China Approves LM-350 Clinical Trials; Could Be a Game Changer for Sino Biopharm (SEHK:1177)

Reviewed by Sasha Jovanovic

- On November 18, 2025, Sino Biopharmaceutical announced that its subsidiary LaNova Medicines received clinical trial approval in China for LM-350, a CDH17-targeting antibody-drug conjugate aimed at treating multiple gastrointestinal cancers.

- This regulatory milestone marks further progress in Sino Biopharmaceutical's efforts to address significant unmet medical needs in the oncology sector through its innovative pipeline.

- We’ll examine how this clinical trial approval for LM-350 shapes Sino Biopharmaceutical’s investment narrative, especially with its focus on cancer innovation.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Sino Biopharmaceutical's Investment Narrative?

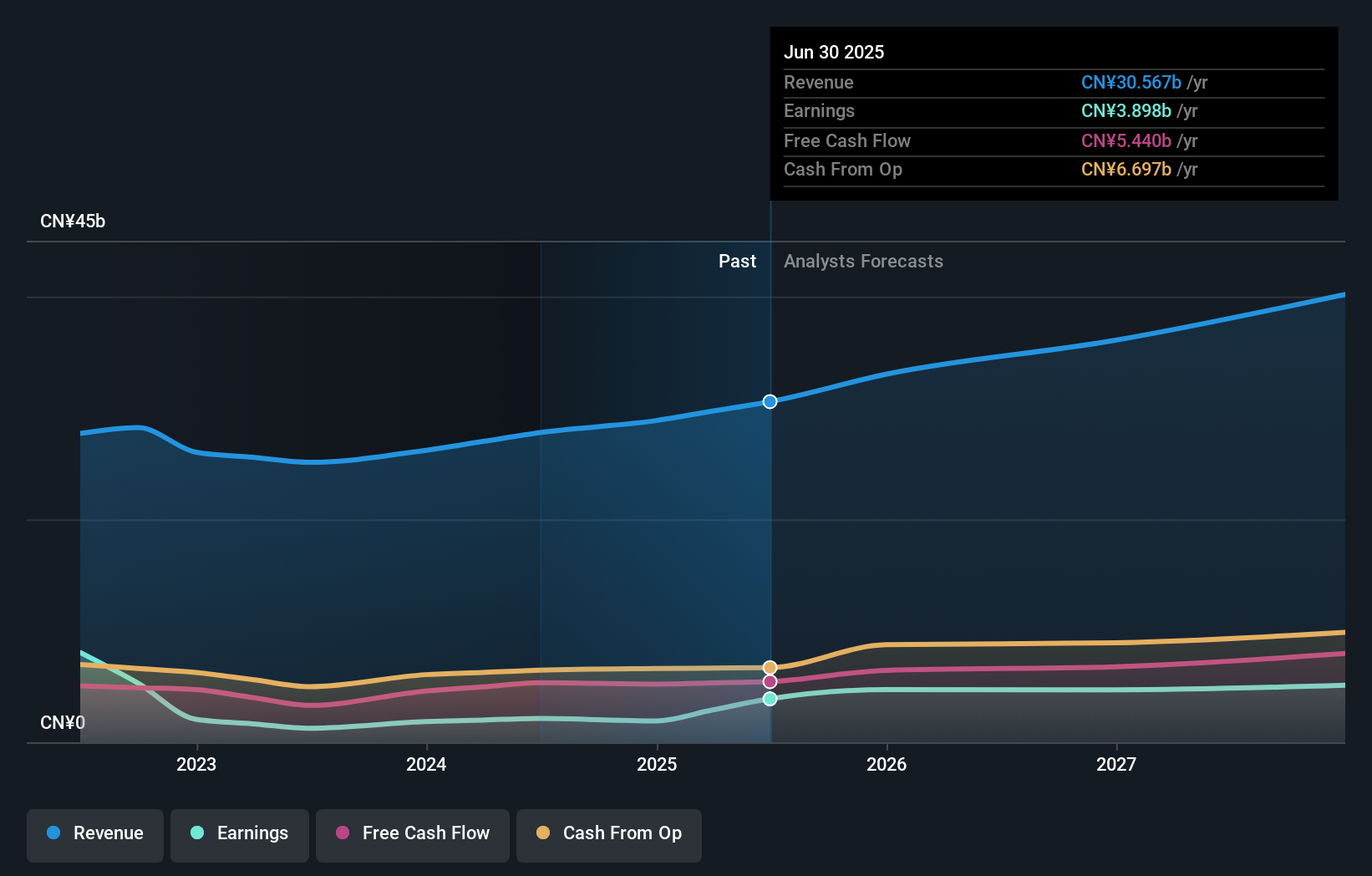

For me, the investment case in Sino Biopharmaceutical rests on an investor’s belief in the company’s capacity to deliver innovation in oncology, while converting its significant pipeline progress into commercial value. The recent clinical trial approval for LM-350 in China marks a meaningful step forward, potentially shifting short-term catalysts toward regulatory progression in this key market, rather than immediate earnings or sales jumps. While the news is a clear pipeline milestone and boosts the credibility of Sino Biopharmaceutical’s R&D efforts, it doesn’t immediately transform commercial prospects or erase core business risks. Investors should remain attentive to earnings volatility, elevated valuation multiples relative to peers, and the lengthy timelines typical of drug development. At the same time, this development sustains optimism around future catalysts as new therapies advance, but doesn’t fundamentally alter the balance of near-term risks versus potential rewards.

But, keep in mind, regulatory wins don’t guarantee swift commercial success, details matter. Despite retreating, Sino Biopharmaceutical's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 2 other fair value estimates on Sino Biopharmaceutical - why the stock might be worth just HK$9.49!

Build Your Own Sino Biopharmaceutical Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sino Biopharmaceutical research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Sino Biopharmaceutical research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sino Biopharmaceutical's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1177

Sino Biopharmaceutical

An investment holding company, operates as a research and development pharmaceutical conglomerate in the People’s Republic of China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success