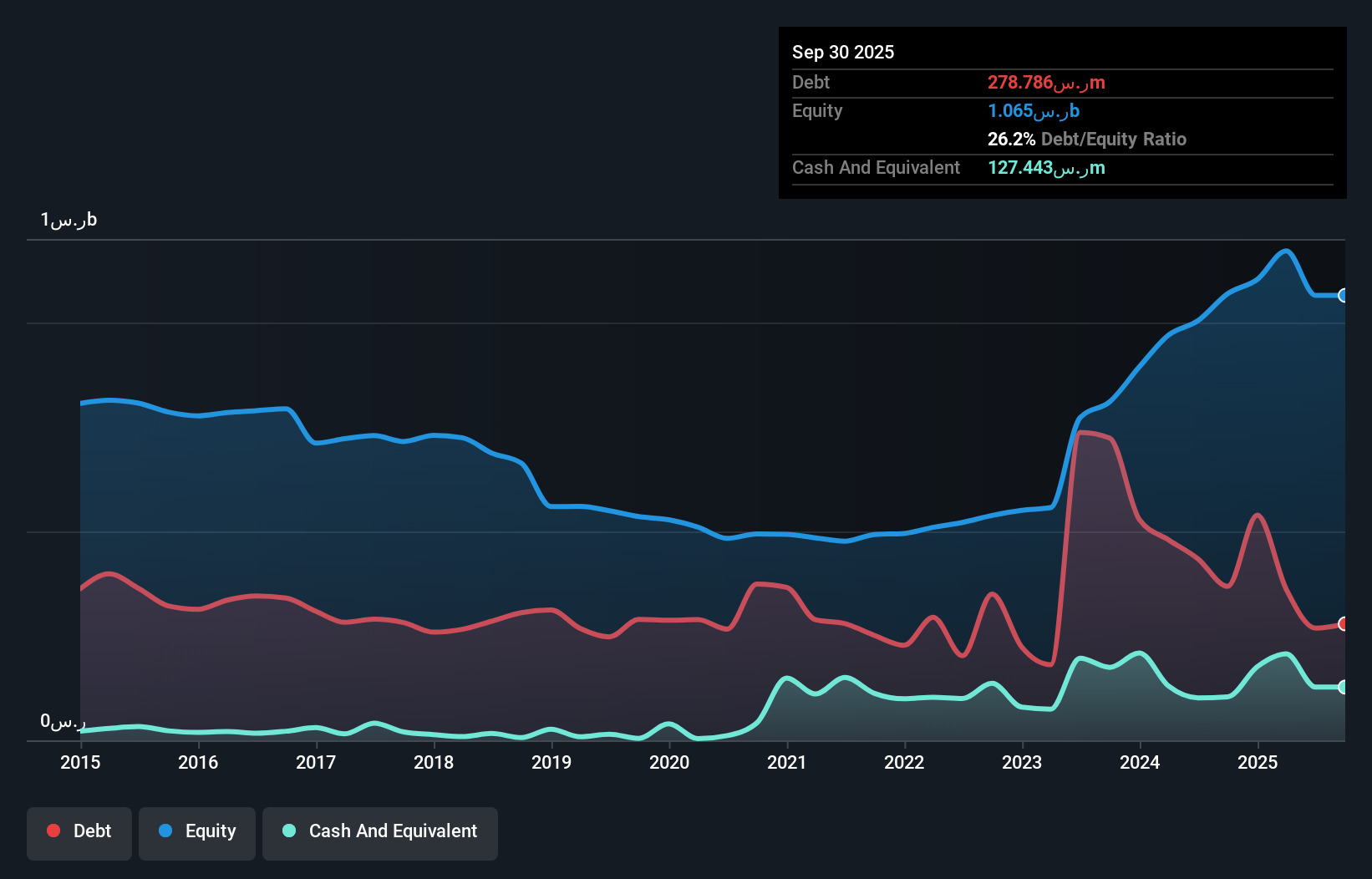

Saudi Steel Pipes (SASE:1320)

Simply Wall St Value Rating: ★★★★★★

Overview: Saudi Steel Pipes Company manufactures and sells steel pipes in the Kingdom of Saudi Arabia and internationally, with a market capitalization of SAR3.44 billion.

Operations: The primary revenue stream for Saudi Steel Pipes comes from its steel pipes segment, generating SAR1.86 billion.

Saudi Steel Pipes, a notable player in the industry, showcases promising financial health and growth potential. The company reported third-quarter sales of SAR 380.77 million and net income of SAR 64.52 million, both up from last year. Its price-to-earnings ratio at 16x is attractive compared to the broader SA market's 23.5x, indicating good relative value. Over five years, earnings have grown at an impressive rate of 77%, with a reduced debt to equity ratio from 54% to a satisfactory 34%. Furthermore, its free cash flow remains positive and interest payments are comfortably covered by EBIT (10.3x).

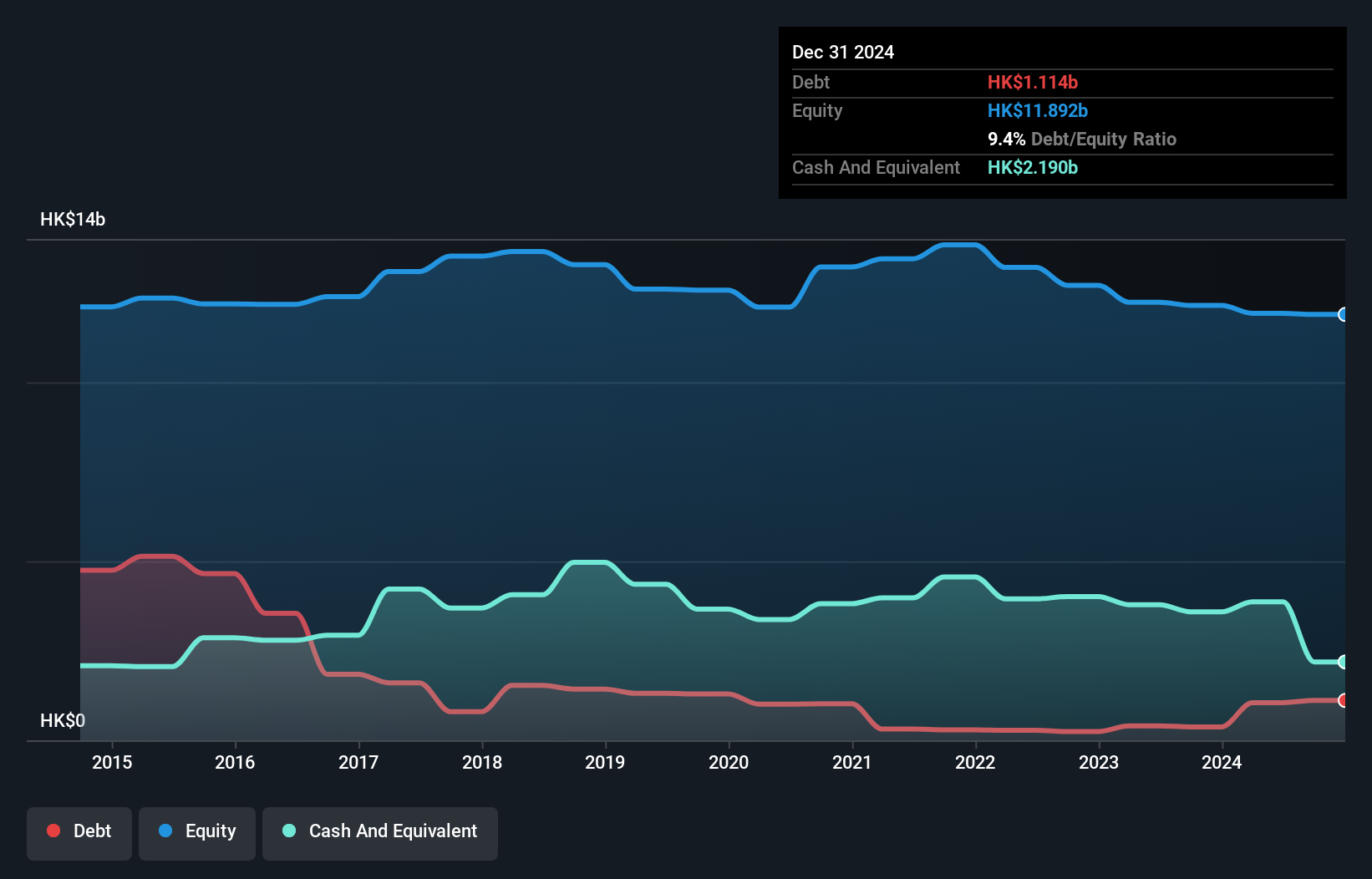

Tomson Group (SEHK:258)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tomson Group Limited is an investment holding company involved in property development and investment, hospitality and leisure, securities trading, and media and entertainment operations across Hong Kong, Macau, and Mainland China with a market cap of HK$5.05 billion.

Operations: Tomson Group derives its revenue primarily from property investment (HK$217.63 million) and leisure activities (HK$49.69 million), with additional contributions from securities trading (HK$20.19 million).

Tomson Group, a relatively small player in the real estate sector, has showcased an impressive earnings growth of 2337.4% over the past year, outpacing the industry average of -15.1%. Despite a challenging five-year period with earnings declining by 23.6% annually, recent results indicate a turnaround with net income jumping to HKD 103.67 million from HKD 19.39 million last year. The debt-to-equity ratio has improved from 10.4% to 8.8%, suggesting better financial health over time, though shareholders faced dilution in the past year and free cash flow remains negative at -HKD 451.94 million as of June 2024.

- Get an in-depth perspective on Tomson Group's performance by reading our health report here.

Gain insights into Tomson Group's historical performance by reviewing our past performance report.

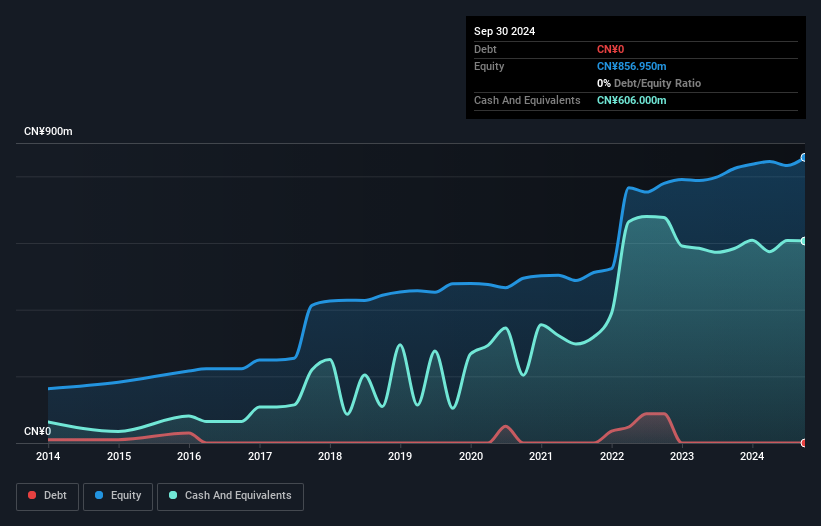

Astro-century Education&TechnologyLtd (SZSE:300654)

Simply Wall St Value Rating: ★★★★★★

Overview: Astro-century Education&Technology Co., Ltd specializes in the planning, design, production, and distribution of teaching aid books for primary, elementary, and high schools in China with a market cap of CN¥4.49 billion.

Operations: Astro-century derives its revenue primarily from the publishing of teaching aid books, generating CN¥526.82 million. The company focuses on the educational sector in China, catering to various school levels.

Astro-century Education & Technology Ltd, a small player in the education sector, has shown resilience with earnings growth of 7.2% over the past year, surpassing the media industry's performance. The company remains debt-free and boasts high-quality earnings, which is a positive indicator for financial health. Recent reports highlight sales reaching CNY 388 million for nine months ending September 2024, slightly up from CNY 369 million last year. Net income saw a marginal increase to CNY 31.48 million from CNY 31.39 million previously, while basic and diluted EPS remained steady at CNY 0.086 per share.

- Delve into the full analysis health report here for a deeper understanding of Astro-century Education&TechnologyLtd.

Learn about Astro-century Education&TechnologyLtd's historical performance.

Seize The Opportunity

- Explore the 4634 names from our Undiscovered Gems With Strong Fundamentals screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300654

Astro-century Education&TechnologyLtd

Engages in planning, design, production, and distribution of teaching aid books for primary, elementary, and high schools in China.

Flawless balance sheet with solid track record.