Shanghai Fudan-Zhangjiang (SEHK:1349) Losses Widen 29.4% Annually, Challenging Turnaround Hopes

Reviewed by Simply Wall St

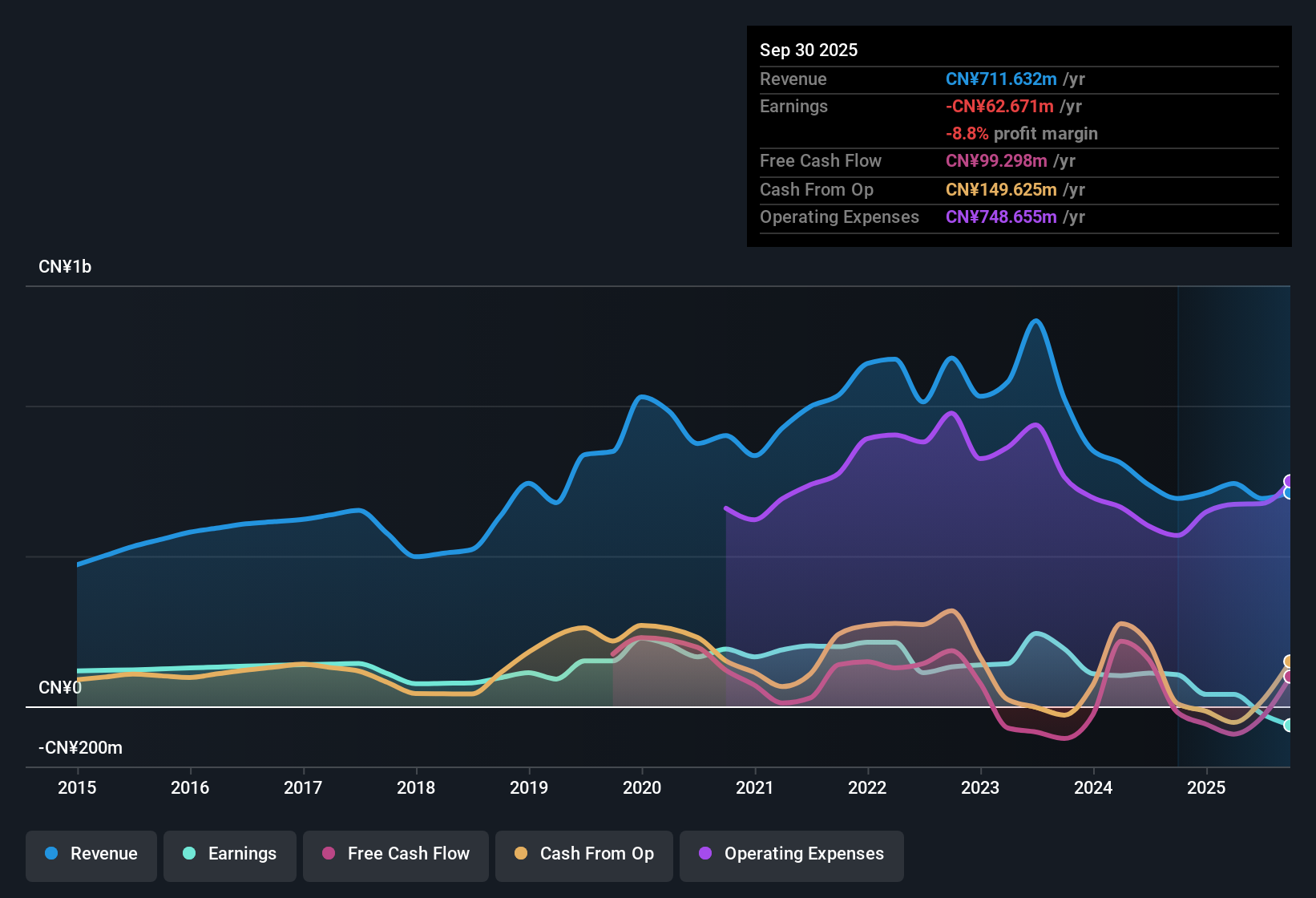

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Ltd (SEHK:1349) reported ongoing losses, with net losses deepening at a 29.4% annual rate over the past five years and no visible turnaround in profit margins this year. The company’s Price-to-Sales ratio stands at 4.4x, higher than the Hong Kong Pharmaceuticals industry average of 2.5x. However, it is more attractive versus peers at 6.6x. Shares are trading at HK$3.27, significantly under an indicated fair value of HK$22.18. Despite weak earnings trends and stagnant growth projections, some investors are keeping an eye on the valuation gap as a potential reward opportunity among peer comparisons.

See our full analysis for Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd.Now, let's see how the latest figures match up with the dominant market narratives and whether expectations align or diverge with what these numbers show.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Compound Faster Than Revenue Stalls

- Net losses have deepened at a 29.4% annual rate over the past five years, outpacing any positive movement on profit margins or revenue expansion in that period.

- What is notable is that despite consistent red ink, the prevailing analysis highlights no improvement in profit margins this year. This reinforces persistent doubts about when, or if, Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Ltd will shift toward real earnings growth.

- The company’s ongoing lack of margin progress stands in contrast to the sector, where many competitors are starting to stabilize or grow operating leverage.

- This absence of visible turnaround keeps the focus on durability concerns rather than near-term cyclical recovery.

P/S Ratio Sits Between Industry and Peers

- The company’s Price-to-Sales (P/S) ratio is currently 4.4x, which sits above the Hong Kong Pharmaceuticals industry average of 2.5x but remains below its peer group average of 6.6x.

- Prevailing analysis views this as a sign the stock is neither in bargain territory nor overly frothy. Instead, investors are weighing whether the modest discount to peers justifies the ongoing operational challenges.

- This middle-ground P/S leaves valuation tension, since buyers may see upside only if profit trends improve and justify even this moderate premium to the industry.

- Any sector rotation or shift in appetite for loss-making biotechs could move this relative valuation quickly in either direction.

DCF Fair Value Far Above Current Trading Price

- Shares are trading at HK$3.27, a steep discount versus the DCF fair value estimate of HK$22.18, highlighting one of the market’s largest valuation gaps among listed peers.

- According to prevailing analysis, investors monitoring this gap see it as a double-edged sword. There is upside potential if fundamentals recover, but without clear signs of margin expansion or a profitability pathway, the gap alone does not guarantee future gains.

- It is this disconnect between theoretical fair value and stubborn losses that fuels both continued attention and skepticism from longer-term holders.

- If progress on profit margins or new catalysts emerge, the wide gap could close quickly. Until then, the price drift signals ongoing prudence about risk.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Ltd continues to struggle with deepening losses and stagnant profit margins. This situation raises doubts about its ability to achieve steady financial progress.

If you want to focus on more consistent performers, use stable growth stocks screener (2094 results) to find companies that deliver reliable growth and stable earnings in any market environment.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1349

Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd

Engages in the research, development, manufacture, and sale of bio-pharmaceutical products in the People's Republic of China.

Excellent balance sheet and fair value.

Market Insights

Community Narratives