Risks Still Elevated At These Prices As Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) Shares Dive 29%

Shanghai Junshi Biosciences Co., Ltd. (HKG:1877) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 69% loss during that time.

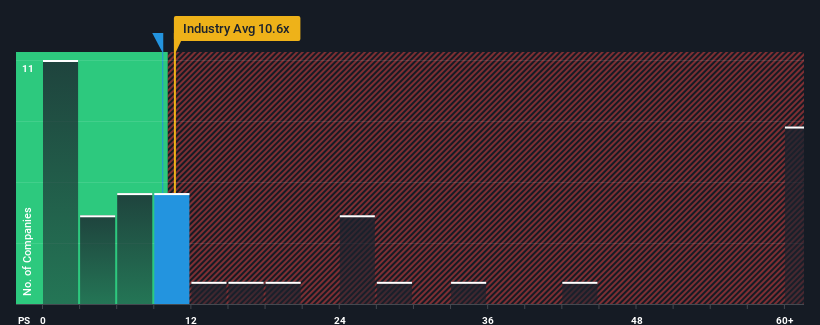

Although its price has dipped substantially, there still wouldn't be many who think Shanghai Junshi Biosciences' price-to-sales (or "P/S") ratio of 9.6x is worth a mention when the median P/S in Hong Kong's Biotechs industry is similar at about 10.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shanghai Junshi Biosciences

What Does Shanghai Junshi Biosciences' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Shanghai Junshi Biosciences' revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Junshi Biosciences will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Shanghai Junshi Biosciences' to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 52%. As a result, revenue from three years ago have also fallen 3.0% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next three years should generate growth of 45% each year as estimated by the five analysts watching the company. With the industry predicted to deliver 68% growth per year, the company is positioned for a weaker revenue result.

With this in mind, we find it intriguing that Shanghai Junshi Biosciences' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

With its share price dropping off a cliff, the P/S for Shanghai Junshi Biosciences looks to be in line with the rest of the Biotechs industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look at the analysts forecasts of Shanghai Junshi Biosciences' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

You should always think about risks. Case in point, we've spotted 1 warning sign for Shanghai Junshi Biosciences you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1877

Shanghai Junshi Biosciences

A biopharmaceutical company, engages in the discovery, development, and commercialization of various drugs in the therapeutic areas of malignant tumors, neurological, autoimmune, chronic metabolic, nervous system, and infectious diseases in the People's Republic of China.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success