- Hong Kong

- /

- Real Estate

- /

- SEHK:207

Joy City Property Limited's (HKG:207) largest shareholders are public companies who were rewarded as market cap surged HK$356m last week

Key Insights

- The considerable ownership by public companies in Joy City Property indicates that they collectively have a greater say in management and business strategy

- 64% of the company is held by a single shareholder (Grandjoy Holdings Group Co., Ltd.)

- Past performance of a company along with ownership data serve to give a strong idea about prospects for a business

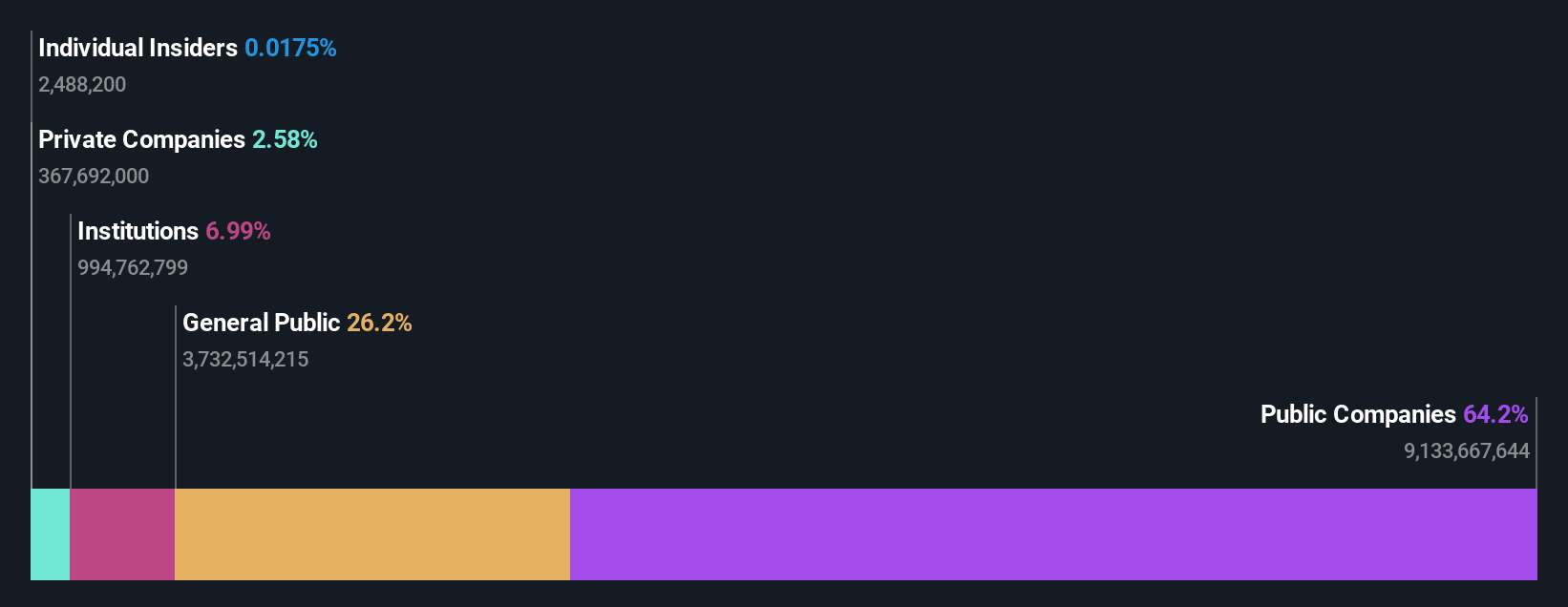

A look at the shareholders of Joy City Property Limited (HKG:207) can tell us which group is most powerful. The group holding the most number of shares in the company, around 64% to be precise, is public companies. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

As a result, public companies were the biggest beneficiaries of last week’s 12% gain.

Let's delve deeper into each type of owner of Joy City Property, beginning with the chart below.

Check out our latest analysis for Joy City Property

What Does The Institutional Ownership Tell Us About Joy City Property?

Many institutions measure their performance against an index that approximates the local market. So they usually pay more attention to companies that are included in major indices.

We can see that Joy City Property does have institutional investors; and they hold a good portion of the company's stock. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. It is not uncommon to see a big share price drop if two large institutional investors try to sell out of a stock at the same time. So it is worth checking the past earnings trajectory of Joy City Property, (below). Of course, keep in mind that there are other factors to consider, too.

Joy City Property is not owned by hedge funds. The company's largest shareholder is Grandjoy Holdings Group Co., Ltd., with ownership of 64%. With such a huge stake in the ownership, we infer that they have significant control of the future of the company. In comparison, the second and third largest shareholders hold about 5.0% and 2.6% of the stock.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. We're not picking up on any analyst coverage of the stock at the moment, so the company is unlikely to be widely held.

Insider Ownership Of Joy City Property

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

Our data suggests that insiders own under 1% of Joy City Property Limited in their own names. But they may have an indirect interest through a corporate structure that we haven't picked up on. It has a market capitalization of just HK$3.4b, and the board has only HK$590k worth of shares in their own names. Many tend to prefer to see a board with bigger shareholdings. A good next step might be to take a look at this free summary of insider buying and selling.

General Public Ownership

With a 26% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Joy City Property. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Public Company Ownership

Public companies currently own 64% of Joy City Property stock. It's hard to say for sure but this suggests they have entwined business interests. This might be a strategic stake, so it's worth watching this space for changes in ownership.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Be aware that Joy City Property is showing 2 warning signs in our investment analysis , you should know about...

If you would prefer check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, backed by strong financial data.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:207

Joy City Property

An investment holding company, engages in real estate business in Mainland China and Hong Kong.

Good value with mediocre balance sheet.

Market Insights

Community Narratives