- Hong Kong

- /

- Entertainment

- /

- SEHK:434

Why Investors Shouldn't Be Surprised By Boyaa Interactive International Limited's (HKG:434) 33% Share Price Surge

Despite an already strong run, Boyaa Interactive International Limited (HKG:434) shares have been powering on, with a gain of 33% in the last thirty days. The last 30 days were the cherry on top of the stock's 332% gain in the last year, which is nothing short of spectacular.

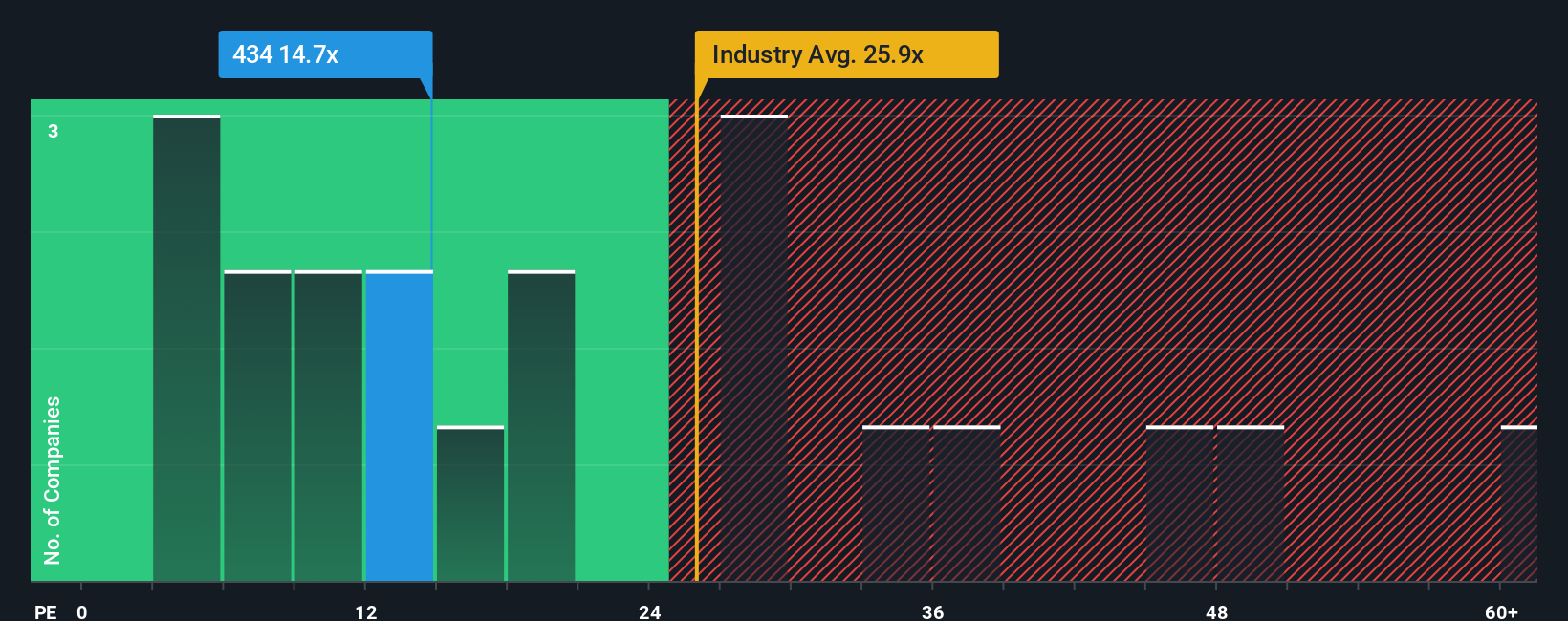

After such a large jump in price, Boyaa Interactive International may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.7x, since almost half of all companies in Hong Kong have P/E ratios under 12x and even P/E's lower than 7x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

For instance, Boyaa Interactive International's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

View our latest analysis for Boyaa Interactive International

How Is Boyaa Interactive International's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Boyaa Interactive International's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 31%. Still, the latest three year period has seen an excellent 968% overall rise in EPS, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Boyaa Interactive International is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Boyaa Interactive International's P/E?

Boyaa Interactive International shares have received a push in the right direction, but its P/E is elevated too. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Boyaa Interactive International maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Boyaa Interactive International that you should be aware of.

If these risks are making you reconsider your opinion on Boyaa Interactive International, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Boyaa Interactive International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:434

Boyaa Interactive International

An investment holding company, develops and operates online card and board games in the People’s Republic of China and Hong Kong.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives