Why Is Keymed Biosciences (SEHK:2162) Drawing Big-Name Support After Stapokibart’s Approval in China?

Reviewed by Sasha Jovanovic

- Goldman Sachs recently initiated coverage on Keymed Biosciences, highlighting the approval of its first commercial product, stapokibart, in China for atopic dermatitis and chronic rhinosinusitis, while expressing confidence in the pipeline asset CM512 for asthma and COPD.

- This development underscores the growing recognition of Keymed's product pipeline and the confidence major institutions are placing in the company's future prospects.

- We'll explore how optimism for Keymed's pipeline, especially CM512, shapes the company's ongoing investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Keymed Biosciences' Investment Narrative?

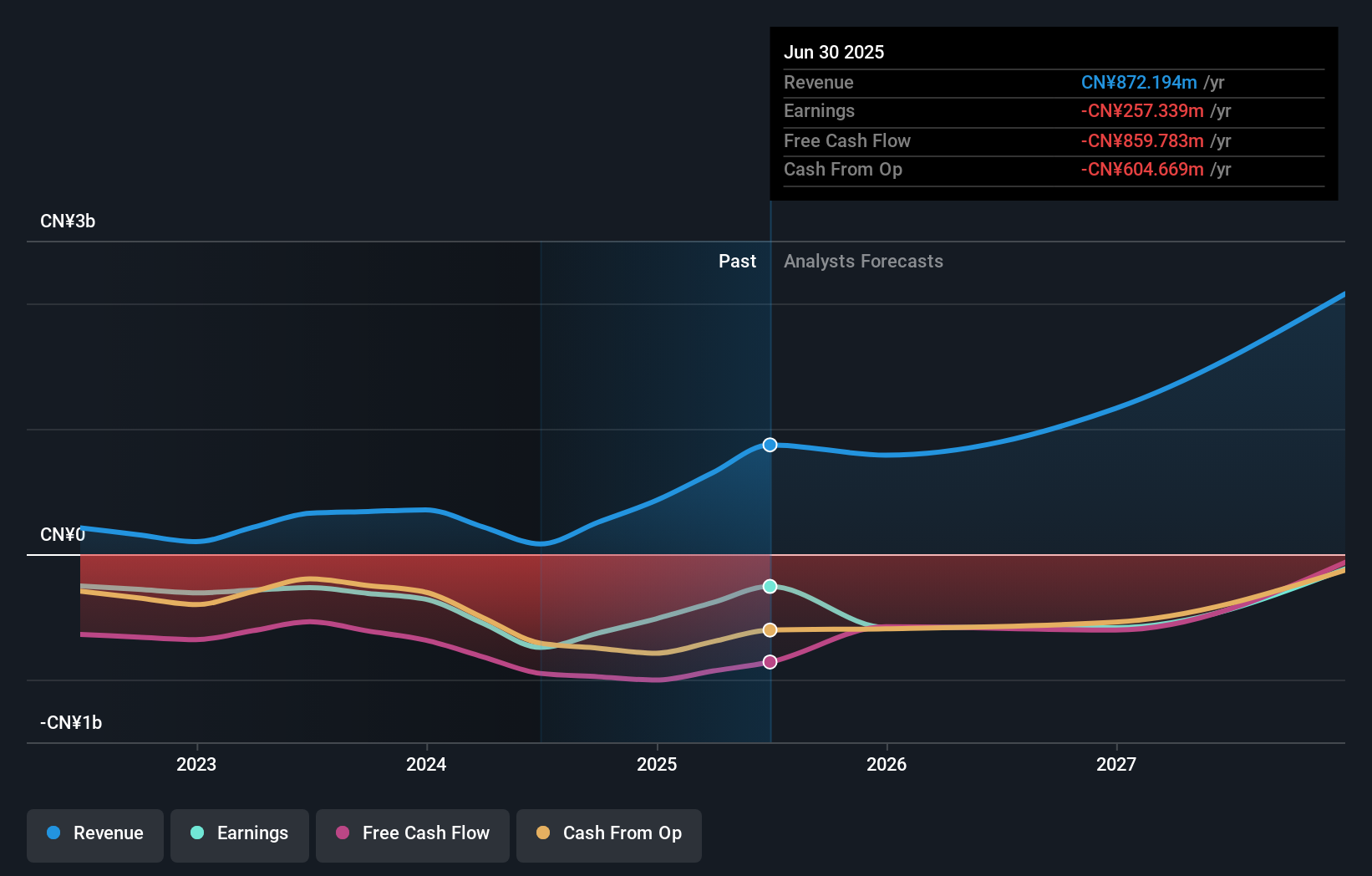

To back Keymed Biosciences, you really need to believe that its expanding pipeline, especially with the newly approved stapokibart and the promise shown by CM512, will turn strong revenue growth into eventual profitability, despite the company remaining unprofitable and expected to stay that way for the next few years. The recent Goldman Sachs coverage draws attention to tangible commercial milestones, possibly shifting the focus of short-term catalysts from regulatory wins to early sales traction and further clinical progress for pipeline drugs. While improved revenue and narrower losses are positives, ongoing concerns persist around executive turnover, cash burn, and board independence. Current price moves suggest the market is absorbing the recent good news, but risks haven’t disappeared, especially as market expectations are now more closely tied to delivering on commercial execution and pipeline performance.

However, some investors may be overlooking the board’s lack of independence and recent executive changes.

Exploring Other Perspectives

Explore another fair value estimate on Keymed Biosciences - why the stock might be worth just HK$81.57!

Build Your Own Keymed Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Keymed Biosciences research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Keymed Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Keymed Biosciences' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keymed Biosciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2162

Keymed Biosciences

A biotechnology company, engages in the discovery and development of biological therapies in the autoimmune and oncology therapeutic areas in Mainland China and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives