Slammed 27% AM Group Holdings Limited (HKG:1849) Screens Well Here But There Might Be A Catch

The AM Group Holdings Limited (HKG:1849) share price has fared very poorly over the last month, falling by a substantial 27%. For any long-term shareholders, the last month ends a year to forget by locking in a 72% share price decline.

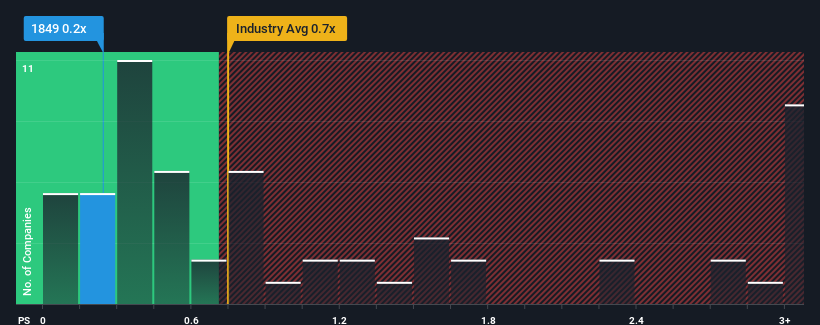

Following the heavy fall in price, when close to half the companies operating in Hong Kong's Media industry have price-to-sales ratios (or "P/S") above 0.7x, you may consider AM Group Holdings as an enticing stock to check out with its 0.2x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for AM Group Holdings

What Does AM Group Holdings' P/S Mean For Shareholders?

Revenue has risen at a steady rate over the last year for AM Group Holdings, which is generally not a bad outcome. It might be that many expect the respectable revenue performance to degrade, which has repressed the P/S. Those who are bullish on AM Group Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on AM Group Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like AM Group Holdings' to be considered reasonable.

Retrospectively, the last year delivered a decent 4.4% gain to the company's revenues. This was backed up an excellent period prior to see revenue up by 56% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 11%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that AM Group Holdings' P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

The southerly movements of AM Group Holdings' shares means its P/S is now sitting at a pretty low level. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We're very surprised to see AM Group Holdings currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

Before you take the next step, you should know about the 2 warning signs for AM Group Holdings that we have uncovered.

If these risks are making you reconsider your opinion on AM Group Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1849

AM Group Holdings

An investment holding company, provides online marketing services in Singapore, Malaysia, and the People’s Republic of China.

Adequate balance sheet slight.

Market Insights

Community Narratives