What SSY Group (SEHK:2005)'s New Respiratory and Liver Drug Approvals Mean For Shareholders

Reviewed by Sasha Jovanovic

- Earlier this week, SSY Group Limited received approval from China's National Medical Products Administration for several new drugs targeting respiratory and liver conditions, including Aminophylline Tablets, Procaterol Hydrochloride Inhalation Solution, and Ademetionine 1,4-Butanedisulfonate for Injection.

- This milestone not only broadens SSY Group’s portfolio but also strengthens its presence in key therapeutic areas with significant healthcare demand.

- We’ll explore how these regulatory approvals, particularly in fast-growing specialty medicine markets, factor into the company’s wider investment story.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is SSY Group's Investment Narrative?

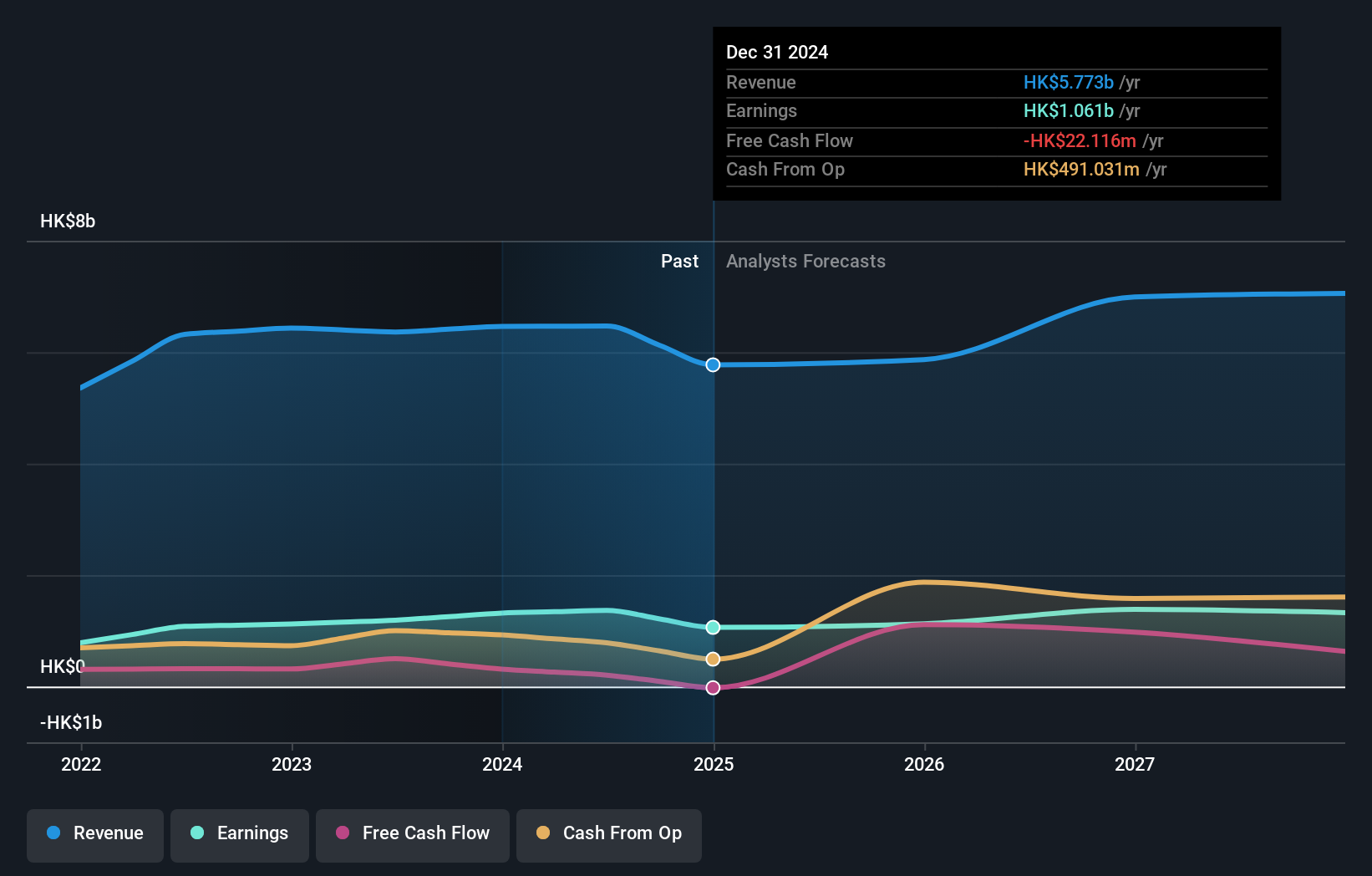

For anyone considering SSY Group, the bigger-picture belief centers on the company’s ability to expand its drug portfolio and capture sustainable demand in China’s high-need therapeutic markets. This week’s drug approvals do provide a fresh sign of momentum, but it’s worth asking if these milestones are likely to shift the short-term outlook. Up until now, the biggest catalysts for SSY Group were expected to be market registration of new products and consistent regulatory wins, both of which the company has delivered on regularly throughout the year. However, those achievements have not translated to rising sales or earnings, with H1 2025 numbers showing a sizable drop and the dividend cut as a result. While this latest batch of approvals supports the long-term appeal and may modestly ease questions about future growth, any material impact will depend on how quickly these drugs gain traction in the market. The main risks remain: earnings and dividends under pressure, slow revenue growth projections, and a share price still trading at a discount even after these positive developments.

But on the other hand, long-term dividend coverage is still not assured. Despite retreating, SSY Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on SSY Group - why the stock might be worth over 2x more than the current price!

Build Your Own SSY Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SSY Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SSY Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SSY Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success