Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) Surges 37% Yet Its Low P/S Is No Reason For Excitement

Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) shareholders would be excited to see that the share price has had a great month, posting a 37% gain and recovering from prior weakness. Looking further back, the 23% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

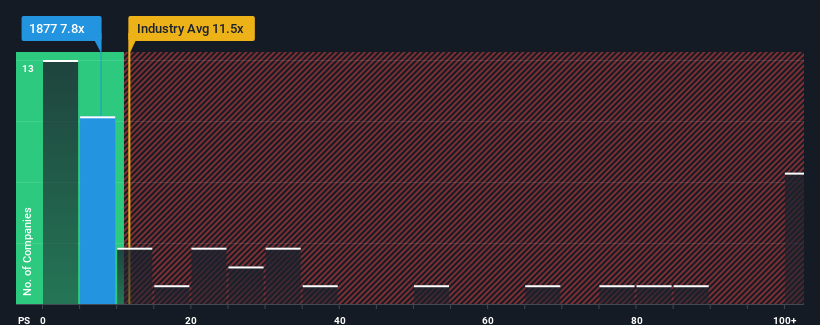

In spite of the firm bounce in price, Shanghai Junshi Biosciences may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 7.8x, since almost half of all companies in the Biotechs industry in Hong Kong have P/S ratios greater than 11.5x and even P/S higher than 52x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shanghai Junshi Biosciences

What Does Shanghai Junshi Biosciences' Recent Performance Look Like?

Shanghai Junshi Biosciences could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Junshi Biosciences will help you uncover what's on the horizon.How Is Shanghai Junshi Biosciences' Revenue Growth Trending?

In order to justify its P/S ratio, Shanghai Junshi Biosciences would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 46%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 46% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 36% over the next year. That's shaping up to be materially lower than the 180% growth forecast for the broader industry.

With this in consideration, its clear as to why Shanghai Junshi Biosciences' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Shanghai Junshi Biosciences' P/S?

Despite Shanghai Junshi Biosciences' share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Shanghai Junshi Biosciences maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Shanghai Junshi Biosciences that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives