Early Clinical Success of Allogeneic CAR-T Therapies Might Change The Case For Investing In CARsgen Therapeutics (SEHK:2171)

Reviewed by Sasha Jovanovic

- CARsgen Therapeutics announced recent clinical data highlighting initially favorable safety and encouraging efficacy from its allogeneic CAR-T therapies, CT0596 and CT1190B, in relapsed/refractory multiple myeloma and non-Hodgkin's lymphoma, with several patients achieving deep responses after extensive prior treatments.

- The progress includes advancement into expanded clinical trial phases and signals plans to submit an Investigational New Drug application, reflecting ongoing momentum in CARsgen's pipeline of cell therapies.

- To further explore CARsgen's investment narrative, we’ll look at how early signs of efficacy for these CAR-T candidates support future growth potential.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is CARsgen Therapeutics Holdings' Investment Narrative?

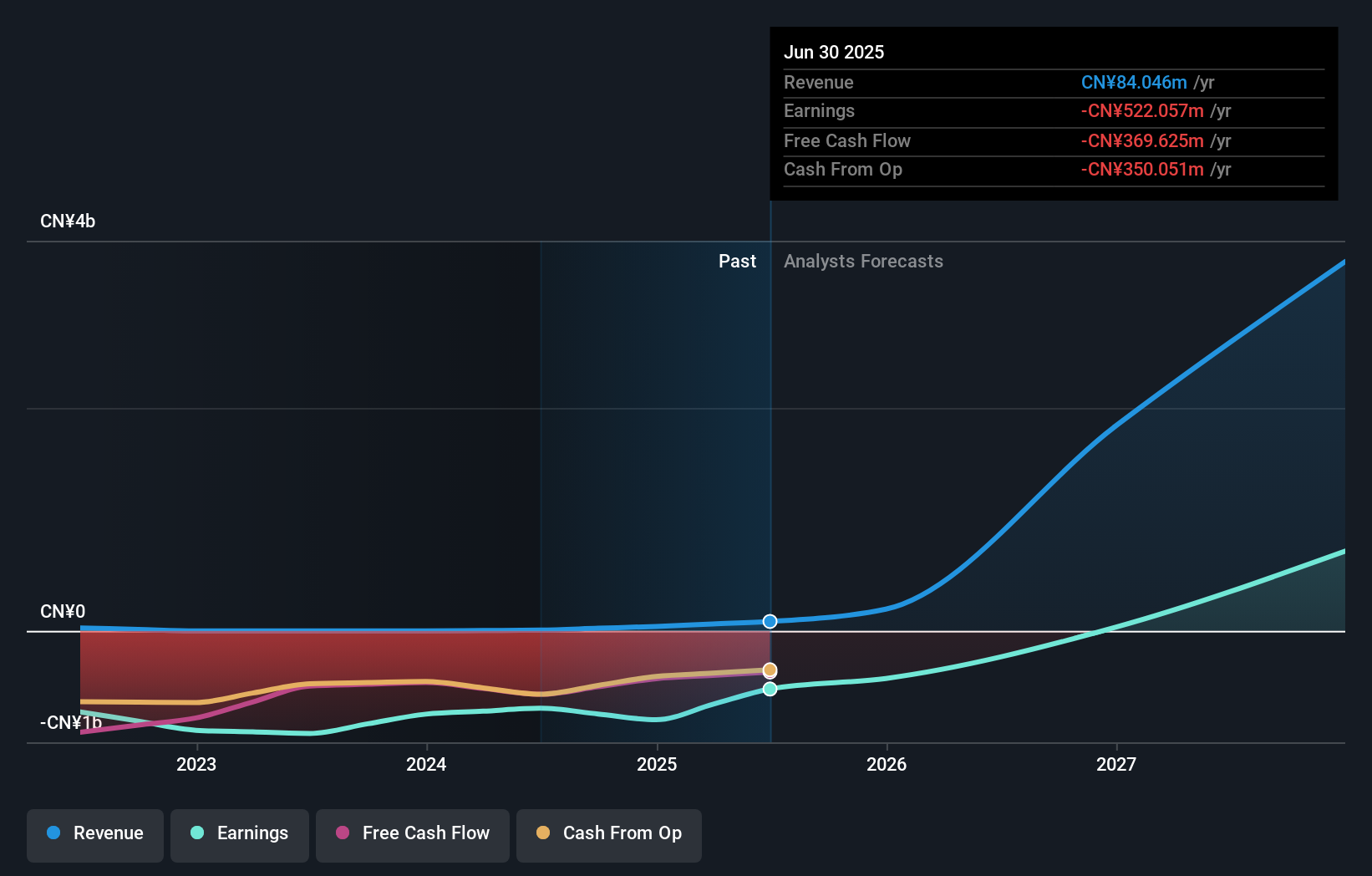

For CARsgen Therapeutics shareholders, the crucial story is belief in the company's progress toward bringing innovative CAR-T therapies to market, powered by rapid revenue growth and ongoing clinical milestones. The recent data on CT0596 and CT1190B, showing early safety and efficacy in difficult-to-treat cancers, directly addresses the company’s biggest short-term catalyst: gaining momentum and investor confidence ahead of key regulatory filings. This is a material boost, as these positive signals could drive investor sentiment and potentially accelerate the path to advanced trial phases or approvals, especially important given CARsgen’s recent earnings improvement and ongoing shift toward profitability. However, risks remain: the expense of clinical development, competition in CAR-T, volatility in the share price, and the importance of securing regulatory green lights for these latest therapies. Ultimately, this news alters the balance between catalyst and risk, sharpening focus on near-term clinical and regulatory inflection points.

On the flip side, heavy spending on clinical development is something you’ll want to consider.

Exploring Other Perspectives

Explore 2 other fair value estimates on CARsgen Therapeutics Holdings - why the stock might be worth just HK$22.64!

Build Your Own CARsgen Therapeutics Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CARsgen Therapeutics Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CARsgen Therapeutics Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CARsgen Therapeutics Holdings' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2171

CARsgen Therapeutics Holdings

An investment holding company, engages in discovering, developing, and commercializing chimeric antigen receptor T (CAR-T) cell therapies for the treatment of hematological malignancies, solid tumors, and autoimmune diseases in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives