Stock Analysis

3SBio Inc.'s (HKG:1530) Stock Is Going Strong: Have Financials A Role To Play?

3SBio (HKG:1530) has had a great run on the share market with its stock up by a significant 19% over the last three months. Given that stock prices are usually aligned with a company's financial performance in the long-term, we decided to study its financial indicators more closely to see if they had a hand to play in the recent price move. Particularly, we will be paying attention to 3SBio's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

View our latest analysis for 3SBio

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for 3SBio is:

9.6% = CN¥1.6b ÷ CN¥17b (Based on the trailing twelve months to December 2023).

The 'return' is the profit over the last twelve months. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.10 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of 3SBio's Earnings Growth And 9.6% ROE

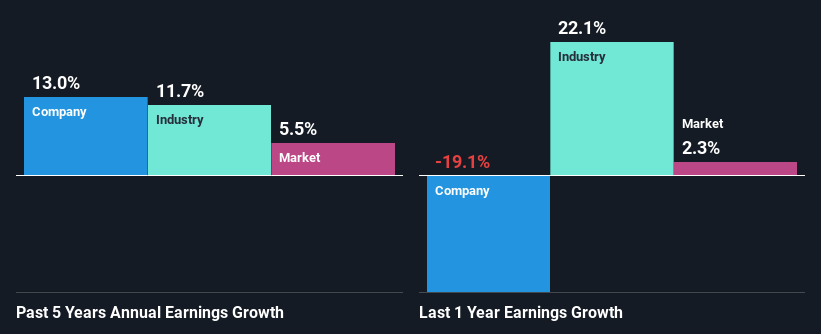

At first glance, 3SBio's ROE doesn't look very promising. A quick further study shows that the company's ROE doesn't compare favorably to the industry average of 17% either. Although, we can see that 3SBio saw a modest net income growth of 13% over the past five years. So, there might be other aspects that are positively influencing the company's earnings growth. For instance, the company has a low payout ratio or is being managed efficiently.

We then performed a comparison between 3SBio's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 12% in the same 5-year period.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. If you're wondering about 3SBio's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

Is 3SBio Using Its Retained Earnings Effectively?

3SBio's three-year median payout ratio to shareholders is 22% (implying that it retains 78% of its income), which is on the lower side, so it seems like the management is reinvesting profits heavily to grow its business.

Moreover, 3SBio is determined to keep sharing its profits with shareholders which we infer from its long history of six years of paying a dividend. Our latest analyst data shows that the future payout ratio of the company over the next three years is expected to be approximately 22%. Regardless, the future ROE for 3SBio is predicted to rise to 12% despite there being not much change expected in its payout ratio.

Summary

In total, it does look like 3SBio has some positive aspects to its business. With a high rate of reinvestment, albeit at a low ROE, the company has managed to see a considerable growth in its earnings. On studying current analyst estimates, we found that analysts expect the company to continue its recent growth streak. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Valuation is complex, but we're helping make it simple.

Find out whether 3SBio is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1530

3SBio

An investment holding company, develops, produces markets, and sells biopharmaceutical products in Mainland China and internationally.

Flawless balance sheet and undervalued.