Akeso (SEHK:9926) Valuation: Assessing Pipeline Momentum After Landmark Alzheimer’s and Oncology R&D Milestones

Reviewed by Simply Wall St

Akeso (SEHK:9926) has just been cleared by China’s National Medical Products Administration to initiate clinical trials for AK152, its first bispecific antibody aimed at tackling Alzheimer’s Disease, and a breakthrough in the domestic biotech space.

See our latest analysis for Akeso.

While Akeso's progress on Alzheimer's and its oncology advances have kept it in the headlines, the share price has pulled back 36% over the past three months after a rapid rally earlier this year. Still, the stock’s total shareholder return over the past year stands at an impressive 54%, and longer-term holders have seen gains north of 240% in three years. This is a testament to how innovation is still fueling long-term momentum.

If Akeso's pipeline breakthroughs have you thinking bigger, now’s the perfect time to expand your search and discover See the full list for free.

With Akeso trading at a significant discount to analyst price targets despite pipeline breakthroughs and strong returns, the crucial question is whether the recent pullback spells a real buying opportunity or if future growth is already reflected in the current price.

Most Popular Narrative: 34.2% Undervalued

With the narrative pointing to a fair value substantially above Akeso’s last close, a significant gap remains between what analysts expect and the market’s current pricing. This disconnect hints at a valuation driven by robust catalysts that could ignite future growth.

The collaboration with SUMMIT Therapeutics and the strategic partnership with Pfizer to combine ivonescimab with Pfizer's ADCs suggests expansion into new therapeutic areas and geographic markets. This arrangement promises to impact earnings positively.

Want to know what powers such a bold fair value? One key metric used in this narrative is a future profit multiple. Hint: it is not your typical biotech expectation. Curiosity piqued? See how surprising revenue and profit targets unlock a valuation the market is not yet pricing in.

Result: Fair Value of $172.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Akeso's profitability challenges and dependence on a handful of key drugs could threaten its ambitious growth story if setbacks occur.

Find out about the key risks to this Akeso narrative.

Another View: Market vs. Fundamentals

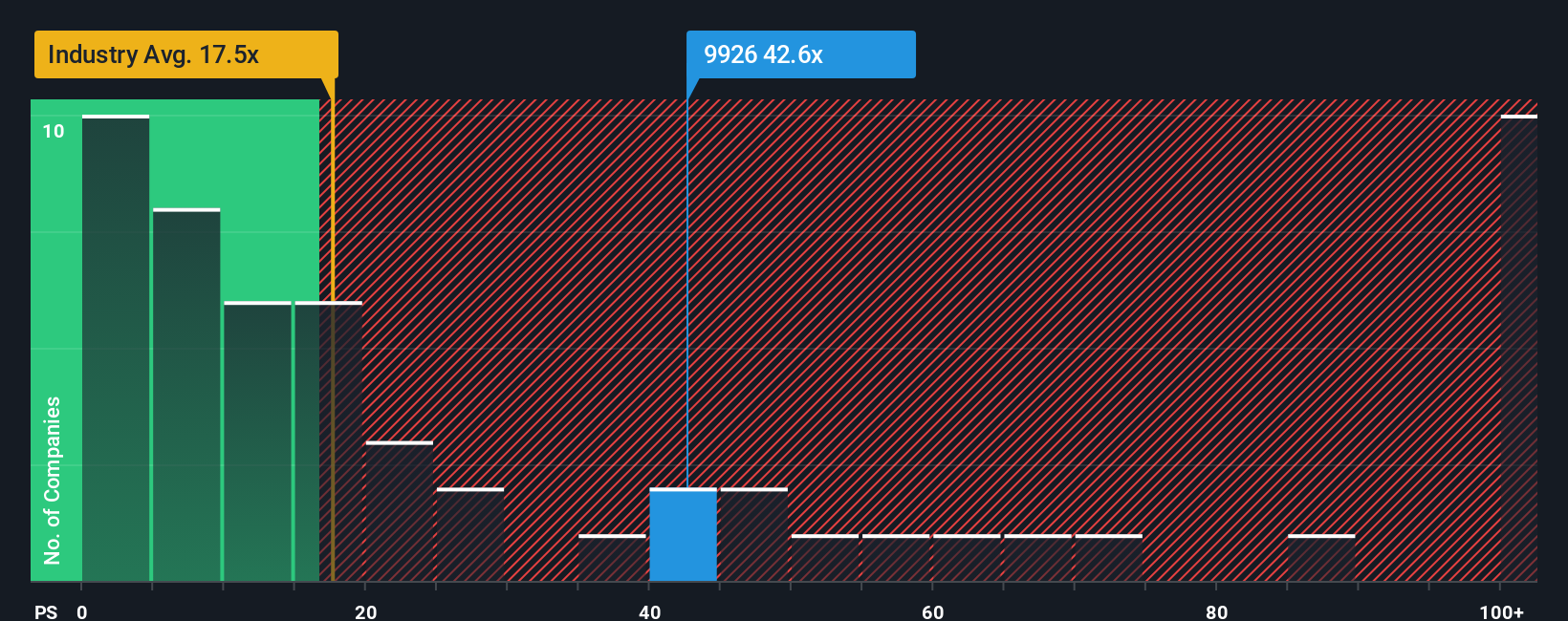

Looking from a different angle, Akeso’s current market value is well above its sector peers when measured against its sales. Trading at a ratio of 37.9 compared to the industry’s 13.4 and a fair ratio of 19.2, the stock appears expensive by this standard. This suggests investors may be pricing in extra optimism. Could this premium leave little room for disappointment, or is it the cost of future potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Akeso Narrative

If you see things differently or want to investigate the numbers on your own terms, you can craft a unique Akeso story in just a few minutes with Do it your way.

A great starting point for your Akeso research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t just stop at Akeso. Expand your investing edge by searching for companies breaking new ground, boasting strong upsides, or redefining tomorrow’s markets.

- Tap into the potential of digital assets and blockchain innovations when you check out these 81 cryptocurrency and blockchain stocks now.

- Hunt for tomorrow’s undervalued winners with built-in financial strength and growth metrics using these 919 undervalued stocks based on cash flows.

- Spot healthcare disruptors making waves with artificial intelligence by exploring these 30 healthcare AI stocks while these trends are in their early stages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9926

Akeso

A biopharmaceutical company, engages in the research, development, manufacture, and commercialization of antibody drugs worldwide.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives