Sichuan Kelun-Biotech (SEHK:6990): Evaluating Valuation Following New Clinical Results and Global Trial Updates

Reviewed by Simply Wall St

Sichuan Kelun-Biotech Biopharmaceutical (SEHK:6990) caught attention this week after unveiling results from several clinical studies on its core cancer therapy, sacituzumab tirumotecan, at a major oncology conference in China.

See our latest analysis for Sichuan Kelun-Biotech Biopharmaceutical.

Momentum around Sichuan Kelun-Biotech Biopharmaceutical has been strong, fueled in part by headline-grabbing clinical trial results and regulatory milestones for sacituzumab tirumotecan. While some volatility appeared recently, the stock’s year-to-date share price return of 162.45% captures investors’ excitement over its innovation and global ambitions.

If breakthroughs in oncology are on your radar, you might also want to explore other promising companies. See the full healthcare stocks list with See the full list for free..

With the stock running up more than 160 percent this year, investors are now left wondering if Kelun-Biotech is still undervalued or if the market has already taken future growth into account, leaving little room for upside.

Price-to-Book of 18.7x: Is it justified?

Sichuan Kelun-Biotech Biopharmaceutical currently trades at a price-to-book (P/B) ratio of 18.7x, which is much lower than that of its closest peers. However, it remains significantly higher when compared to the broader Hong Kong biotechs industry.

The price-to-book ratio measures how much investors are willing to pay for each dollar of net assets. For a fast-growing or innovative biotech, an elevated P/B ratio can suggest optimism about future pipeline successes or revenue expansion.

While the company's P/B ratio represents good value relative to peer companies that average 40.8x, it is still much more expensive than the wider industry average of just 4.9x. This considerable premium highlights the market’s expectation for outstanding future growth, but also signals that expectations are already high compared to sector norms.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 18.7x (ABOUT RIGHT)

However, ongoing losses and revenue fluctuations could challenge investor confidence, especially if future pipeline milestones or regulatory approvals are delayed.

Find out about the key risks to this Sichuan Kelun-Biotech Biopharmaceutical narrative.

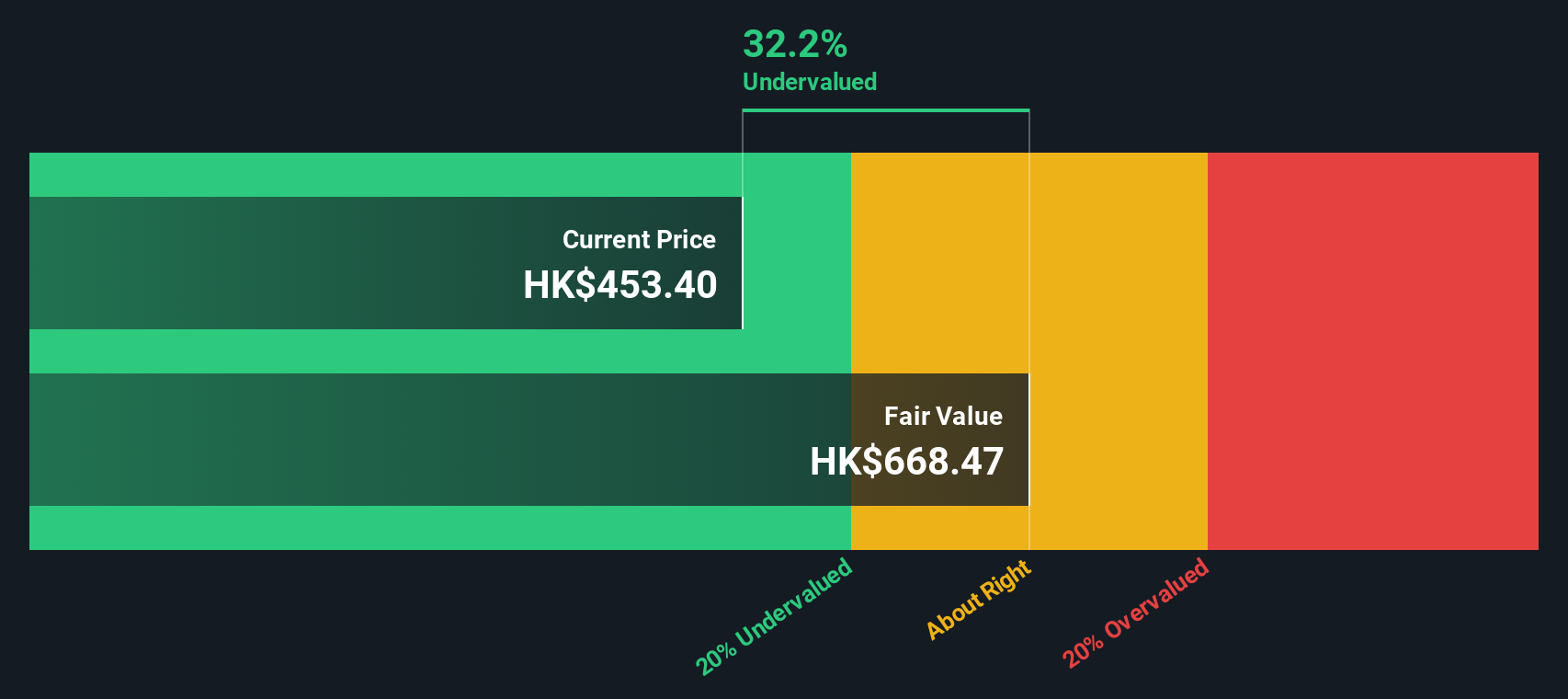

Another View: Discounted Cash Flow Perspective

Looking at the SWS DCF model provides a different perspective. In this model, Sichuan Kelun-Biotech Biopharmaceutical is estimated to be trading at a 34.4% discount to its calculated fair value. This indicates that, based on projected cash flows, the current share price may not fully reflect the company’s potential.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sichuan Kelun-Biotech Biopharmaceutical for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sichuan Kelun-Biotech Biopharmaceutical Narrative

If you have a different perspective or want to dive deeper into the figures, you can craft your own story using our tools in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Sichuan Kelun-Biotech Biopharmaceutical.

Looking for more investment ideas?

Why settle for the ordinary when smarter choices are just a click away? Take action now and explore exceptional, ready-made stock ideas before others do.

- Capitalize on overlooked value by reviewing these 919 undervalued stocks based on cash flows with attractive fundamentals and strong cash flow potential.

- Target strong, consistent returns from these 16 dividend stocks with yields > 3% offering yields above 3% and a record of rewarding shareholders.

- Get ahead in technology breakthroughs by identifying tomorrow’s innovations through these 26 AI penny stocks fueling the artificial intelligence wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6990

Sichuan Kelun-Biotech Biopharmaceutical

A biopharmaceutical company, engages in the research and development, manufacturing, and commercialization of novel drugs in oncology, immunology, and other therapeutic areas in the People’s Republic of China and internationally.

Exceptional growth potential with excellent balance sheet.

Market Insights

Community Narratives