A Look at Shanghai Henlius Biotech’s (SEHK:2696) Valuation Following Its Strategic Immunotherapy Partnership

Reviewed by Simply Wall St

Shanghai Henlius Biotech (SEHK:2696) has entered a strategic partnership with Forlong Biotechnology to jointly develop next-generation cancer immunotherapies. This move brings together Henlius’s antibody expertise and Forlong’s engineered cytokine technologies, further expanding Henlius’s oncology pipeline.

See our latest analysis for Shanghai Henlius Biotech.

Shanghai Henlius Biotech’s latest partnership news comes at a time when its stock has seen remarkable momentum, with the 1-year total shareholder return standing at a striking 218.95%. The share price has surged nearly 200% so far this year, signaling renewed confidence and growth potential, even with some typical short-term volatility along the way.

If breakthroughs in cancer immunotherapy spark your curiosity, consider broadening your outlook and discover more standout healthcare innovators through our See the full list for free..

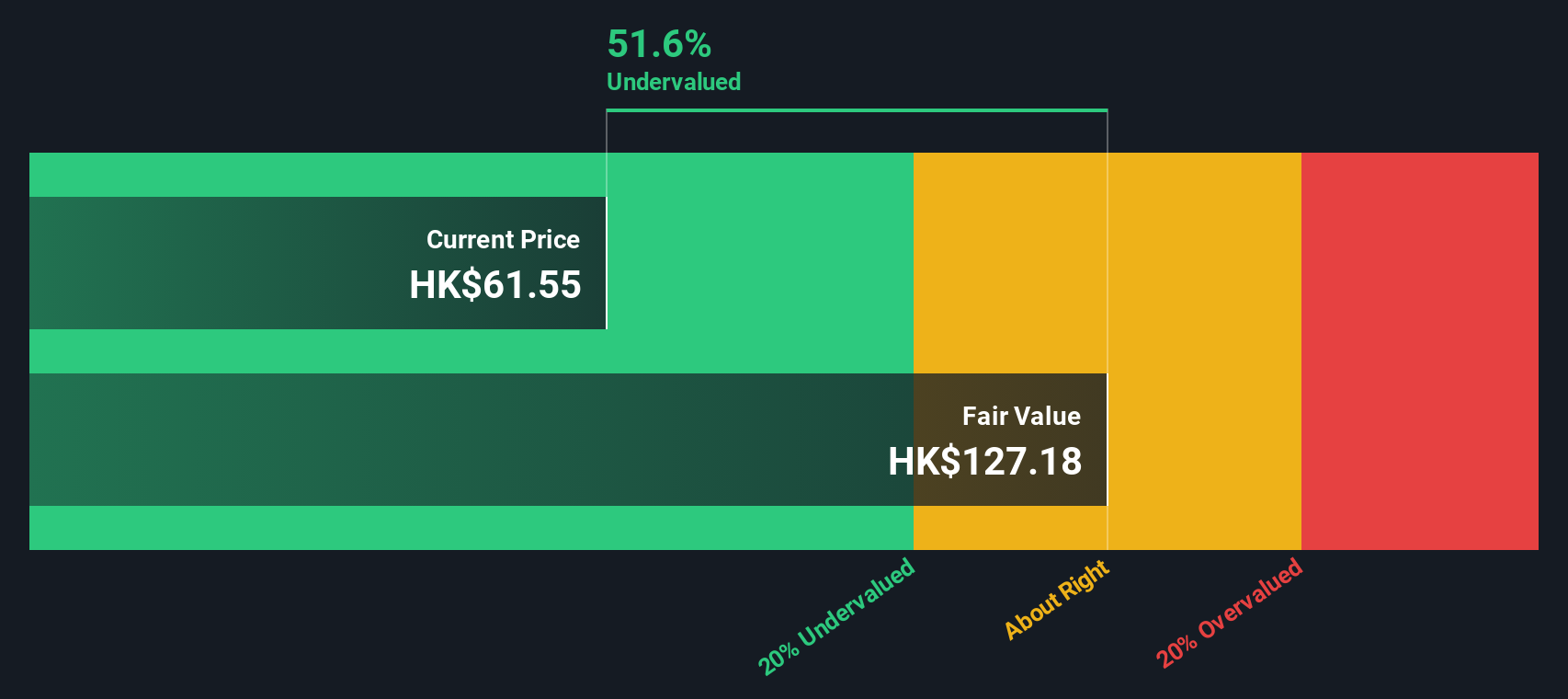

But with the stock’s meteoric gains and pipeline momentum, investors may wonder: is Henlius still undervalued at today’s price, or has the market already factored in the company’s future growth potential?

Price-to-Earnings of 42.2x: Is it justified?

Henlius trades at a price-to-earnings (P/E) ratio of 42.2x, close to the average for Asian biotechs and lower than its listed peer group. At its last close price of HK$69.85, the stock appears attractively valued versus some peers, but not against its fair value anchor.

The price-to-earnings ratio compares Henlius’s share price to its per-share earnings and is widely used to measure whether investors are paying a premium for future growth or value. In high-growth biotech, a high P/E reflects strong earnings expectations as companies reinvest to scale up innovation and commercialization.

Henlius’s P/E sits just below the Asian biotech sector average of 43.7x and well below its direct peer group’s average of 61.6x. However, it stands significantly above its calculated “fair” P/E ratio of 23.3x, indicating the market has priced in ambitious growth and profitability assumptions, possibly more than what fundamental models suggest is sustainable long term.

Explore the SWS fair ratio for Shanghai Henlius Biotech

Result: Price-to-Earnings of 42.2x (ABOUT RIGHT)

However, slower revenue growth and ambitious market expectations could pose headwinds if Henlius’s innovation or commercial momentum does not keep pace.

Find out about the key risks to this Shanghai Henlius Biotech narrative.

Another View: Discounted Cash Flow Suggests Undervaluation

Our SWS DCF model provides a different perspective, estimating Henlius’s fair value at HK$124.47, which is well above the current share price of HK$69.85. This method implies the stock could be trading at a significant discount. Does this alternative outlook hint at hidden upside, or does it reflect overly optimistic assumptions?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Shanghai Henlius Biotech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Shanghai Henlius Biotech Narrative

If you have a different perspective or want to dig deeper into the numbers yourself, you can build your own story from the ground up in just a few minutes, starting here: Do it your way.

A great starting point for your Shanghai Henlius Biotech research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. The market is filled with companies on the verge of breakthroughs, and missing out could cost you real upside.

- Find high-potential upstarts by checking out these 3590 penny stocks with strong financials that combine strong financials with underestimated market positions.

- Unlock the next wave of innovation by starting with these 26 AI penny stocks powering transformative changes in artificial intelligence across industries.

- Strengthen your portfolio’s resilience by targeting these 22 dividend stocks with yields > 3% offering reliable income from stable, consistent payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2696

Shanghai Henlius Biotech

Engages in the research and development of biologic medicines with a focus on oncology, autoimmune diseases, and ophthalmic diseases.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives