- Hong Kong

- /

- Real Estate

- /

- SEHK:1109

How Investors May Respond To China Resources Land (SEHK:1109) After Hong Kong’s Economic Rally and Trade Truce

Reviewed by Sasha Jovanovic

- In recent days, Hong Kong’s economy has shown resilience with 3.8% GDP growth and rising retail sales, providing support to key developers like China Resources Land.

- A recent U.S.-China trade truce and tariff reductions offer further relief to companies involved in cross-border property markets, even as China faces manufacturing headwinds.

- To assess what this means for China Resources Land, we’ll explore how Hong Kong’s strong economic performance influences the company’s investment outlook.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

What Is China Resources Land's Investment Narrative?

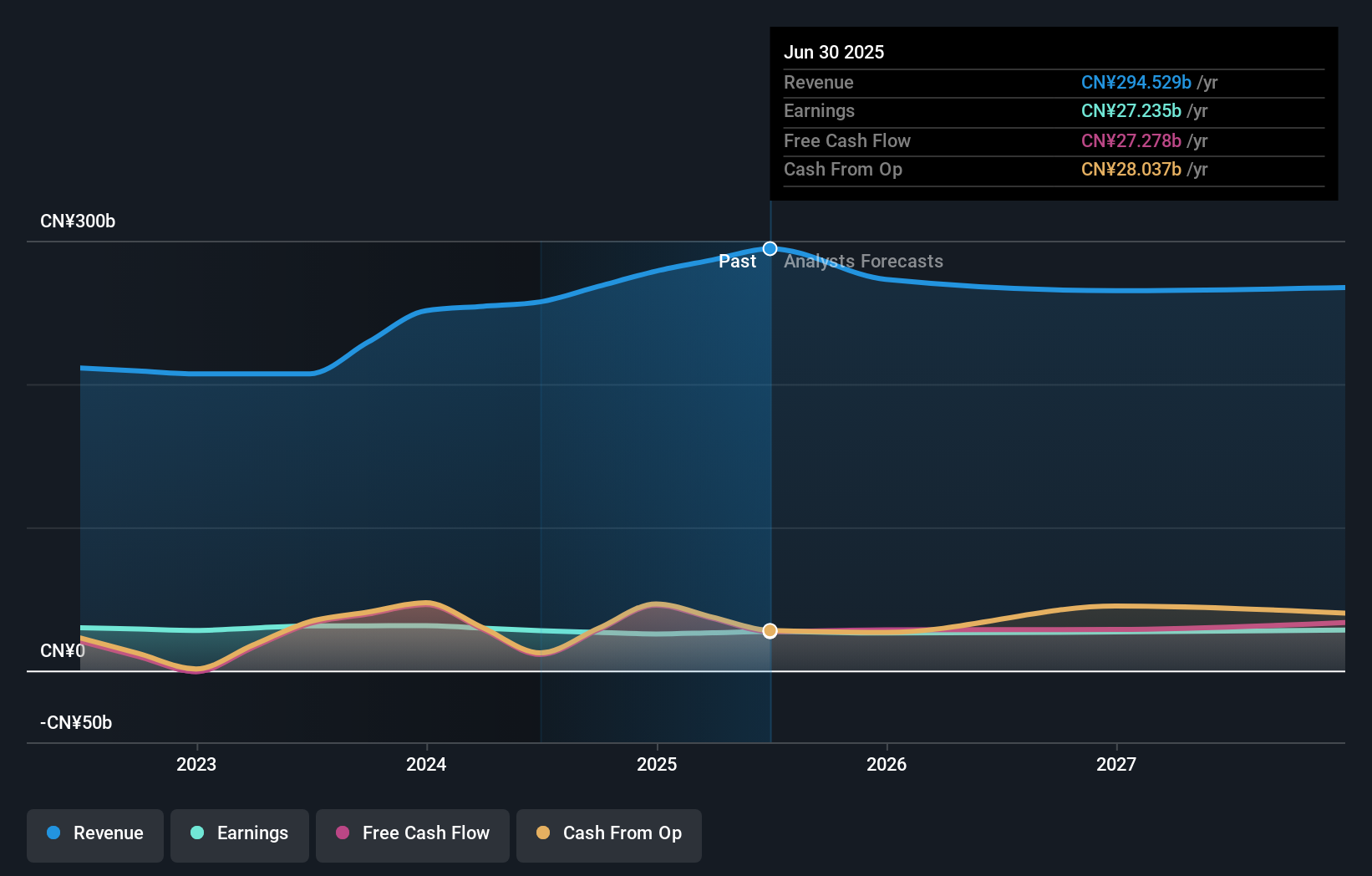

For someone to back China Resources Land today, they’d need to see clear opportunity in the Hong Kong property sector’s recovery and the company’s steady value metrics. The recent GDP lift and trade truce add some near-term relief, possibly improving sentiment and giving property earnings a short-lived boost. However, analysts had cautioned before the news that revenue is expected to see a 1% decline per year, and profit growth outlooks remain subdued versus the wider market. With board and management changes this year, experience and stability are still developing at the top. The short-term catalyst now centers on sustained demand from Hong Kong’s rebound, but persistent manufacturing weakness and a high pace of leadership turnover could still pressure future results. Recent moves don’t appear to fully offset these ongoing risks, according to price action and consensus.

But despite positive signals, management turnover remains a risk for confidence and direction. China Resources Land's shares have been on the rise but are still potentially undervalued by 45%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on China Resources Land - why the stock might be worth as much as 82% more than the current price!

Build Your Own China Resources Land Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Resources Land research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Resources Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Resources Land's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1109

China Resources Land

An investment holding company, engages in the investment, development, management, and sale of properties in the People’s Republic of China.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives