- Hong Kong

- /

- Real Estate

- /

- SEHK:17

Is New World Development’s US$1.9 Billion Debt Exchange Reshaping Its Investment Case (SEHK:17)?

Reviewed by Sasha Jovanovic

- New World Development recently launched a debt exchange offer of up to US$1.9 billion to restructure its outstanding perpetual securities, aiming to extend debt maturities and boost liquidity amid persistent property market challenges in Hong Kong.

- This financial restructuring comes after earlier deferrals of coupon payments on perpetual bonds, highlighting intensified efforts to manage a heavy debt profile in a difficult financing environment.

- We'll examine how New World Development’s large-scale debt exchange could influence its investment narrative through improved balance sheet flexibility.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

New World Development Investment Narrative Recap

To be a shareholder in New World Development, one must believe in a recovery of Hong Kong and mainland China's property markets along with the company's ability to manage high leverage and restore profitability. The recent US$1.9 billion debt exchange offer targets short-term liquidity and maturity pressures, but the company’s ongoing exposure to elevated interest costs and persistent market headwinds remains the most important near-term risk, while the success of its financial restructuring is the key catalyst to watch.

Among recent announcements, the July 2025 discussions to sell the 11 Skies mall for potential liquidity relief are especially relevant in context with the debt exchange, reflecting a focus on managing leverage and cash flow. This potential asset sale could support near-term balance sheet flexibility if completed, though it may also crystallize losses and highlight underlying profitability challenges.

By contrast, investors should be aware that while debt management is critical to the immediate outlook, high leverage and...

Read the full narrative on New World Development (it's free!)

New World Development's narrative projects HK$40.5 billion revenue and HK$1.7 billion earnings by 2028. This requires 4.5% yearly revenue growth and a HK$20.2 billion increase in earnings from HK$-18.5 billion today.

Uncover how New World Development's forecasts yield a HK$5.36 fair value, a 28% downside to its current price.

Exploring Other Perspectives

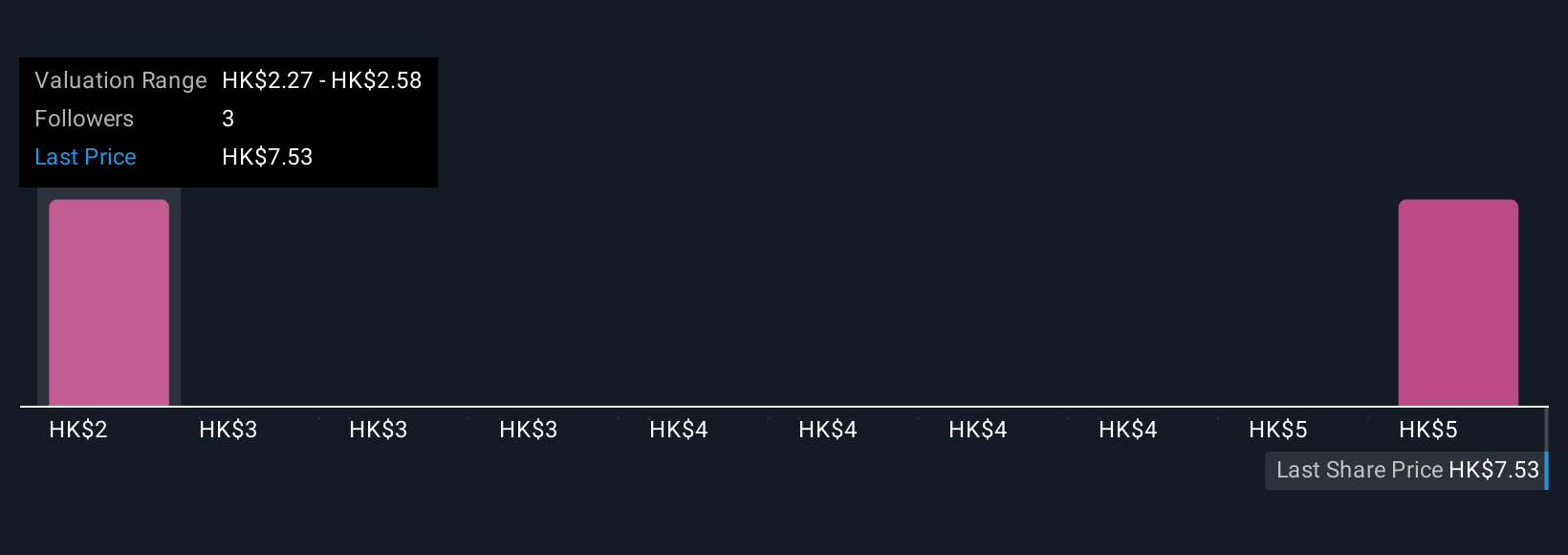

Simply Wall St Community members provided two fair value estimates for New World Development, ranging widely from HK$2.27 to HK$5.36 per share. With the company's high leverage still in focus, your outlook could shift significantly depending on how you weigh short-term liquidity efforts and longer term balance sheet risks.

Explore 2 other fair value estimates on New World Development - why the stock might be worth less than half the current price!

Build Your Own New World Development Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your New World Development research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free New World Development research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate New World Development's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New World Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:17

New World Development

An investment holding company, operates in the property development and investment business in Hong Kong and Mainland China.

Fair value with worrying balance sheet.

Similar Companies

Market Insights

Community Narratives