- Hong Kong

- /

- Real Estate

- /

- SEHK:21

Great China Holdings (Hong Kong) (HKG:21 shareholders incur further losses as stock declines 17% this week, taking three-year losses to 36%

While it may not be enough for some shareholders, we think it is good to see the Great China Holdings (Hong Kong) Limited (HKG:21) share price up 11% in a single quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 36% in the last three years, falling well short of the market return.

If the past week is anything to go by, investor sentiment for Great China Holdings (Hong Kong) isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for Great China Holdings (Hong Kong)

Great China Holdings (Hong Kong) isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Over the last three years, Great China Holdings (Hong Kong)'s revenue dropped 18% per year. That means its revenue trend is very weak compared to other loss making companies. On the face of it we'd posit the share price fall of 11% compound, over three years is well justified by the fundamental deterioration. It would probably be worth asking whether the company can fund itself to profitability. The company will need to return to revenue growth as quickly as possible, if it wants to see some enthusiasm from investors.

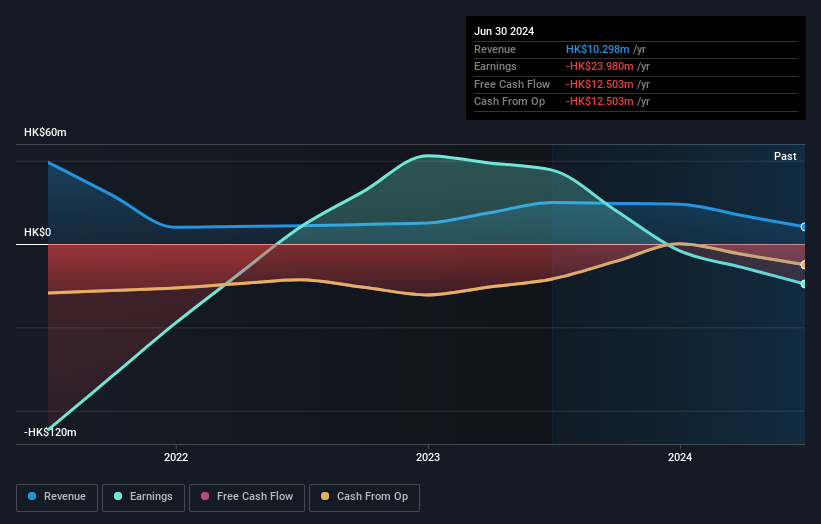

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's nice to see that Great China Holdings (Hong Kong) shareholders have received a total shareholder return of 18% over the last year. That certainly beats the loss of about 4% per year over the last half decade. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. It's always interesting to track share price performance over the longer term. But to understand Great China Holdings (Hong Kong) better, we need to consider many other factors. Even so, be aware that Great China Holdings (Hong Kong) is showing 2 warning signs in our investment analysis , you should know about...

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:21

Great China Holdings (Hong Kong)

An investment holding company, engages in the property development and investment business in the People’s Republic of China.

Imperfect balance sheet very low.