- Hong Kong

- /

- Real Estate

- /

- SEHK:17

New World Development (SEHK:17): Decoding Valuation After Recent Share Price Volatility

Reviewed by Simply Wall St

See our latest analysis for New World Development.

New World Development’s shares have been on a rollercoaster this year, with short-term gains giving way to recent losses. After a sharp 90-day share price return of 10.45% and a strong year-to-date climb of 42.66%, momentum has cooled lately. This is evident in the 1-month share price drop of 8.06%. However, taking a longer view, the 1-year total shareholder return is down 8.76%, and losses deepen over three and five years. This highlights the challenges for long-term investors.

If you’re weighing what else the market has to offer right now, consider broadening your search and discovering fast growing stocks with high insider ownership.

With volatility still a central theme, the real question emerges: Is New World Development undervalued based on recent setbacks, or has the market already baked future growth into today’s prices, presenting a genuine buying opportunity?

Most Popular Narrative: 34.1% Overvalued

According to the most widely followed narrative, New World Development’s estimated fair value is HK$5.36 per share. With the last close price at HK$7.19, the market is pricing in far more optimism than analysts’ consensus suggests.

The company's high leverage remains a critical risk, and management continues to prioritize debt reduction through asset sales, cost-cutting, and suspending dividends. However, persistently high interest rates mean debt servicing costs will remain elevated, potentially compressing net margins and weighing on future earnings.

Curious why this valuation looks so steep? This narrative banks on a turnaround in earnings and margin growth, with some aggressive forward-looking assumptions locked in. Want to see just how bold the underlying forecasts are? Hit the full narrative to uncover the projections shaping this fair value call.

Result: Fair Value of $5.36 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, signs of property market recovery in China or stronger than expected performance from key commercial projects could quickly challenge this cautious outlook.

Find out about the key risks to this New World Development narrative.

Another View: Value Ratios Tell a Different Story

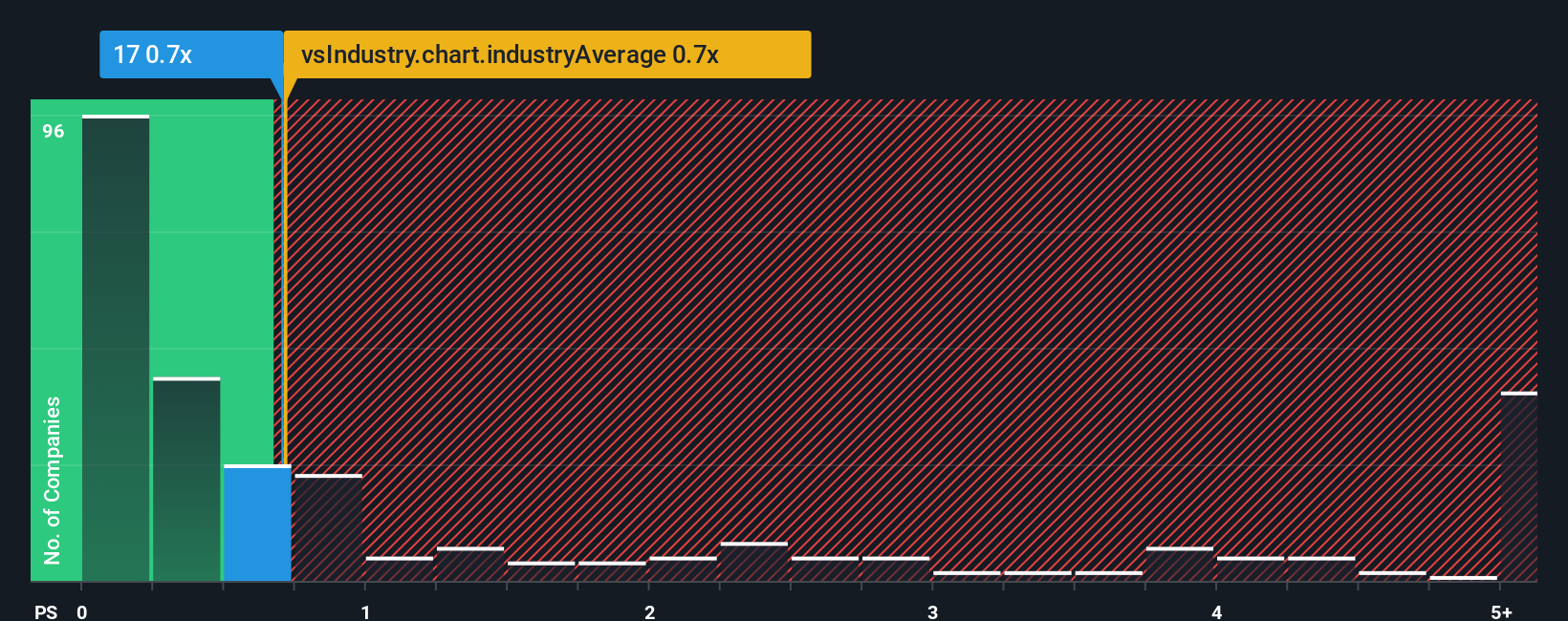

Switching gears to look at sales-based valuation, New World Development’s price-to-sales ratio is just 0.7x. That is in line with the Hong Kong real estate industry average and significantly lower than the average of its peers at 3.9x, and even under the fair ratio of 1x. This suggests that investors may be discounting the company’s long-term potential, but is the market underestimating a turnaround, or pricing in the real risks ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own New World Development Narrative

If you see things differently or prefer your own investigating, why not dive into the data and shape your own view in just a few minutes? Do it your way

A great starting point for your New World Development research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Confident, timely choices separate smart investors from the crowd. Don’t let fresh stock opportunities pass you by. There’s a world of standout ideas beyond New World Development.

- Uncover steady yields and income potential by checking out these 24 dividend stocks with yields > 3%, where cashflow matters most for investors focused on robust dividends.

- Fuel your portfolio’s future by investing in tomorrow’s innovative breakthroughs. Start with these 26 AI penny stocks to see which companies are driving the next wave of intelligent tech.

- Capitalize on stocks priced below their real value and position yourself for upside with these 834 undervalued stocks based on cash flows for high-potential hidden gems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New World Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:17

New World Development

An investment holding company, operates in the property development and investment business in Hong Kong and Mainland China.

Fair value with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives