Stock Analysis

- Hong Kong

- /

- Real Estate

- /

- SEHK:1668

China South City Holdings (HKG:1668 investor five-year losses grow to 70% as the stock sheds HK$572m this past week

Over the last month the China South City Holdings Limited (HKG:1668) has been much stronger than before, rebounding by 123%. But that doesn't change the fact that the returns over the last half decade have been disappointing. Indeed, the share price is down 75% in the period. Some might say the recent bounce is to be expected after such a bad drop. We'd err towards caution given the long term under-performance.

With the stock having lost 15% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for China South City Holdings

China South City Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Shareholders of unprofitable companies usually desire strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last five years China South City Holdings saw its revenue shrink by 16% per year. That puts it in an unattractive cohort, to put it mildly. So it's not altogether surprising to see the share price down 12% per year in the same time period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

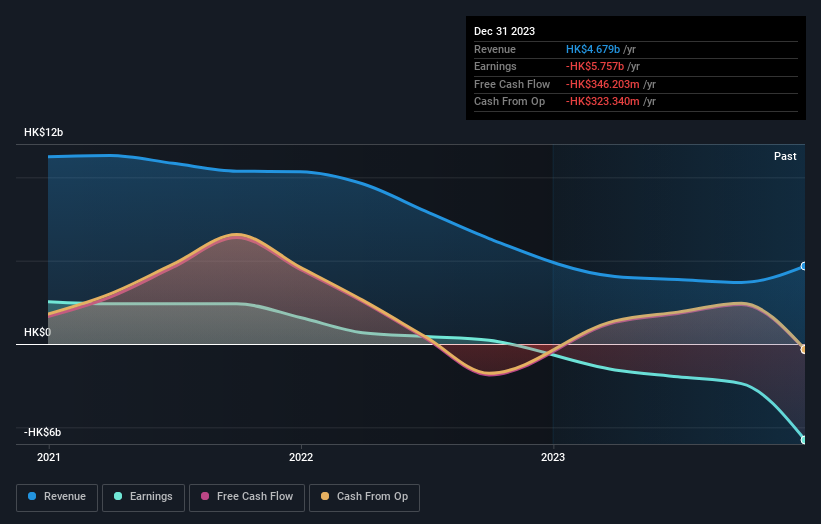

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between China South City Holdings' total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for China South City Holdings shareholders, and that cash payout explains why its total shareholder loss of 70%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Investors in China South City Holdings had a tough year, with a total loss of 38%, against a market gain of about 8.2%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 11% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand China South City Holdings better, we need to consider many other factors. To that end, you should be aware of the 3 warning signs we've spotted with China South City Holdings .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether China South City Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1668

China South City Holdings

Develops and operates integrated logistics and trade centers in the People’s Republic of China.

Mediocre balance sheet and overvalued.