Stock Analysis

As global markets experience shifts with interest rate adjustments and economic indicators showing mixed signals, the Hong Kong market remains a focal point for investors seeking opportunities in high-growth tech sectors. In this dynamic environment, identifying promising stocks often involves assessing companies that not only demonstrate robust innovation and adaptability but also align well with prevailing market trends and economic conditions.

Top 10 High Growth Tech Companies In Hong Kong

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Wasion Holdings | 22.37% | 25.47% | ★★★★★☆ |

| MedSci Healthcare Holdings | 48.74% | 48.78% | ★★★★★☆ |

| Inspur Digital Enterprise Technology | 25.31% | 39.04% | ★★★★★☆ |

| RemeGen | 26.23% | 52.03% | ★★★★★☆ |

| Cowell e Holdings | 31.68% | 35.44% | ★★★★★★ |

| Innovent Biologics | 22.11% | 59.31% | ★★★★★☆ |

| Akeso | 33.50% | 53.12% | ★★★★★★ |

| Biocytogen Pharmaceuticals (Beijing) | 21.53% | 109.17% | ★★★★★☆ |

| Beijing Airdoc Technology | 37.47% | 93.35% | ★★★★★☆ |

| Sichuan Kelun-Biotech Biopharmaceutical | 24.70% | 8.53% | ★★★★★☆ |

Click here to see the full list of 43 stocks from our SEHK High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315)

Simply Wall St Growth Rating: ★★★★★☆

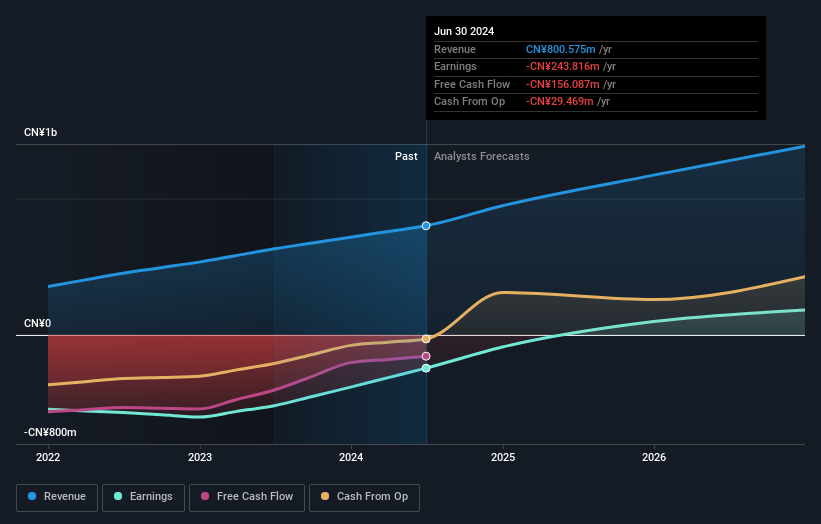

Overview: Biocytogen Pharmaceuticals (Beijing) Co., Ltd. is a biotechnology company focused on the research and development of antibody-based drugs, operating in China, the United States, and internationally with a market capitalization of HK$2.78 billion.

Operations: Biocytogen Pharmaceuticals generates revenue primarily from animal models selling, antibody development, and pre-clinical pharmacology and efficacy evaluation, with animal models selling contributing the largest share at CN¥354.44 million. The company is engaged in the biotechnology sector with a focus on antibody-based drug research and development across various regions including China and the United States.

Biocytogen Pharmaceuticals has demonstrated a notable rebound, with its recent half-year sales surging to CNY 410.5 million, a significant rise from the previous year's CNY 326.84 million. This 21.5% increase in revenue underscores the company's robust growth trajectory, further evidenced by a sharp reduction in net losses from CNY 189.81 million to CNY 50.67 million year-over-year. The company's strategic pivot towards high-margin antibody licensing and enhanced gene-editing technologies has not only improved financial health but also positioned it as an emerging leader in biotech innovations, particularly within the lucrative field of oncology treatments through partnerships like the one with IDEAYA Biosciences, potentially bringing in up to $406.5 million in milestone payments.

XD (SEHK:2400)

Simply Wall St Growth Rating: ★★★★★☆

Overview: XD Inc. is an investment holding company that focuses on developing, publishing, operating, and distributing mobile and web games in Mainland China and internationally, with a market cap of approximately HK$10.22 billion.

Operations: XD Inc. generates revenue primarily from its game development and distribution segment, contributing CN¥2.43 billion, and the TapTap platform, which adds CN¥1.43 billion. The company focuses on both domestic and international markets for mobile and web games.

XD Inc. has showcased a robust growth trajectory, with its half-year sales climbing to CNY 2.22 billion, marking a substantial 26.7% increase from the previous year's CNY 1.75 billion. This surge is complemented by a significant boost in net income, which more than doubled to CNY 205.1 million from CNY 90.19 million, reflecting an earnings growth of approximately 127%. Particularly noteworthy is the company's commitment to innovation as evidenced by R&D expenses that have escalated consistently, aligning with revenue increases and underscoring its strategic emphasis on developing cutting-edge gaming and information service solutions. The firm’s recent launches like GoGo Muffin and Sword of Convallaria not only enhance its product portfolio but also solidify its market position in tech-intensive sectors, promising continued upward momentum.

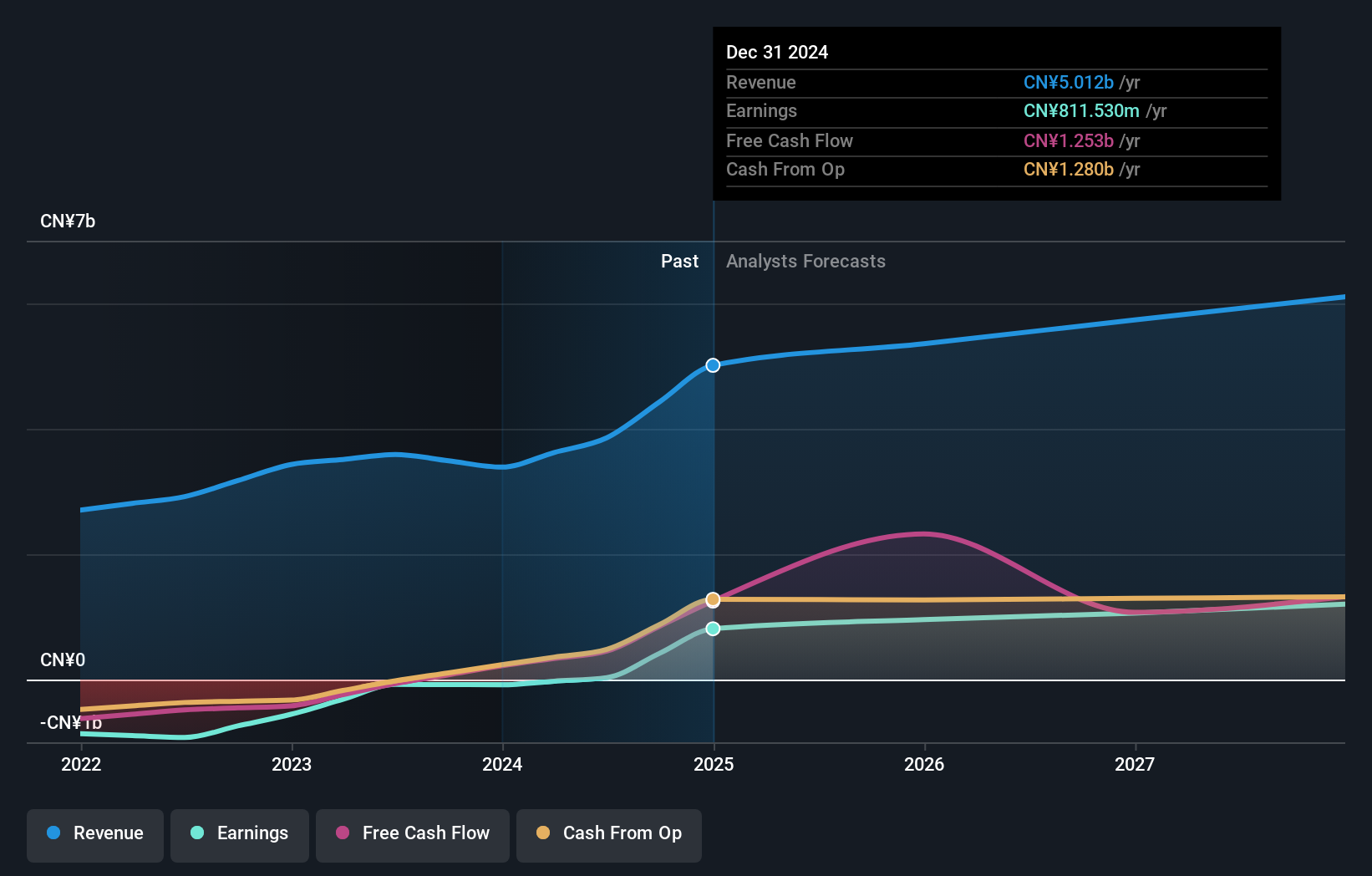

Alphamab Oncology (SEHK:9966)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphamab Oncology is a clinical stage biopharmaceutical company focused on the research, development, manufacture, and commercialization of oncology biologics, with a market cap of HK$3.86 billion.

Operations: The company generates revenue primarily from its pharmaceuticals segment, which amounted to CN¥255.87 million. As a clinical stage biopharmaceutical entity, it is involved in the entire lifecycle of oncology biologics from research and development to commercialization.

Alphamab Oncology's strategic focus on innovative cancer treatments is underscored by its recent licensing deal, potentially bringing in up to RMB 3.08 billion with milestones, including a substantial RMB 400 million upfront. This financial infusion is critical as the company ramps up its R&D efforts, which have historically aligned closely with revenue growth trends. In fact, their commitment to research is evident from the significant portion of revenue reinvested into R&D, aiming to enhance their proprietary platforms and drug candidates like JSKN003. This bispecific antibody-drug conjugate shows promising efficacy and safety profiles in advanced trials, particularly for hard-to-treat cancers such as HER2-positive tumors where traditional treatments falter. Alphamab's approach not only addresses urgent medical needs but also positions it well within the high-stakes biotech arena in Hong Kong, despite its current non-profitable status and market volatility.

Turning Ideas Into Actions

- Click this link to deep-dive into the 43 companies within our SEHK High Growth Tech and AI Stocks screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9966

Alphamab Oncology

A clinical stage biopharmaceutical company, engages in the research and development, manufacture, and commercialization of oncology biologics.