Can Alphamab Oncology’s (SEHK:9966) FDA Fast Track Milestone Reshape Its Competitive Position in Oncology?

Reviewed by Sasha Jovanovic

- Alphamab Oncology recently announced that its drug candidate JSKN003 has received Fast Track Designation from the U.S. FDA for the treatment of platinum-resistant recurrent epithelial ovarian cancer, primary peritoneal cancer, or fallopian tube cancer, without restriction by HER2 expression.

- This regulatory milestone builds on promising international clinical trial data and highlights momentum in Alphamab's pipeline of antibody-based oncology therapies.

- We'll explore how the U.S. FDA's Fast Track Designation for JSKN003 enhances Alphamab Oncology's position in developing innovative cancer treatments.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Alphamab Oncology's Investment Narrative?

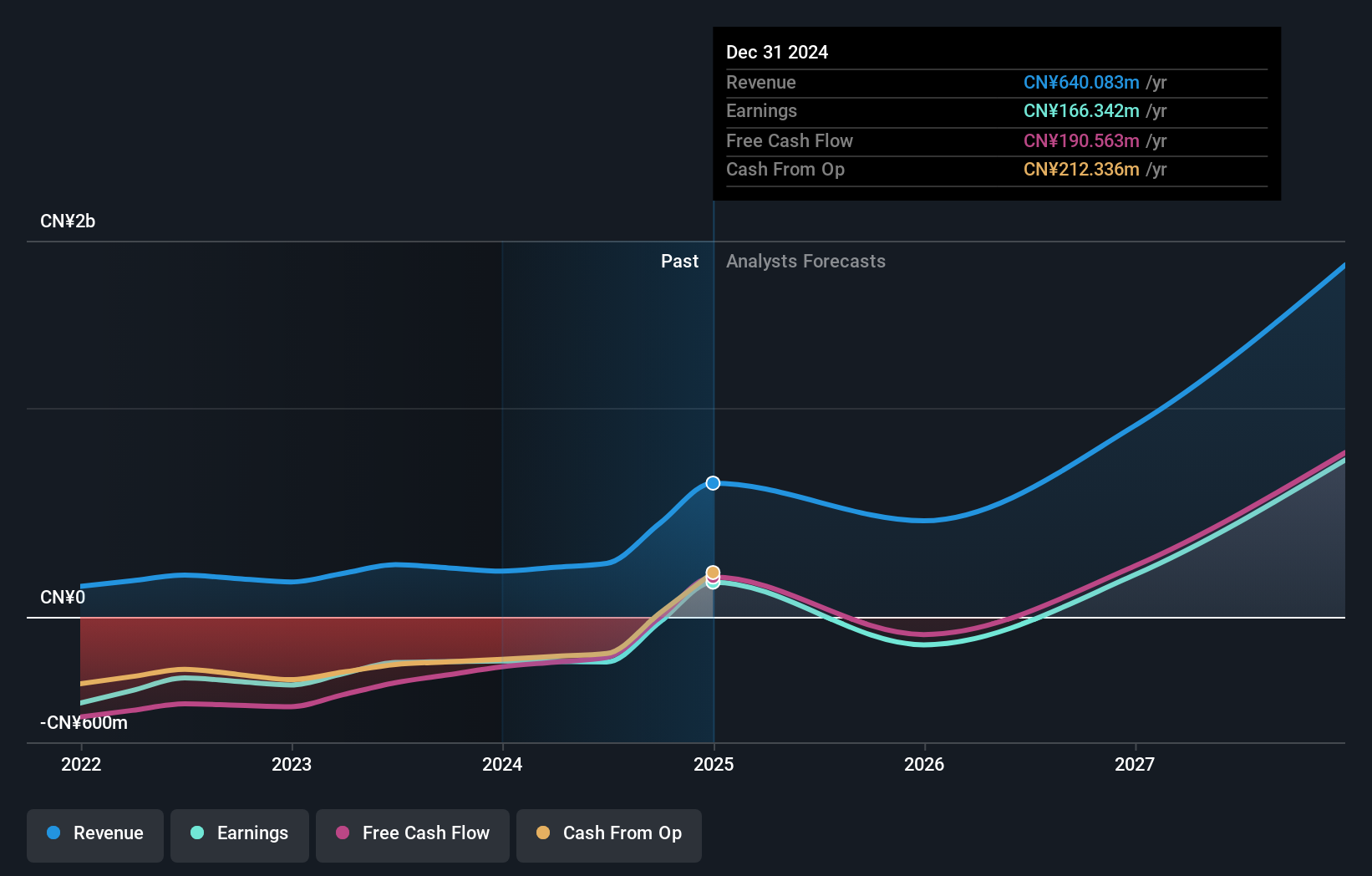

For those considering Alphamab Oncology, the belief at the core is that regulatory milestones and clinical progress can drive revaluation in innovative biotech companies, especially with a pipeline as advanced as Alphamab’s. The recent U.S. FDA Fast Track Designation for JSKN003, on the back of promising phase data, could energize near-term catalysts, opening doors to accelerated timelines and a stronger global profile for the firm’s antibody-drug conjugates. This milestone adds weight to positive revenue forecasts and recent profitability but also shifts attention to execution risk, turning compelling trial results into regulatory approvals and eventual commercialization, particularly outside China. Volatile share price action and recent insider selling remain watchpoints, even as valuation metrics and clinical momentum now appear more balanced in light of this news. The competitive intensity and the company’s ability to sustain pipeline progress are the central risks to monitor as expectations recalibrate.

But, on the other hand, significant insider selling is something investors should keep front of mind. Despite retreating, Alphamab Oncology's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Alphamab Oncology - why the stock might be worth as much as HK$7.00!

Build Your Own Alphamab Oncology Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Alphamab Oncology research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Alphamab Oncology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alphamab Oncology's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9966

Alphamab Oncology

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of biotherapeutics for cancer treatment in the People’s Republic of China.

Excellent balance sheet and good value.

Market Insights

Community Narratives