- Hong Kong

- /

- Entertainment

- /

- SEHK:6633

Qingci Games Inc. (HKG:6633) Stocks Pounded By 30% But Not Lagging Industry On Growth Or Pricing

The Qingci Games Inc. (HKG:6633) share price has fared very poorly over the last month, falling by a substantial 30%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

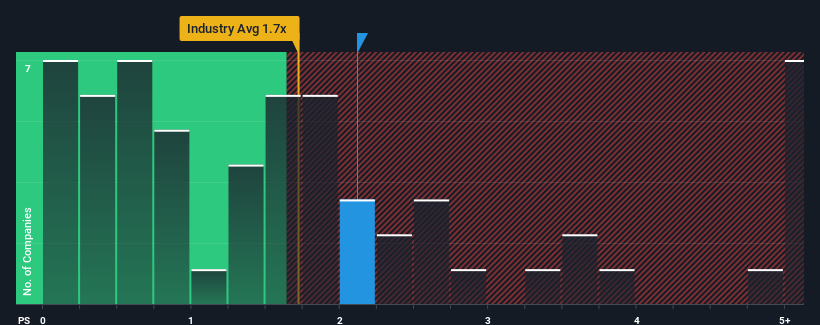

Even after such a large drop in price, it's still not a stretch to say that Qingci Games' price-to-sales (or "P/S") ratio of 2.1x right now seems quite "middle-of-the-road" compared to the Entertainment industry in Hong Kong, where the median P/S ratio is around 1.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Qingci Games

What Does Qingci Games' Recent Performance Look Like?

Qingci Games could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Qingci Games.Is There Some Revenue Growth Forecasted For Qingci Games?

Qingci Games' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 44% last year. However, this wasn't enough as the latest three year period has seen the company endure a nasty 26% drop in revenue in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue should grow by 20% over the next year. That's shaping up to be similar to the 20% growth forecast for the broader industry.

With this in mind, it makes sense that Qingci Games' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Qingci Games' P/S

With its share price dropping off a cliff, the P/S for Qingci Games looks to be in line with the rest of the Entertainment industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Qingci Games' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Entertainment industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Qingci Games with six simple checks on some of these key factors.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Qingci Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6633

Qingci Games

An investment holding company, develops, publishes, and operates mobile games in the People’s Republic of China, Japan, the United States, Canada, Australia, New Zealand, Hong Kong, Macau, Taiwan, and internationally.

Flawless balance sheet with questionable track record.

Market Insights

Community Narratives