- Hong Kong

- /

- Real Estate

- /

- SEHK:16

Sun Hung Kai Properties (SEHK:16): Is There Value After a Mixed Month for the Shares?

Reviewed by Simply Wall St

See our latest analysis for Sun Hung Kai Properties.

While Sun Hung Kai Properties’ share price has cooled in the past week, it has been a strong performer over the longer run, with year-to-date share price gains of 31.4% and a 1-year total shareholder return of 32.5%. This recent pullback likely reflects some profit-taking after strong momentum earlier this year. However, long-term investors have benefited from the steady upward trend and renewed confidence in the company’s growth prospects.

If you’re looking to discover more opportunities beyond this sector, now is a good time to broaden your search and check out fast growing stocks with high insider ownership

With a record of steady gains so far this year, investors may now be weighing whether Sun Hung Kai Properties is trading at a bargain or if its recent growth is already factored into the price. Is there still room to buy, or has the market moved ahead?

Most Popular Narrative: 1.9% Undervalued

Sun Hung Kai Properties' most widely watched valuation narrative suggests the shares still trade a touch below fair value, compared to the recent close. The narrative highlights shifting profit dynamics and bold new project rollouts that may drive the next chapter for this Hong Kong giant.

The Group is expected to continue launching new residential projects, including YOHO WEST PARKSIDE and other major developments. These projects are anticipated to drive significant property sales in Hong Kong, which is likely to positively impact revenue and development profit.

Curious what’s powering this optimism? The foundation rests on a crucial shift in profit margins and a calculated play on future growth. What is the profit engine, and how steep are the financial expectations? See how the valuation hinges on a dramatic uptick in future earnings and the numbers that set this outlook apart from the crowd.

Result: Fair Value of $98.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing declines in rental income and uncertainties in Mainland China's property market could pose challenges to Sun Hung Kai Properties' growth outlook in the coming years.

Find out about the key risks to this Sun Hung Kai Properties narrative.

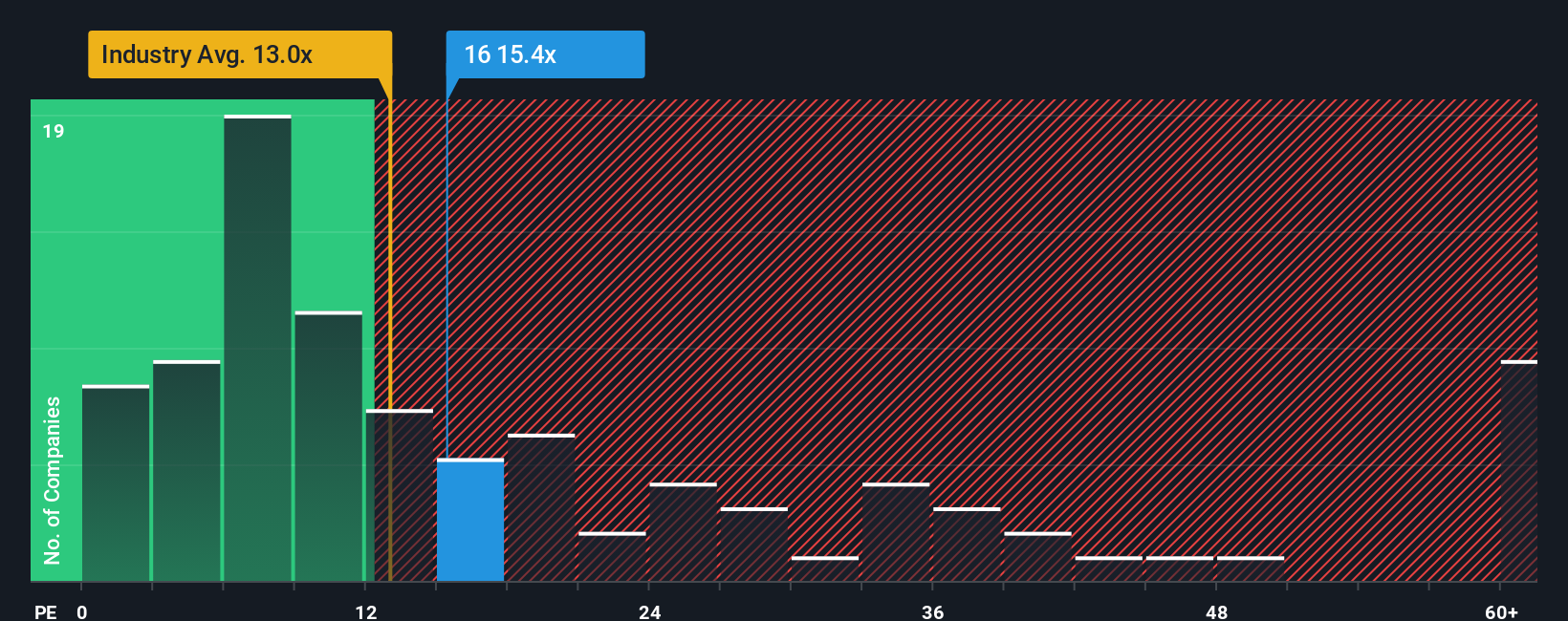

Another View: Multiples Tell a Different Story

While the fair value narrative suggests Sun Hung Kai Properties is a touch undervalued, a look at the price-to-earnings ratio tells a more cautious tale. The company's ratio of 14.6x is higher than the Hong Kong industry average of 13.5x, but well below the peer average of 27.8x. Interestingly, it also sits beneath its estimated fair ratio of 17.7x. This means the market could still move up to close this gap. Does this imply an opportunity, or does it suggest investors are pricing in potential risks ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sun Hung Kai Properties Narrative

Keep in mind, you can always dig into the numbers and assemble your own perspective. The process takes just a few minutes. Do it your way

A great starting point for your Sun Hung Kai Properties research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Step up your investing game and seize fresh opportunities before the crowd catches on. The Simply Wall Street Screener brings you powerful stock ideas you won’t want to miss.

- Uncover tomorrow’s tech trailblazers and get ahead of the curve with these 25 AI penny stocks, which are set to redefine entire sectors.

- Boost your future income by targeting companies offering strong, reliable payments with these 16 dividend stocks with yields > 3%, now yielding above 3%.

- Seize hidden value with these 916 undervalued stocks based on cash flows, which appear poised for a rebound based on robust cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:16

Sun Hung Kai Properties

An investment holding company, develops and invests in properties for sale and rent in Hong Kong, Mainland China, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives