As global markets continue to reach new heights, with indices such as the S&P 500 and Russell 2000 hitting record intraday highs, investors are keenly exploring diverse opportunities. Penny stocks, a term that may seem outdated but remains pertinent, often refer to shares of smaller or newer companies offering potential growth at lower price points. By focusing on those with solid financial foundations and promising outlooks, investors can uncover hidden gems in this sector.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.48 | MYR2.39B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.795 | A$144.95M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.1B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.875 | MYR295.43M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.245 | £845.83M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$45.48B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.59 | A$66.23M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.335 | £431.14M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.57 | £68.08M | ★★★★☆☆ |

Click here to see the full list of 5,683 stocks from our Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Inkeverse Group (SEHK:3700)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Inkeverse Group Limited is an investment holding company that operates mobile live streaming platforms in the People’s Republic of China, with a market cap of HK$3.76 billion.

Operations: The company generates revenue primarily from its Live Streaming Business, which amounted to CN¥7.25 billion.

Market Cap: HK$3.76B

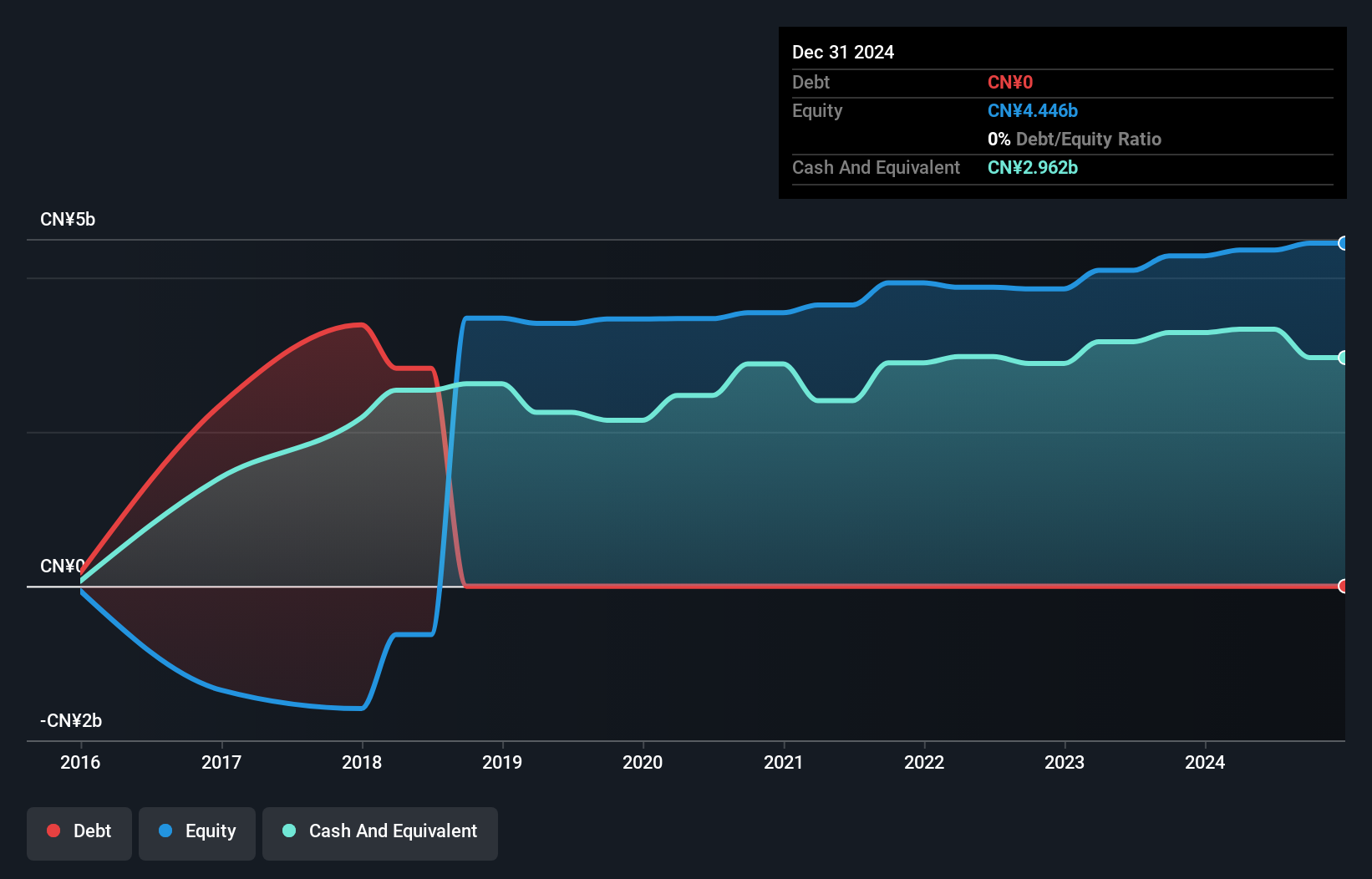

Inkeverse Group Limited, with a market cap of HK$3.76 billion, primarily generates revenue from its Live Streaming Business, amounting to CN¥7.25 billion. The company is debt-free and has experienced significant earnings growth of 136.1% over the past year, surpassing both its five-year average and industry growth rates. Its short-term assets comfortably cover both short- and long-term liabilities, indicating strong financial health. Recent board changes include the appointment of Ms. Zheng Congnan as an independent non-executive director; her extensive technology management experience could enhance strategic direction in product innovation and team efficiency for Inkeverse Group Limited's operations moving forward.

- Navigate through the intricacies of Inkeverse Group with our comprehensive balance sheet health report here.

- Gain insights into Inkeverse Group's past trends and performance with our report on the company's historical track record.

Dongguan Rural Commercial Bank (SEHK:9889)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dongguan Rural Commercial Bank Co., Ltd. offers a range of banking products and services in China with a market cap of HK$23.97 billion.

Operations: Dongguan Rural Commercial Bank Co., Ltd. has not reported any specific revenue segments.

