- Hong Kong

- /

- Life Sciences

- /

- SEHK:1548

Genscript Biotech Corporation (HKG:1548) Stock's 26% Dive Might Signal An Opportunity But It Requires Some Scrutiny

Genscript Biotech Corporation (HKG:1548) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 51% share price decline.

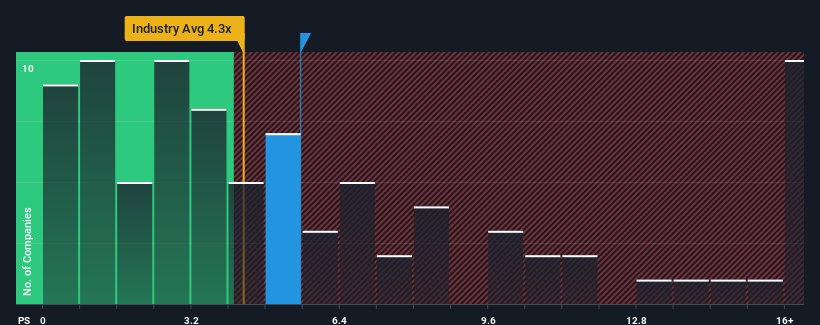

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Genscript Biotech's P/S ratio of 5.5x, since the median price-to-sales (or "P/S") ratio for the Life Sciences industry in Hong Kong is also close to 6.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Genscript Biotech

How Genscript Biotech Has Been Performing

Recent times haven't been great for Genscript Biotech as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Genscript Biotech will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Genscript Biotech's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 24% gain to the company's top line. The latest three year period has also seen an excellent 123% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 50% per annum over the next three years. With the industry only predicted to deliver 20% each year, the company is positioned for a stronger revenue result.

With this information, we find it interesting that Genscript Biotech is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Genscript Biotech's P/S?

Following Genscript Biotech's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Genscript Biotech's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 2 warning signs we've spotted with Genscript Biotech.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1548

Genscript Biotech

An investment holding company, engages in the manufacture and sale of life science research products and services in the United States of America, Europe, Mainland China, Europe, Asia Pacific, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives