Qunabox Group Limited (HKG:917) Shares Slammed 25% But Getting In Cheap Might Be Difficult Regardless

The Qunabox Group Limited (HKG:917) share price has softened a substantial 25% over the previous 30 days, handing back much of the gains the stock has made lately. Still, a bad month hasn't completely ruined the past year with the stock gaining 96%, which is great even in a bull market.

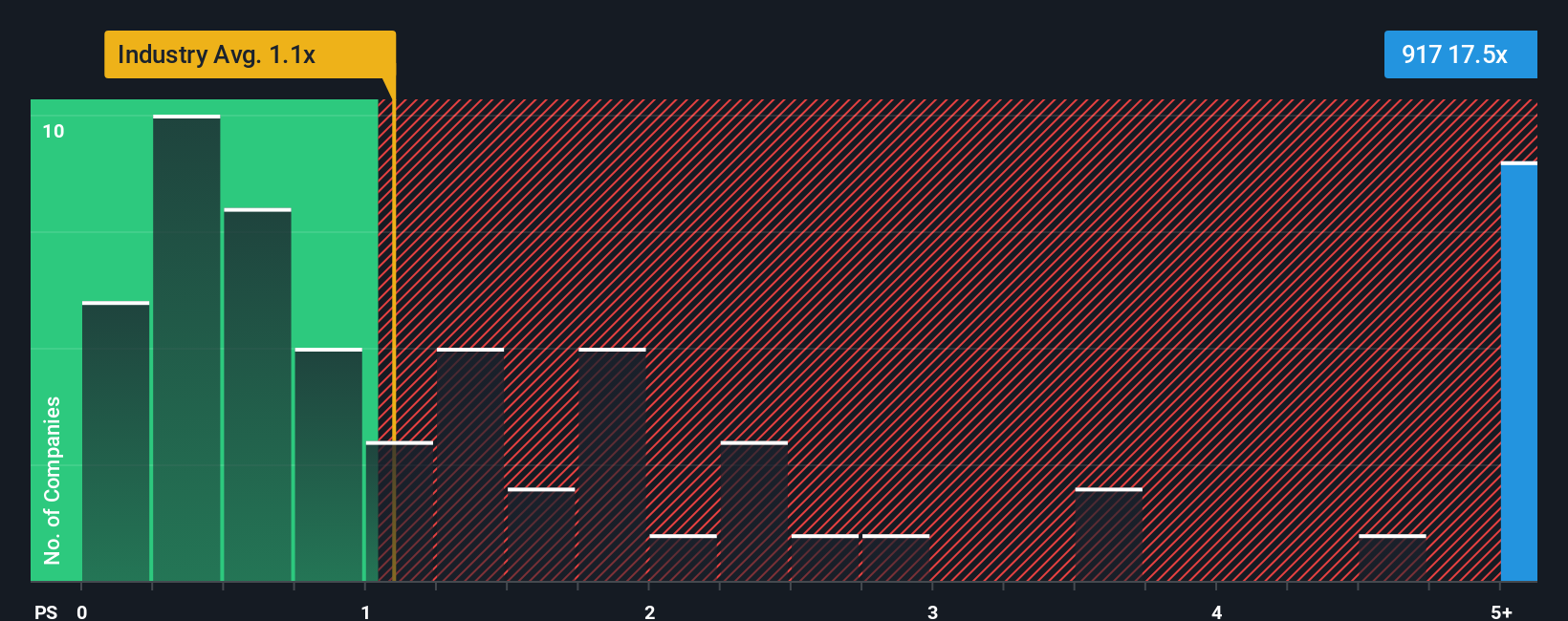

In spite of the heavy fall in price, given around half the companies in Hong Kong's Media industry have price-to-sales ratios (or "P/S") below 1.1x, you may still consider Qunabox Group as a stock to avoid entirely with its 17.5x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for Qunabox Group

How Has Qunabox Group Performed Recently?

With revenue growth that's exceedingly strong of late, Qunabox Group has been doing very well. The P/S ratio is probably high because investors think this strong revenue growth will be enough to outperform the broader industry in the near future. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Qunabox Group's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Qunabox Group?

The only time you'd be truly comfortable seeing a P/S as steep as Qunabox Group's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 33% last year. The strong recent performance means it was also able to grow revenue by 167% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Qunabox Group's P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Qunabox Group's P/S

Even after such a strong price drop, Qunabox Group's P/S still exceeds the industry median significantly. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Qunabox Group maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for Qunabox Group with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Qunabox Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Qunabox Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:917

Qunabox Group

Provides marketing services, merchandise sales, and other services in Mainland China.

Exceptional growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives