Stock Analysis

- Hong Kong

- /

- Real Estate

- /

- SEHK:1997

Wharf Real Estate Investment (HKG:1997) sheds HK$6.1b, company earnings and investor returns have been trending downwards for past five years

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Wharf Real Estate Investment Company Limited (HKG:1997), since the last five years saw the share price fall 53%. And it's not just long term holders hurting, because the stock is down 36% in the last year. On top of that, the share price is down 7.3% in the last week. However, this move may have been influenced by the broader market, which fell 3.1% in that time.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Wharf Real Estate Investment

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Wharf Real Estate Investment moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The most recent dividend was actually lower than it was in the past, so that may have sent the share price lower. On top of that, revenue has declined by 5.2% per year over the half decade; that could be a red flag for some investors.

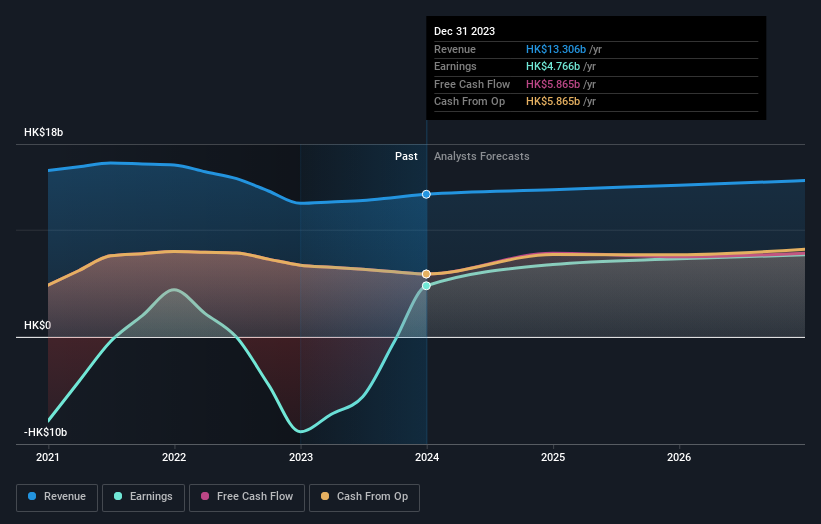

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Wharf Real Estate Investment is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Wharf Real Estate Investment will earn in the future (free analyst consensus estimates)

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Wharf Real Estate Investment's TSR for the last 5 years was -42%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market gained around 7.7% in the last year, Wharf Real Estate Investment shareholders lost 34% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Wharf Real Estate Investment is showing 2 warning signs in our investment analysis , you should know about...

Of course Wharf Real Estate Investment may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Wharf Real Estate Investment is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1997

Wharf Real Estate Investment

An investment holding company, invests in, develops, owns, and operates properties and hotels in Hong Kong, Mainland China, and Singapore.

Fair value second-rate dividend payer.