- Hong Kong

- /

- Real Estate

- /

- SEHK:1965

Insider Sellers Might Regret Selling Landsea Green Life Service Shares at a Lower Price Than Current Market Value

Landsea Green Life Service Company Limited's (HKG:1965) value has fallen 11% in the last week, but insiders who sold CN¥118m worth of stock over the last year have had less success. Insiders might have been better off holding onto their shares, given that the average selling price of CN¥2.46 is still below the current share price.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Check out our latest analysis for Landsea Green Life Service

The Last 12 Months Of Insider Transactions At Landsea Green Life Service

In the last twelve months, the biggest single purchase by an insider was when insider Bofeng Lin bought HK$110m worth of shares at a price of HK$2.54 per share. That means that an insider was happy to buy shares at above the current price of HK$0.20. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. To us, it's very important to consider the price insiders pay for shares. Generally speaking, it catches our eye when an insider has purchased shares at above current prices, as it suggests they believed the shares were worth buying, even at a higher price. The only individual insider to buy over the last year was Bofeng Lin.

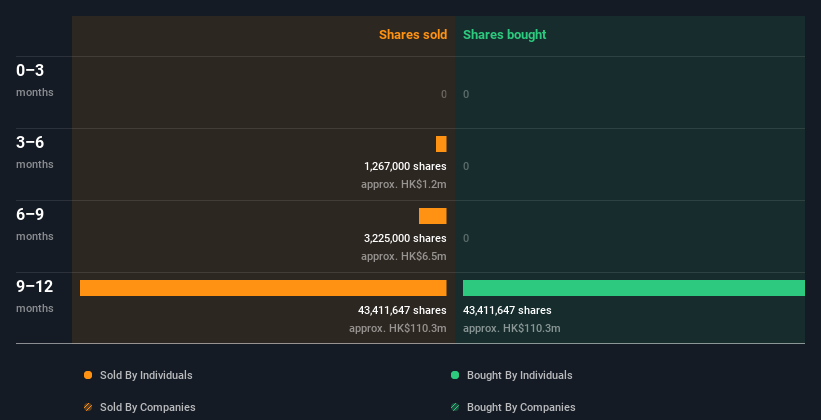

All up, insiders sold more shares in Landsea Green Life Service than they bought, over the last year. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. It's great to see that Landsea Green Life Service insiders own 54% of the company, worth about HK$44m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

What Might The Insider Transactions At Landsea Green Life Service Tell Us?

There haven't been any insider transactions in the last three months -- that doesn't mean much. It's heartening that insiders own plenty of stock, but we'd like to see more insider buying, since the last year of Landsea Green Life Service insider transactions don't fill us with confidence. While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. For instance, we've identified 3 warning signs for Landsea Green Life Service (1 is a bit concerning) you should be aware of.

But note: Landsea Green Life Service may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1965

Landsea Green Life Service

Provides property management and value-added services to the property developers, owners, and residents in China.

Good value with adequate balance sheet.