Qunabox Group Limited (HKG:917) Stocks Shoot Up 27% But Its P/S Still Looks Reasonable

Qunabox Group Limited (HKG:917) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. The last month tops off a massive increase of 141% in the last year.

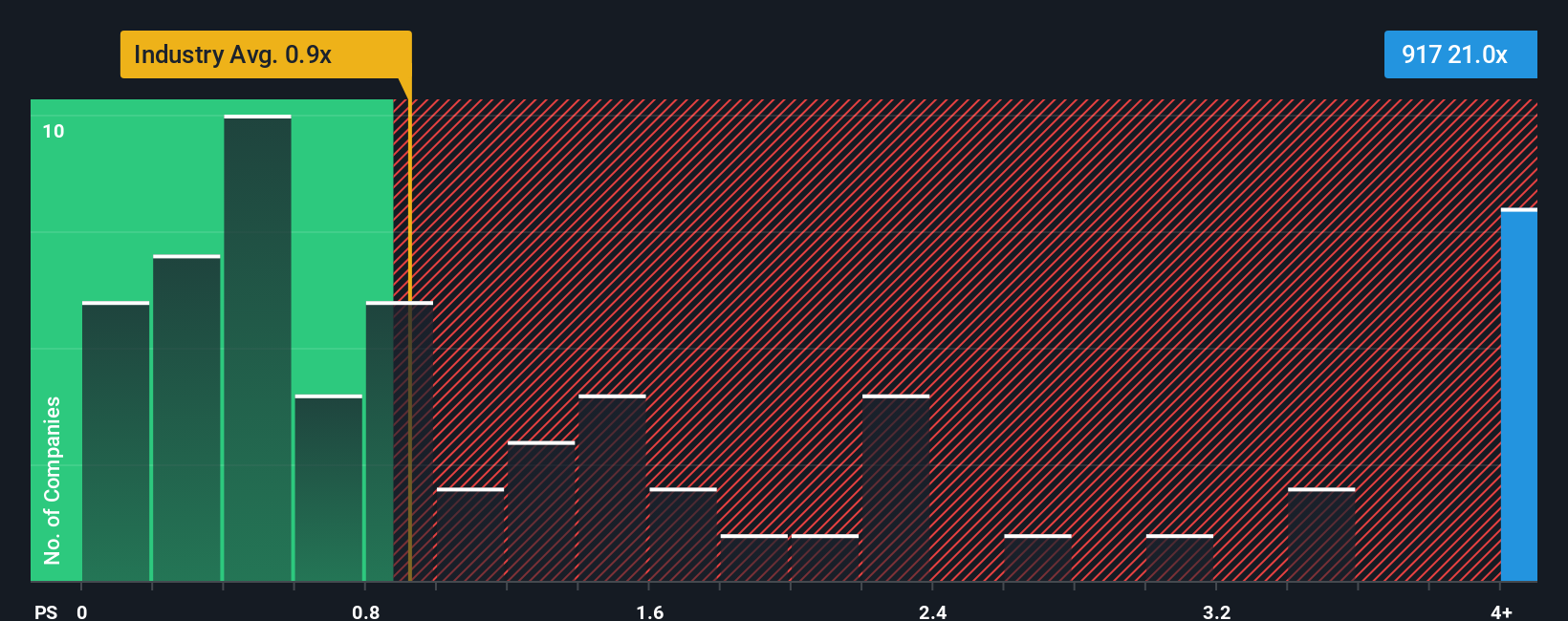

Since its price has surged higher, given around half the companies in Hong Kong's Media industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider Qunabox Group as a stock to avoid entirely with its 21x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Qunabox Group

What Does Qunabox Group's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Qunabox Group has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Qunabox Group's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Qunabox Group's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. Pleasingly, revenue has also lifted 167% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

This is in contrast to the rest of the industry, which is expected to grow by 8.9% over the next year, materially lower than the company's recent medium-term annualised growth rates.

In light of this, it's understandable that Qunabox Group's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Key Takeaway

The strong share price surge has lead to Qunabox Group's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Qunabox Group revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Qunabox Group with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Qunabox Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:917

Qunabox Group

Provides marketing services, merchandise sales, and other services in Mainland China.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives