As global markets experience shifts, with small-cap indices like the Russell 2000 and S&P MidCap 400 outperforming, investors are increasingly turning their attention to smaller companies for potential growth opportunities. Penny stocks, often seen as relics of past market eras, continue to offer intriguing prospects due to their affordability and potential for significant returns when backed by strong financials. This article explores three such penny stocks that stand out for their financial strength and growth potential in today's evolving market landscape.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| Tristel (AIM:TSTL) | £3.95 | £184.64M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.20 | MYR337.78M | ★★★★★★ |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.60 | MYR2.96B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.74 | MYR128.18M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.77 | HK$488.79M | ★★★★★★ |

| Zhejiang Giuseppe Garment (SZSE:002687) | CN¥4.23 | CN¥2.07B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.905 | MYR300.41M | ★★★★★★ |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR3.58 | MYR2.59B | ★★★★★☆ |

| Embark Early Education (ASX:EVO) | A$0.805 | A$128.44M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £4.355 | £407.27M | ★★★★☆☆ |

Click here to see the full list of 5,783 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd (SEHK:1349)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. operates in the research, development, manufacture, and sale of bio-pharmaceutical products mainly in China with a market cap of HK$8.03 billion.

Operations: The company's revenue is primarily derived from its Pharmaceuticals segment, totaling CN¥736.03 million.

Market Cap: HK$8.03B

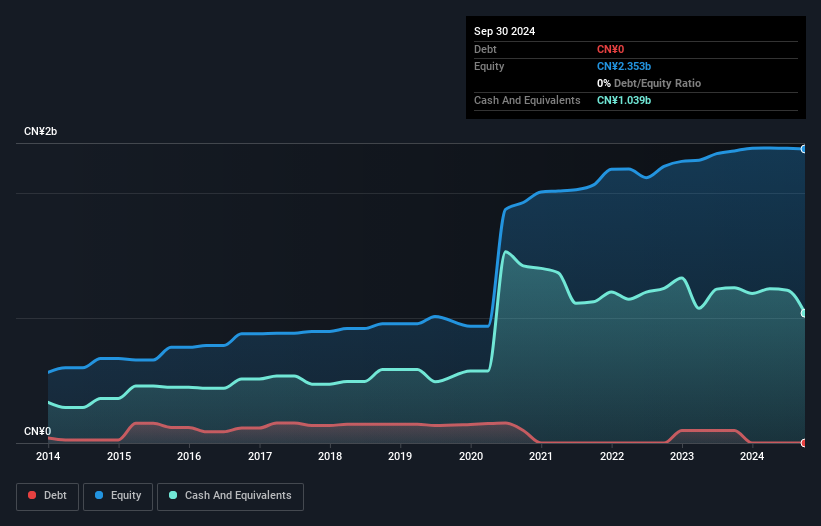

Shanghai Fudan-Zhangjiang Bio-Pharmaceutical Co., Ltd. is navigating a complex landscape with its focus on bio-pharmaceutical innovations, despite recent volatility and challenges. The company has no debt, which provides financial flexibility, but its earnings have declined by 6.5% annually over the past five years, and it experienced a significant drop in earnings growth last year. Recent clinical developments include phase II trials for Hemoporfin in the U.S. and phase III trials for an antibody drug conjugate targeting triple-negative breast cancer, indicating ongoing investment in R&D amid fluctuating revenues of CN¥736.03 million primarily from pharmaceuticals sales.

- Click here and access our complete financial health analysis report to understand the dynamics of Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd.

- Assess Shanghai Fudan-Zhangjiang Bio-PharmaceuticalLtd's previous results with our detailed historical performance reports.

PSG Corporation (SET:PSG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PSG Corporation Public Company Limited, along with its subsidiary PSGC (Lao) Sole Company Limited, operates in turnkey engineering, procurement, and construction (EPC) and large-scale construction projects in Thailand and the Lao People's Democratic Republic, with a market cap of THB37.05 billion.

Operations: The company's revenue primarily comes from plant and building construction, amounting to THB4.15 billion.

Market Cap: THB37.05B

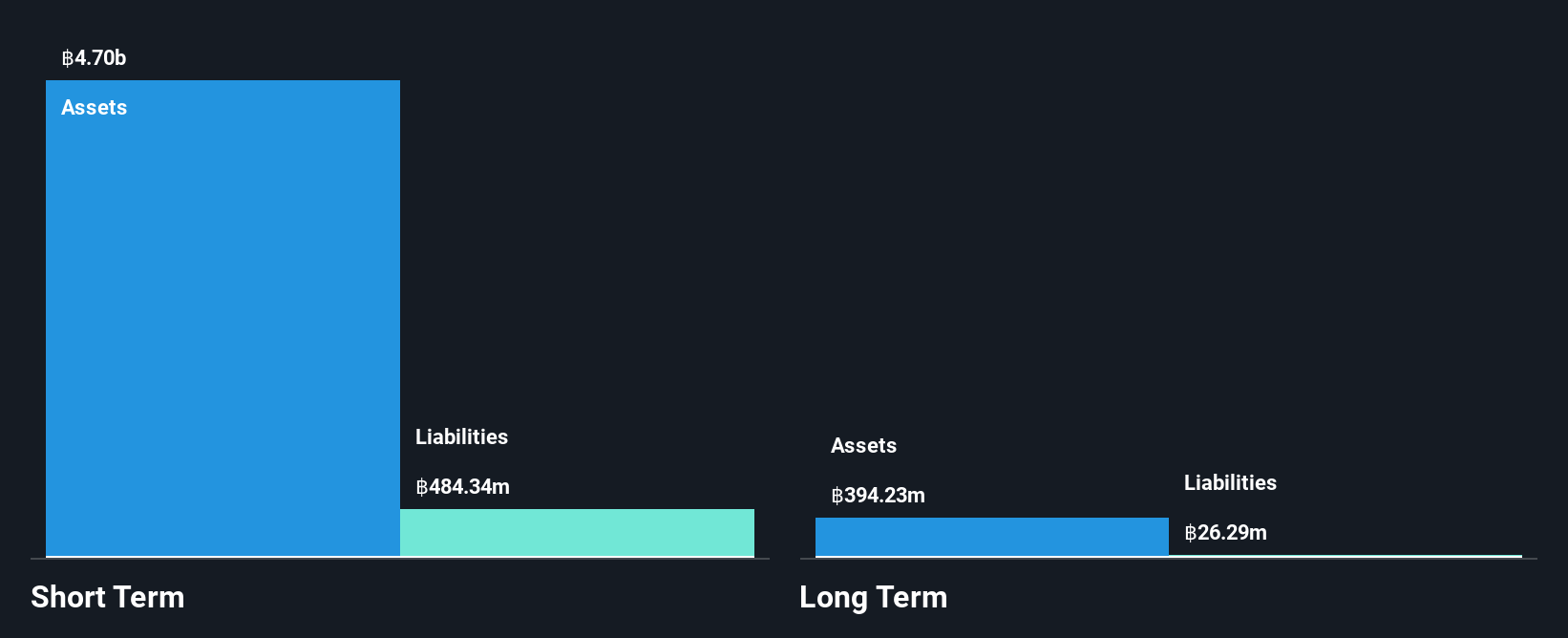

PSG Corporation has demonstrated robust financial health, with no debt and a strong Return on Equity of 48.2%, indicating efficient management of shareholder equity. The company reported significant earnings growth of 178.5% over the past year, far outpacing industry averages, despite a slight decline in profit margins from 52.6% to 49.3%. Its short-term assets comfortably cover both short- and long-term liabilities, enhancing its liquidity position. However, the share price has been highly volatile recently and trades at a substantial discount to estimated fair value, suggesting potential market mispricing or investor caution despite high non-cash earnings quality.

- Get an in-depth perspective on PSG Corporation's performance by reading our balance sheet health report here.

- Gain insights into PSG Corporation's past trends and performance with our report on the company's historical track record.

Fuan Pharmaceutical (Group) (SZSE:300194)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fuan Pharmaceutical (Group) Co., Ltd. and its subsidiaries focus on researching, developing, producing, and selling chemical drugs in the People's Republic of China, with a market cap of CN¥5.73 billion.

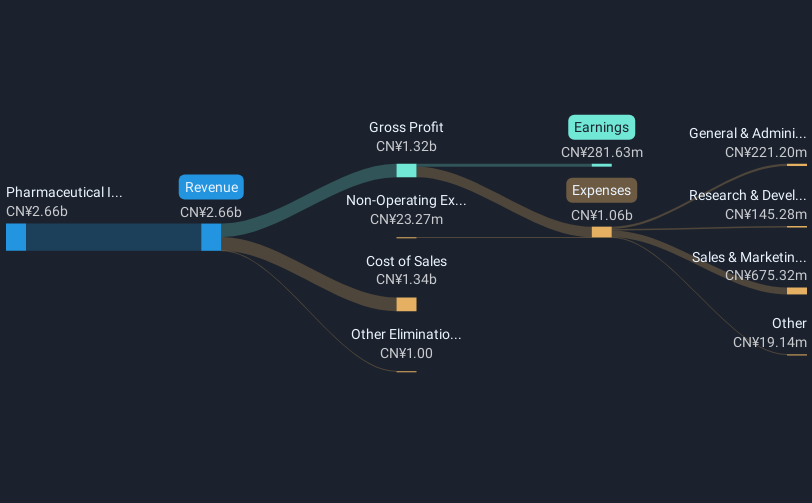

Operations: The company generates CN¥2.75 billion in revenue from its pharmaceutical industry segment.

Market Cap: CN¥5.73B

Fuan Pharmaceutical (Group) Co., Ltd. trades significantly below its estimated fair value, presenting a potential opportunity for investors interested in undervalued stocks. The company has demonstrated stable financial health, with short-term assets exceeding both short- and long-term liabilities and more cash than total debt. Its management team is seasoned, contributing to consistent earnings growth of 3.5% over the past year despite low return on equity at 6.6%. Recent earnings reports show increased revenue and net income compared to the previous year, although profit margins have slightly declined from last year’s figures.

- Click here to discover the nuances of Fuan Pharmaceutical (Group) with our detailed analytical financial health report.

- Evaluate Fuan Pharmaceutical (Group)'s historical performance by accessing our past performance report.

Where To Now?

- Unlock our comprehensive list of 5,783 Penny Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300194

Fuan Pharmaceutical (Group)

Research and develops, produces, and sells chemical drugs in the People's Republic of China.

Excellent balance sheet, good value and pays a dividend.