Market Cap: HK$23.97B

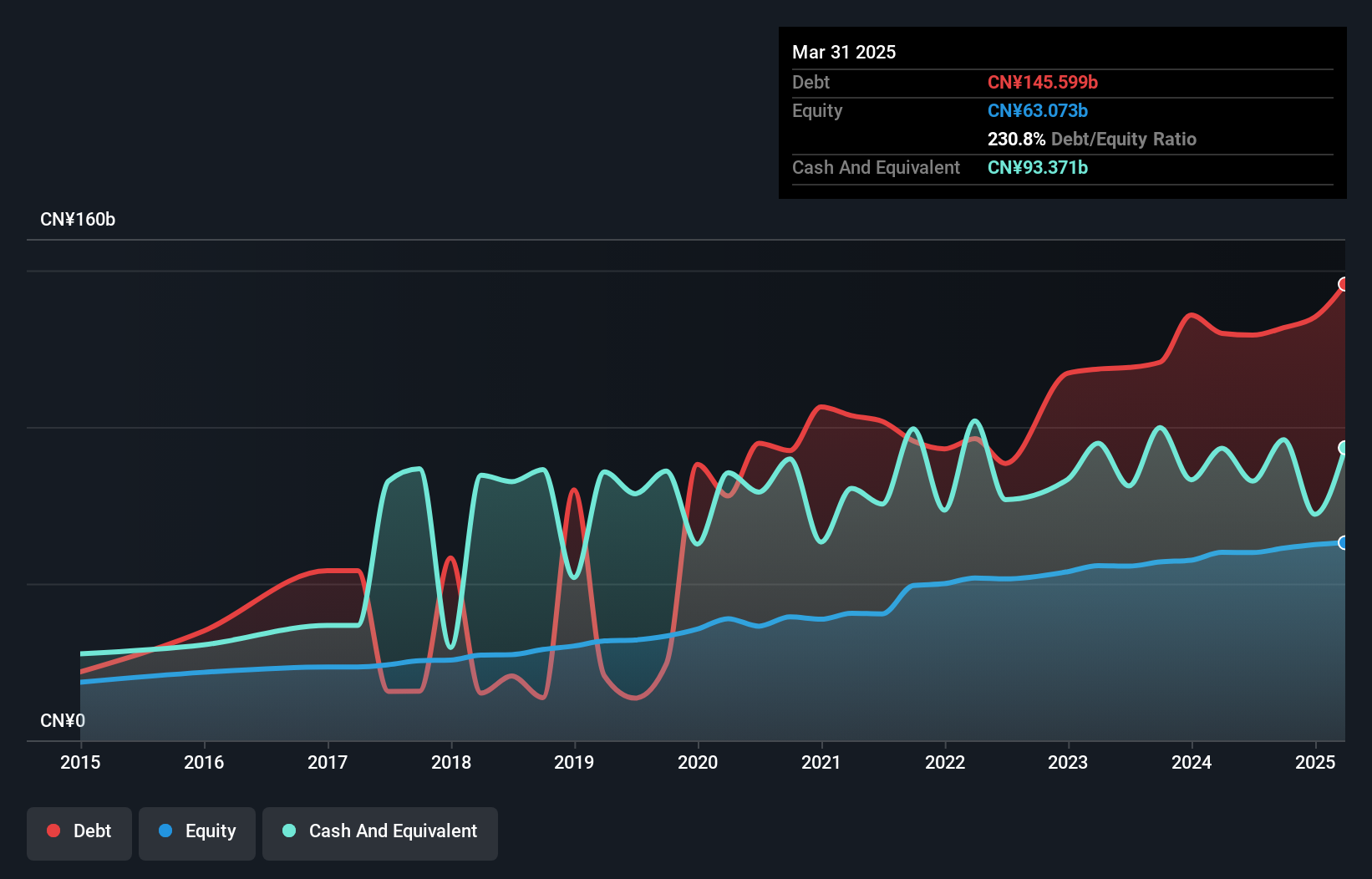

Dongguan Rural Commercial Bank, with a market cap of HK$23.97 billion, has demonstrated financial stability despite recent challenges. The bank's funding is primarily from low-risk customer deposits, and its loans to deposits ratio of 70% is well-managed. However, earnings have declined over the past year with net income falling to CNY 4.56 billion from CNY 5.06 billion previously. The management team and board are experienced, contributing to stable operations amid volatility in earnings growth and profit margins. Trading at a significant discount to estimated fair value may present an opportunity for investors seeking undervalued stocks in the banking sector.

- Click here and access our complete financial health analysis report to understand the dynamics of Dongguan Rural Commercial Bank.

- Learn about Dongguan Rural Commercial Bank's future growth trajectory here.

Japfa (SGX:UD2)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Japfa Ltd., with a market cap of SGD784.25 million, is an agri-food company that produces and sells protein staples and packaged food products in Indonesia, Vietnam, India, Myanmar, and internationally.

Operations: Japfa's revenue is primarily derived from its Animal Protein PT Japfa Tbk segment, which includes consumer food and generated $3.46 billion, along with the Animal Protein - Other segment contributing $1.07 billion.

Market Cap: SGD784.25M

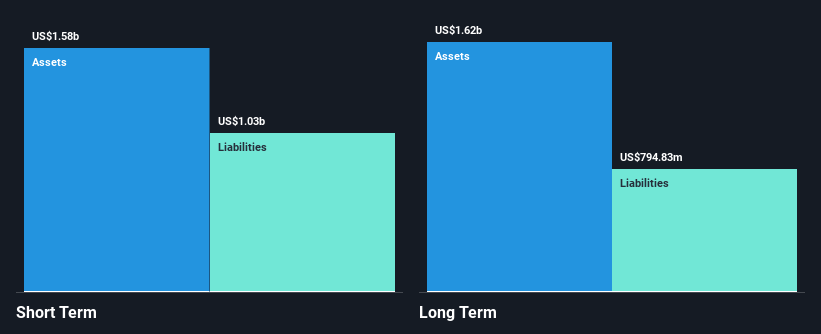

Japfa Ltd., with a market cap of SGD784.25 million, has recently turned profitable, reporting net income of US$87.54 million for the first nine months of 2024 compared to a loss last year. The company benefits from strong revenue streams in its Animal Protein segments, generating billions annually. Japfa's financial position shows improvement with reduced debt levels and interest well covered by EBIT at 3.3 times coverage. Despite high debt ratios, short-term assets exceed liabilities significantly, indicating sound liquidity management. The company's stock trades below estimated fair value and offers dividends, enhancing its appeal among penny stocks investors seeking growth potential amidst volatility.

- Unlock comprehensive insights into our analysis of Japfa stock in this financial health report.

- Evaluate Japfa's prospects by accessing our earnings growth report.

Key Takeaways

- Get an in-depth perspective on all 5,683 Penny Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9889

Dongguan Rural Commercial Bank

Provides various banking products and services in China.

Flawless balance sheet and fair value.