- Hong Kong

- /

- Real Estate

- /

- SEHK:173

Asian Market Gems: 3 Penny Stocks Under US$1B Market Cap

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate and trade discussions between major economies continue, Asian markets are navigating a complex landscape. Within this context, penny stocks—often smaller or newer companies—remain a focal point for investors seeking growth opportunities. Despite their reputation as speculative investments, those with strong financials can offer compelling value and potential upside.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.92 | HK$2.38B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.22 | HK$769.76M | ✅ 4 ⚠️ 2 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.16 | HK$1.8B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.445 | SGD180.35M | ✅ 3 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.19 | HK$1.99B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.30 | SGD9.05B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.179 | SGD35.66M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.14 | SGD861.46M | ✅ 4 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.64 | HK$53.16B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,154 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

K. Wah International Holdings (SEHK:173)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: K. Wah International Holdings Limited is an investment holding company involved in property development and investment in Hong Kong and Mainland China, with a market cap of HK$5.93 billion.

Operations: The company's revenue is primarily derived from property development in Mainland China (HK$5.91 billion) and Hong Kong (HK$540.49 million), along with property investment activities generating HK$642.97 million.

Market Cap: HK$5.93B

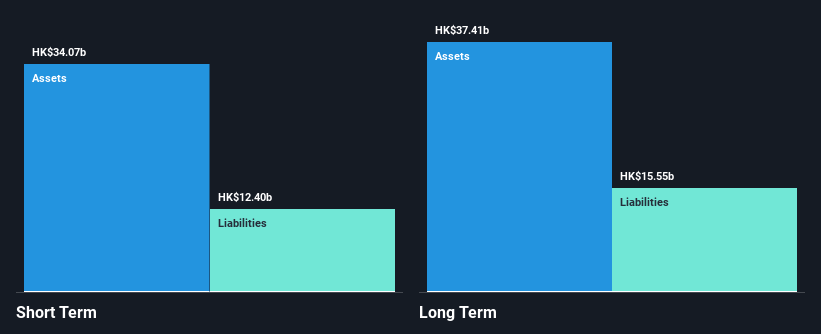

K. Wah International Holdings, with a market cap of HK$5.93 billion, derives significant revenue from property development and investment in Hong Kong and Mainland China, totaling HK$7.19 billion in 2024. Despite stable weekly volatility and satisfactory debt levels, the company faces challenges including declining earnings growth over the past year and reduced profit margins compared to previous years. Recent executive changes include appointing Mr. Francis Lui as Chairman of the Board while co-managing directors were named to guide operations forward. The board recommended a lower final cash dividend for 2024 compared to the previous year’s distribution.

- Click here and access our complete financial health analysis report to understand the dynamics of K. Wah International Holdings.

- Review our growth performance report to gain insights into K. Wah International Holdings' future.

UMS Integration (SGX:558)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UMS Integration Limited, with a market cap of SGD873.96 million, is an investment holding company that manufactures and markets precision machining components while also offering electromechanical assembly and final testing services.

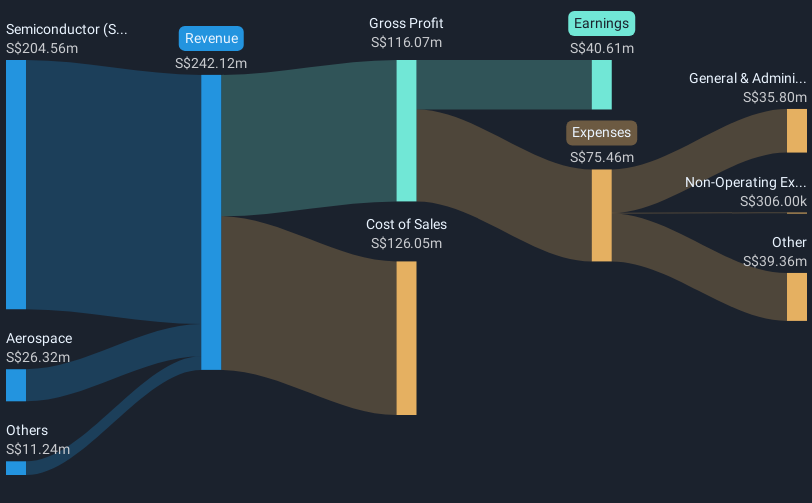

Operations: The company's revenue is primarily derived from its Semiconductor segment, which accounts for SGD207.51 million, followed by the Aerospace segment with SGD27.43 million.

Market Cap: SGD873.96M

UMS Integration Limited, with a market cap of SGD873.96 million, has shown financial resilience in the penny stock arena through its strong asset management, as short-term assets significantly exceed both long and short-term liabilities. The company benefits from a low debt-to-equity ratio and high-quality earnings despite recent negative earnings growth of -22.5%. Recent board changes aim to strengthen governance with new independent directors appointed to key committees. However, profit margins have declined from 19.2% to 16.5% over the past year, and dividends are not well covered by free cash flows, indicating potential challenges ahead for investors.

- Unlock comprehensive insights into our analysis of UMS Integration stock in this financial health report.

- Examine UMS Integration's earnings growth report to understand how analysts expect it to perform.

Beijing Watertek Information Technology (SZSE:300324)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Beijing Watertek Information Technology Co., Ltd. operates in the information technology sector, focusing on providing security solutions and services, with a market cap of CN¥6.86 billion.

Operations: The company generates its revenue of CN¥2.73 billion from the Software and Information Technology Services Industry segment.

Market Cap: CN¥6.86B

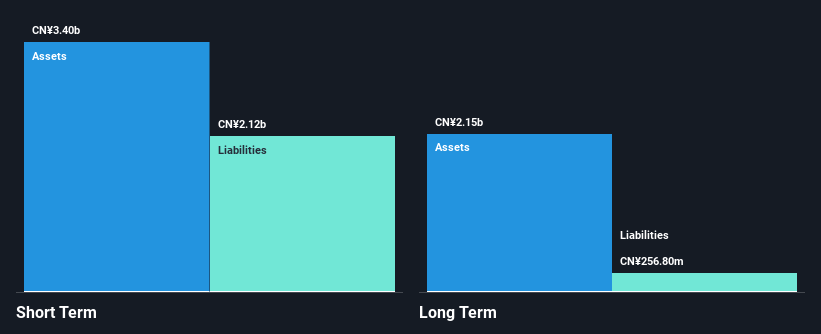

Beijing Watertek Information Technology, with a market cap of CN¥6.86 billion, operates in the IT security sector and faces challenges typical of penny stocks, such as volatility and unprofitability. Despite this, its short-term assets exceed both short and long-term liabilities, suggesting solid asset management. The company has reduced its debt-to-equity ratio over five years and maintains a cash runway exceeding three years if current cash flow trends persist. Recent earnings reports indicate stable revenue but increased net losses year-over-year. Management's experience averages 4.5 years, providing some stability amidst financial hurdles.

- Click here to discover the nuances of Beijing Watertek Information Technology with our detailed analytical financial health report.

- Evaluate Beijing Watertek Information Technology's historical performance by accessing our past performance report.

Taking Advantage

- Unlock more gems! Our Asian Penny Stocks screener has unearthed 1,151 more companies for you to explore.Click here to unveil our expertly curated list of 1,154 Asian Penny Stocks.

- Looking For Alternative Opportunities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K. Wah International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:173

K. Wah International Holdings

An investment holding company, engages in the property development and investment businesses in Hong Kong and Mainland China.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives