How Investors Are Reacting To SSY Group (SEHK:2005) Winning Approval For Its Vitamin B6 Injection

Reviewed by Sasha Jovanovic

- SSY Group Limited recently announced that its Vitamin B6 Injection received approval from the National Medical Products Administration of China for the Consistency Evaluation of the Quality and Efficacy of Generic Drugs.

- This regulatory milestone broadens SSY Group’s product range and could improve treatment access for individuals affected by vitamin B6 deficiency in China.

- We'll explore how this regulatory approval in China could influence SSY Group’s investment narrative, particularly regarding its pharmaceutical portfolio expansion.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is SSY Group's Investment Narrative?

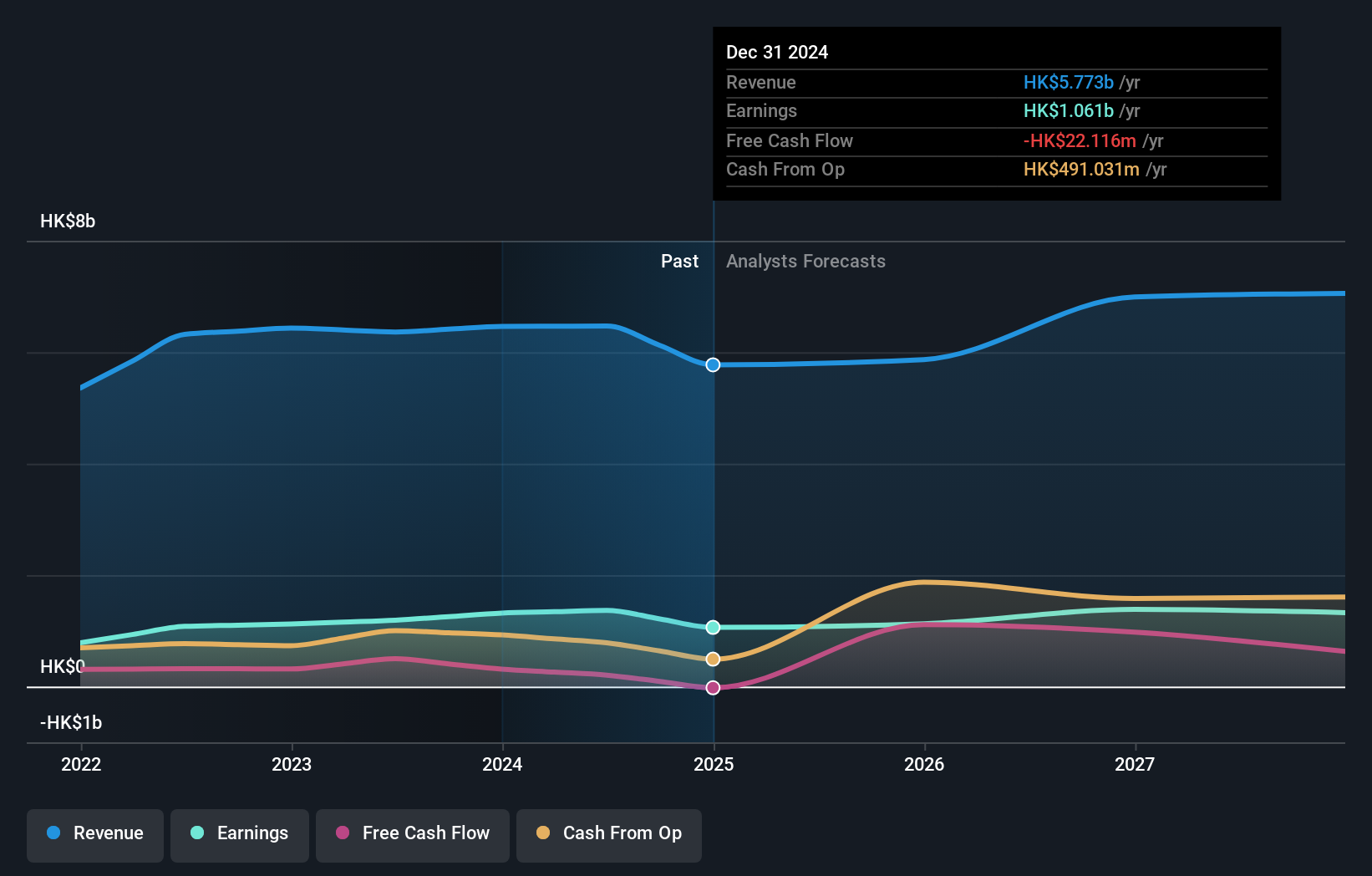

For someone considering SSY Group, the big picture hinges on faith in the firm’s ability to expand its healthcare product portfolio while turning regulatory wins into meaningful profit growth. The recent Vitamin B6 Injection approval by Chinese regulators bolsters SSY’s credentials in generic pharmaceuticals, signaling a continued focus on new product launches after a string of recent approvals. However, the company’s most recent earnings update highlighted weaker sales (HK$2,147.19 million) and shrinking profits, so whether these product approvals can offset softer financials in the short term is a key question. Persistent pressures include a declining profit margin, underperformance against the Hong Kong market, and a lack of strong board independence. The B6 milestone may help as a short-term catalyst, but unless it spurs wider growth adoption, the primary risks remain unchanged. In contrast, limited board independence could present further governance issues.

Despite retreating, SSY Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 3 other fair value estimates on SSY Group - why the stock might be worth over 2x more than the current price!

Build Your Own SSY Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SSY Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free SSY Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SSY Group's overall financial health at a glance.

Interested In Other Possibilities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2005

SSY Group

An investment holding company, researches, develops, manufactures, trades in, and sells various pharmaceutical products to hospitals and distributors in the People’s Republic of China and internationally.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives