Will Promising Preclinical Results in Obesity Candidates Reshape Ascletis Pharma's (SEHK:1672) Innovation Narrative?

Reviewed by Sasha Jovanovic

- Ascletis Pharma announced that its co-formulation of ASC36 and ASC35, two once-monthly next-generation peptide drug candidates, showed promising efficacy and chemical stability in preclinical obesity studies, with plans to submit an Investigational New Drug Application to the US FDA in the second quarter of 2026.

- This advancement leverages Ascletis’ proprietary AI-assisted and ultra-long-acting drug technologies, aiming to address unmet needs in obesity treatment with differentiated dosing and potential improvements in clinical outcomes.

- We’ll explore how the strong preclinical performance and upcoming FDA submission timeline contribute to Ascletis Pharma’s investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Ascletis Pharma's Investment Narrative?

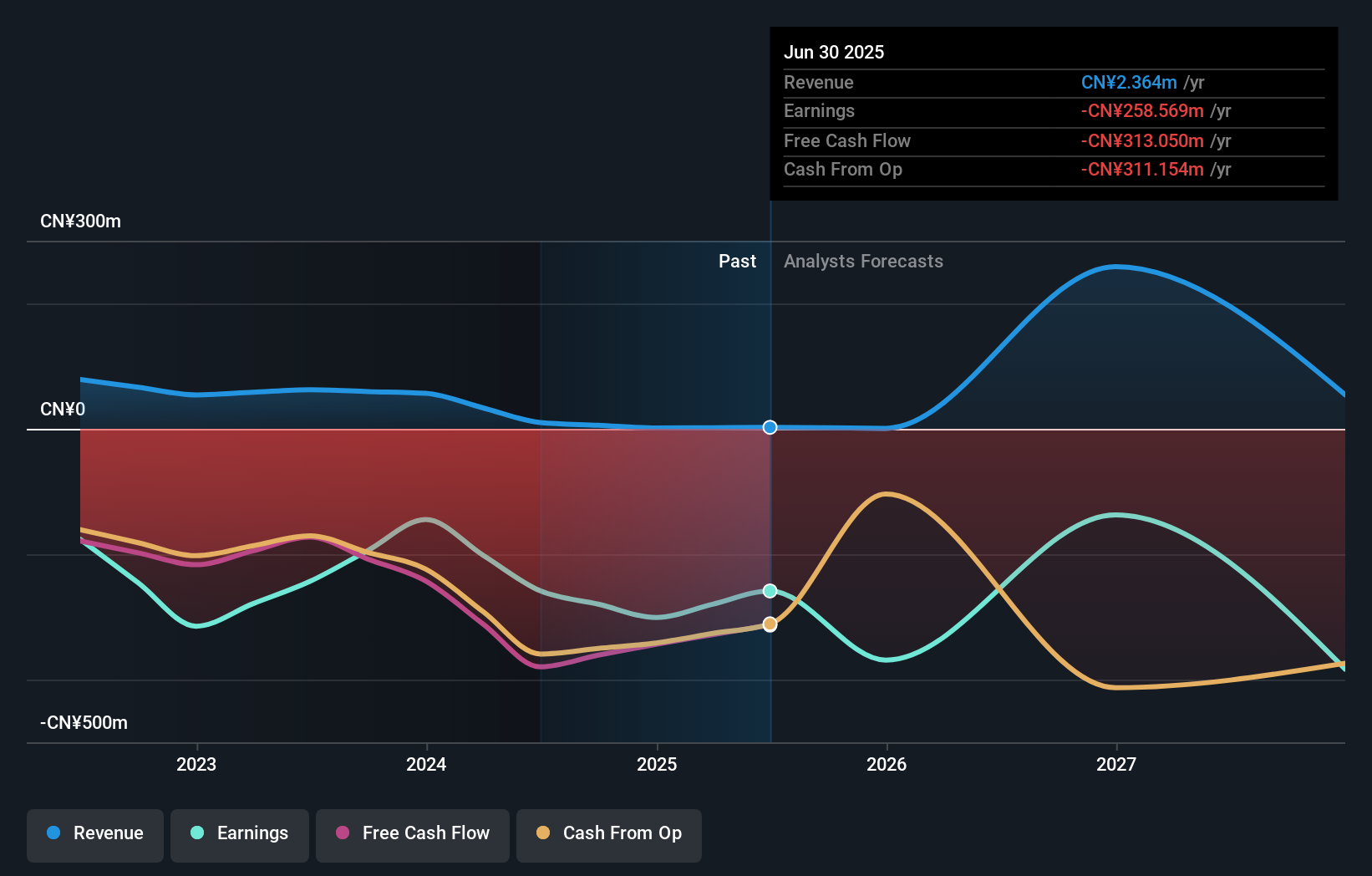

To be confident in Ascletis Pharma as a shareholder, you must buy into the idea that its ultra-long-acting peptide platform can deliver breakthrough therapies for obesity and cardiometabolic diseases, transforming promising preclinical data into meaningful revenue streams. The recent news on the ASC36 and ASC35 co-formulation strengthens this story, suggesting that Ascletis’ AI-driven and slow-release technologies could carve out a differentiated position in this fast-evolving field. This update potentially accelerates the company’s timeline toward major clinical and regulatory milestones, making the FDA submission in 2026 a more tangible near-term catalyst. However, it’s worth acknowledging that Ascletis remains unprofitable and its earnings are forecast to continue declining. Dramatic share price gains earlier this year reflect high expectations, but commercializing such novel therapies involves clinical, regulatory, and market risks that are not diminished by strong preclinical results.

On the flip side, looming regulatory and execution risks are front and center for investors to consider. Our comprehensive valuation report raises the possibility that Ascletis Pharma is priced higher than what may be justified by its financials.Exploring Other Perspectives

Explore another fair value estimate on Ascletis Pharma - why the stock might be worth as much as HK$0.022!

Build Your Own Ascletis Pharma Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ascletis Pharma research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Ascletis Pharma research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ascletis Pharma's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1672

Ascletis Pharma

A biotechnology company, engages in the research and development, manufacture, marketing, and sale of pharmaceutical products in Mainland China.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success