- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:6100

Promising Penny Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a boost from easing U.S. core inflation and robust bank earnings, investors are increasingly looking for opportunities that balance potential growth with financial stability. Penny stocks, often representing smaller or newer companies, remain an intriguing area for those willing to explore beyond traditional investment avenues. Despite their vintage moniker, these stocks can offer surprising value when backed by strong financials, presenting a chance to uncover hidden gems poised for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.11B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.67 | HK$42.25B | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$1.01 | HK$641.14M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.934 | £147.58M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.88 | MYR292.11M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.07 | £778.12M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.76 | A$139.45M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.42 | £180.2M | ★★★★★☆ |

Click here to see the full list of 5,712 stocks from our Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

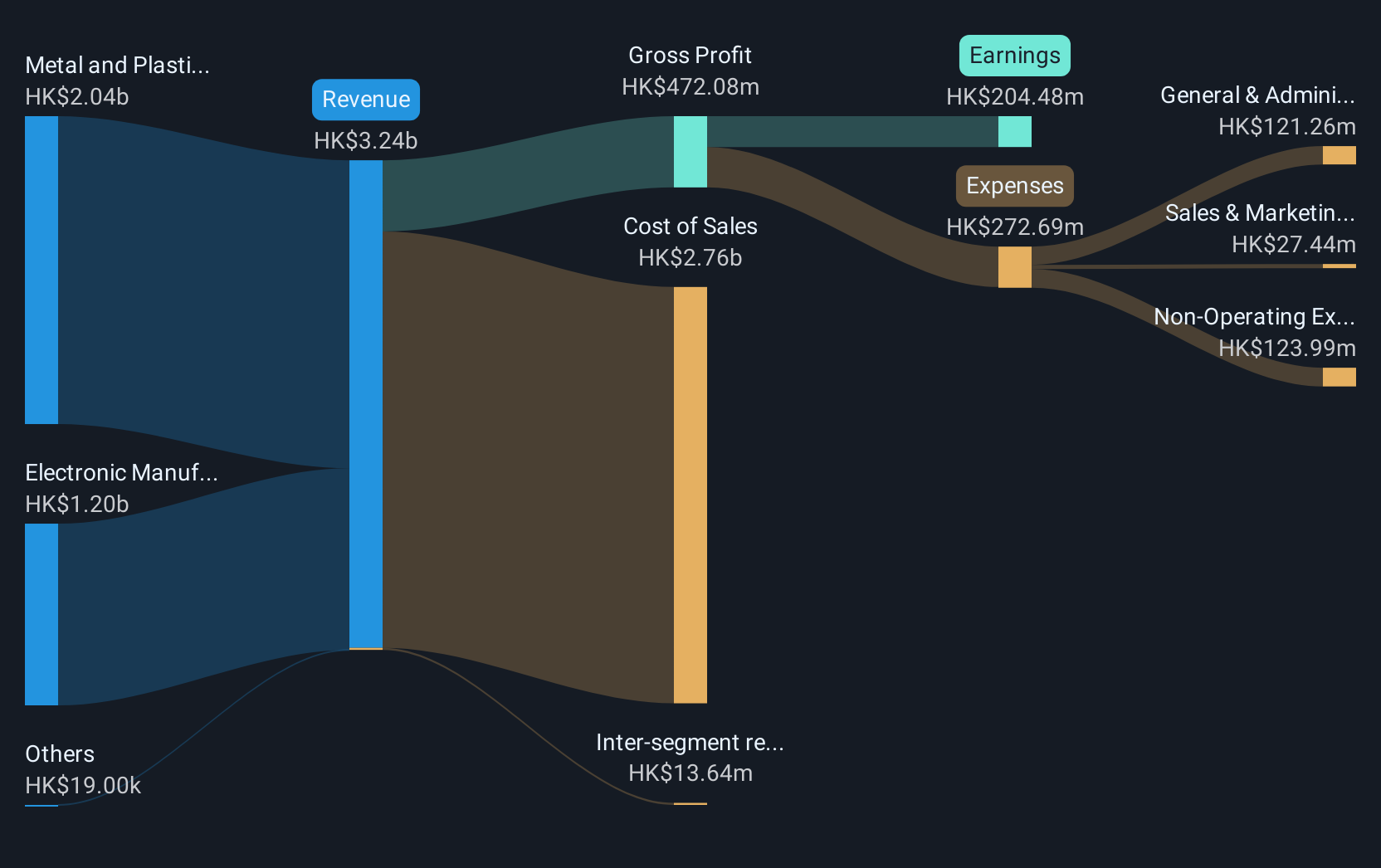

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across various regions including Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market capitalization of approximately HK$1.60 billion.

Operations: The company generates revenue primarily from its Metal and Plastic Business, which accounts for HK$1.86 billion, and its Electronic Manufacturing Services Business, contributing HK$1.16 billion.

Market Cap: HK$1.6B

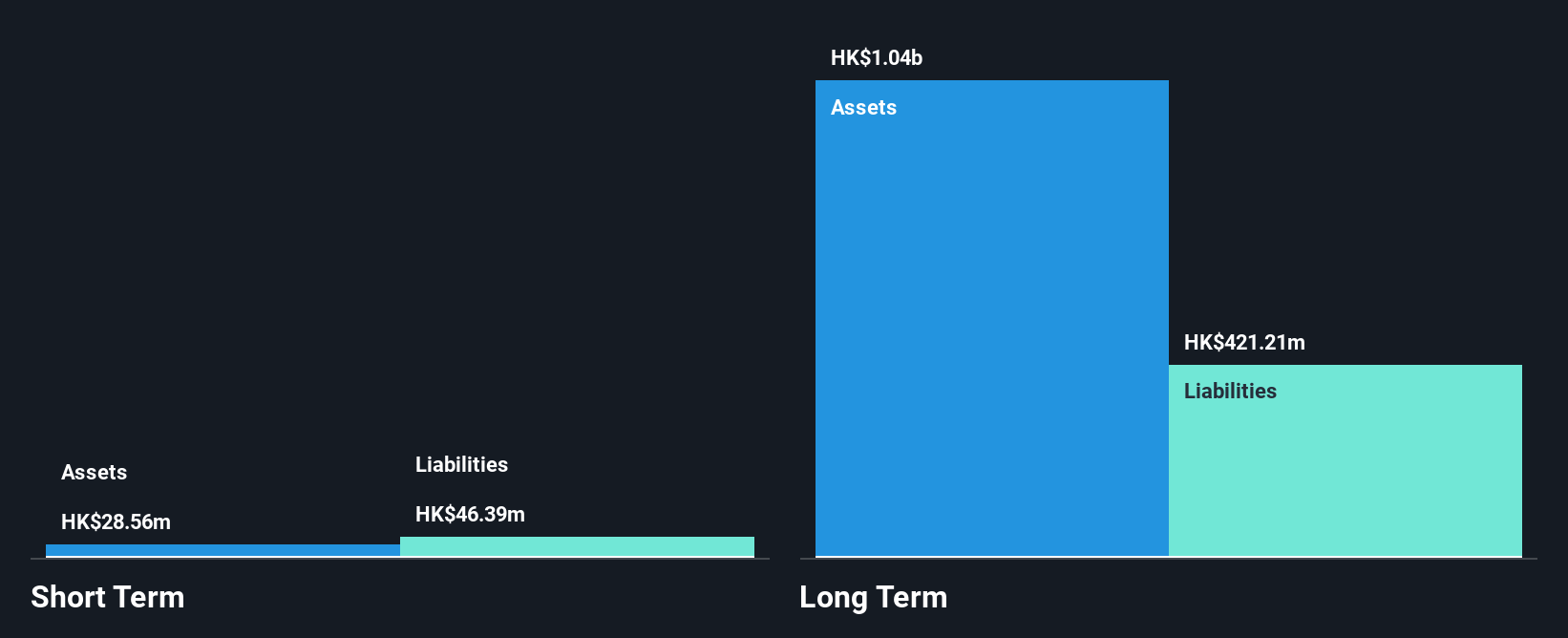

Karrie International Holdings has demonstrated a solid financial position with short-term assets exceeding both short and long-term liabilities, and its debt is well-covered by operating cash flow. The company has shown an impressive earnings growth of 21.3% over the past year, surpassing industry averages, although it faces challenges with a high net debt to equity ratio of 42.3%. Recent initiatives include share repurchases intended to boost net asset value and earnings per share, alongside an increased interim dividend reflecting improved profitability. However, its historical profit decline suggests caution despite recent positive momentum.

- Click here to discover the nuances of Karrie International Holdings with our detailed analytical financial health report.

- Gain insights into Karrie International Holdings' past trends and performance with our report on the company's historical track record.

China City Infrastructure Group (SEHK:2349)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China City Infrastructure Group Limited is an investment holding company involved in property investment, development, and management in the People's Republic of China and Hong Kong, with a market cap of HK$203.34 million.

Operations: The company generates revenue from its Property Investment Business, amounting to HK$35.05 million, and its Property Management Business, contributing HK$12.52 million.

Market Cap: HK$203.34M

China City Infrastructure Group, with a market cap of HK$203.34 million, remains unprofitable but has managed to reduce its losses by 10.2% annually over the past five years. The company trades significantly below its estimated fair value and maintains a high net debt to equity ratio of 58%. Despite this, it holds sufficient cash runway for over three years if current free cash flow levels persist. Short-term assets cover short-term liabilities but fall short against long-term obligations. The board's experience averages 7.5 years, yet volatility and negative return on equity remain concerns for investors.

- Dive into the specifics of China City Infrastructure Group here with our thorough balance sheet health report.

- Assess China City Infrastructure Group's previous results with our detailed historical performance reports.

Tongdao Liepin Group (SEHK:6100)

Simply Wall St Financial Health Rating: ★★★★★☆

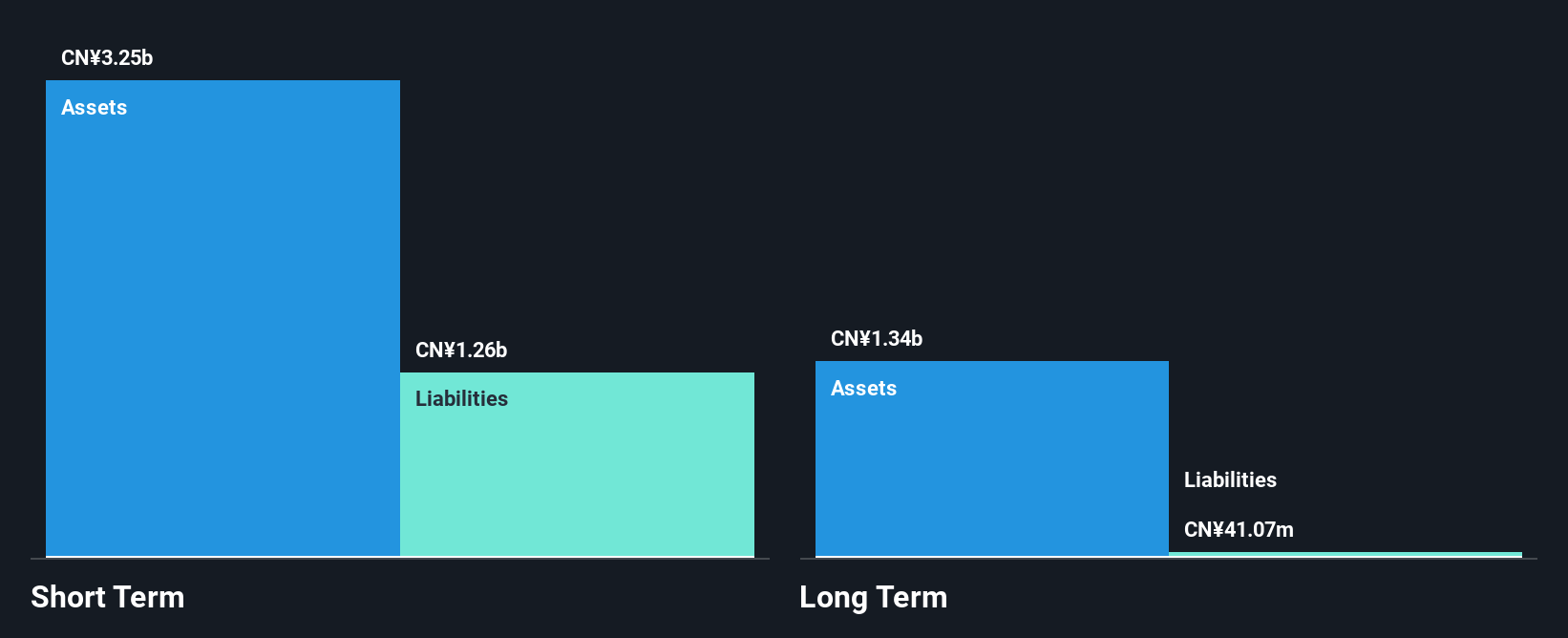

Overview: Tongdao Liepin Group, with a market cap of HK$1.53 billion, is an investment holding company that offers talent acquisition services in the People’s Republic of China.

Operations: The company generates revenue from Talent Services amounting to CN¥2.15 billion.

Market Cap: HK$1.53B

Tongdao Liepin Group, with a market cap of HK$1.53 billion, has shown improvement in profitability, reporting CN¥91.29 million net income for the first nine months of 2024 despite a decline in sales to CN¥1.52 billion year-on-year. The company's return on equity is low at 2.8%, but its debt is well covered by operating cash flow and it holds more cash than total debt. Short-term assets significantly exceed liabilities, indicating strong liquidity management. However, past earnings have been affected by large one-off losses and share price volatility remains high compared to most Hong Kong stocks.

- Take a closer look at Tongdao Liepin Group's potential here in our financial health report.

- Examine Tongdao Liepin Group's earnings growth report to understand how analysts expect it to perform.

Make It Happen

- Click here to access our complete index of 5,712 Penny Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongdao Liepin Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6100

Tongdao Liepin Group

An investment holding company, provides talent acquisition services in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives