Do CStone Pharmaceuticals' (SEHK:2616) New Antibody Trials Hint at a Shift in Global Ambitions?

Reviewed by Sasha Jovanovic

- In early November 2025, CStone Pharmaceuticals reported regulatory approval in China for Phase clinical trials of its innovative tri-specific antibody CS2009 for advanced solid tumors and revealed the first international presentation of its bispecific antibody CS2015 at the ACAAI Annual Scientific Meeting in the United States.

- These developments not only highlight progress in CStone’s R&D pipeline but also mark an important step in gaining broader global scientific recognition for its novel drug candidates.

- We’ll examine how CStone’s milestone clinical updates and international scientific presence impact the company’s investment narrative and future prospects.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is CStone Pharmaceuticals' Investment Narrative?

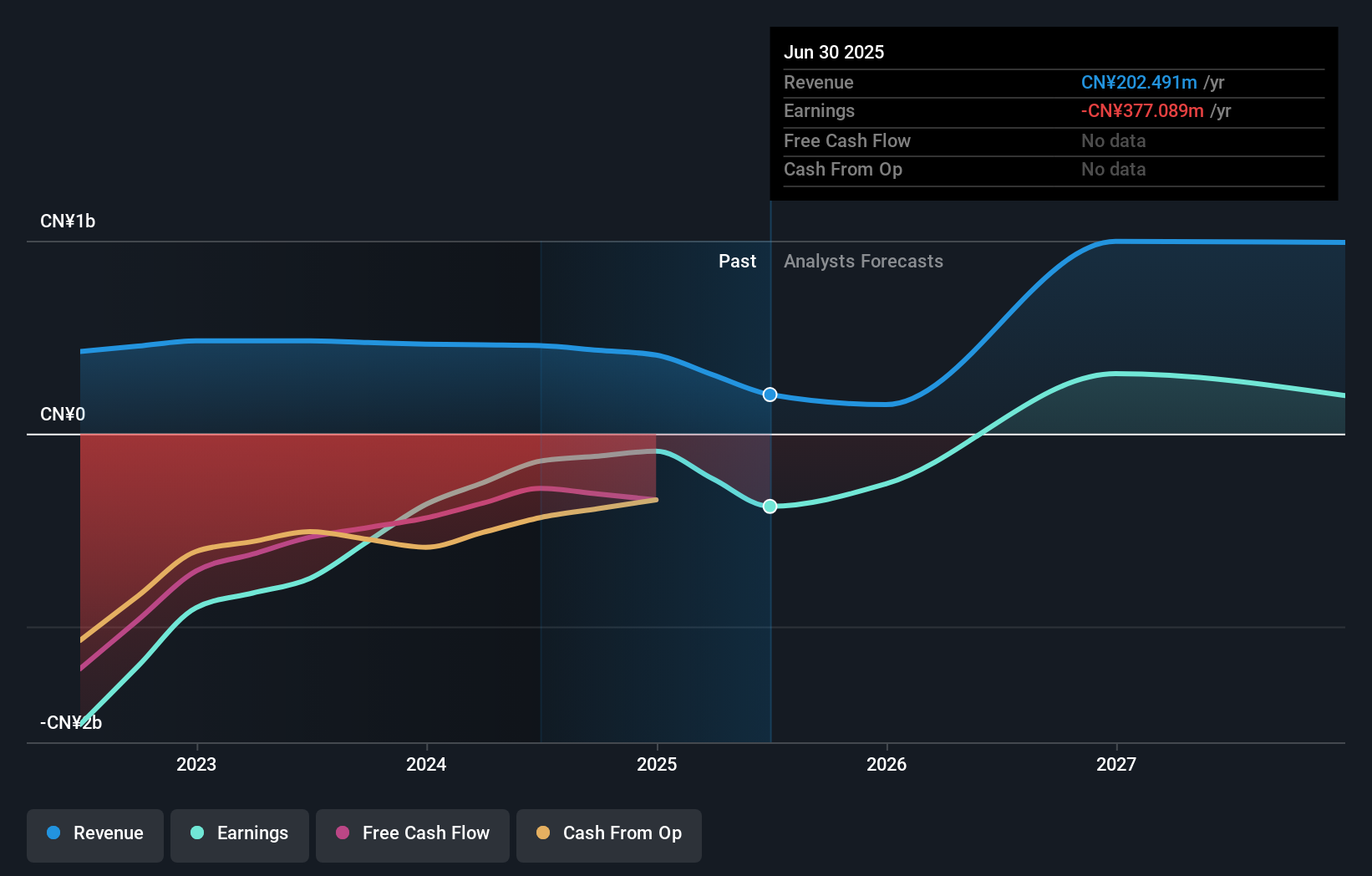

Anyone considering CStone Pharmaceuticals right now is essentially betting on the company’s ability to turn innovative clinical progress into commercial and financial breakthroughs. With the latest regulatory green light for CS2009’s Phase II trials in China and CS2015’s debut at a premier U.S. scientific meeting, CStone adds fuel to its R&D narrative, moving beyond Asia and gaining important scientific legitimacy abroad. These events could sharpen near-term catalysts, especially as the global CS2009 trial enrolls across key markets and the international scientific community takes note of CS2015’s profile in inflammation. That said, with widened product losses, the business is still loss-making, and the run-up in price over the last year may already reflect much optimism. Looking ahead, investors will need to weigh CStone’s pace of pipeline progress against real revenue growth, funding needs, and the volatile pricing common in high-risk biotech.

However, not all investors may be factoring in the ongoing cash burn and dilution risk. Despite retreating, CStone Pharmaceuticals' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on CStone Pharmaceuticals - why the stock might be worth just HK$6.92!

Build Your Own CStone Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CStone Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free CStone Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CStone Pharmaceuticals' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2616

CStone Pharmaceuticals

A biopharmaceutical company, researches and develops anti-cancer therapies to address the unmet medical needs of cancer patients in Mainland China and internationally.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives