The one-year returns have been impressive for Wisdom Sports Group (HKG:1661) shareholders despite underlying losses increasing

Unfortunately, investing is risky - companies can and do go bankrupt. But when you pick a company that is really flourishing, you can make more than 100%. For example, the Wisdom Sports Group (HKG:1661) share price has soared 173% return in just a single year. On top of that, the share price is up 71% in about a quarter. This could be related to the recent financial results, released recently - you can catch up on the most recent data by reading our company report. Unfortunately the longer term returns are not so good, with the stock falling 24% in the last three years.

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

View our latest analysis for Wisdom Sports Group

Because Wisdom Sports Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Over the last twelve months, Wisdom Sports Group's revenue grew by 548%. That's a head and shoulders above most loss-making companies. And the share price has responded, gaining 173% as we previously mentioned. That sort of revenue growth is bound to attract attention, even if the company doesn't turn a profit. Given the positive sentiment around the stock we're cautious, but there's no doubt its worth watching.

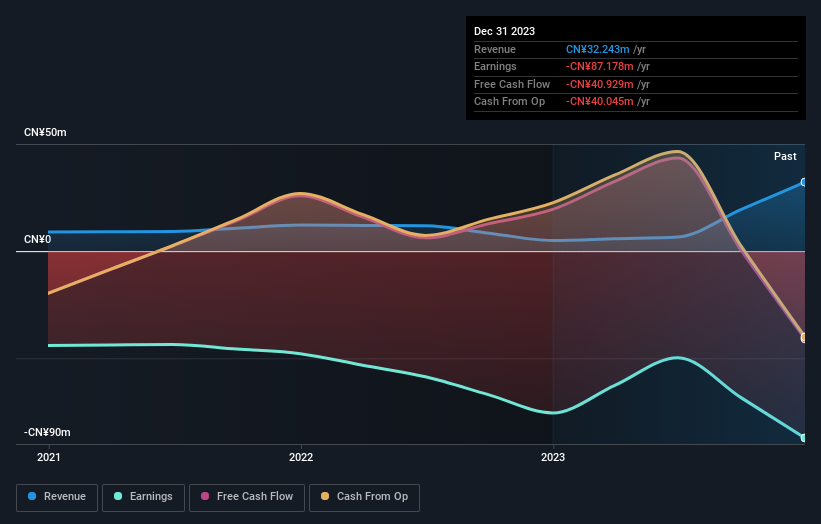

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. It might be well worthwhile taking a look at our free report on Wisdom Sports Group's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that Wisdom Sports Group shareholders have received a total shareholder return of 173% over one year. There's no doubt those recent returns are much better than the TSR loss of 8% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Wisdom Sports Group (at least 1 which makes us a bit uncomfortable) , and understanding them should be part of your investment process.

Wisdom Sports Group is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1661

China Frontier Technology Group

An investment holding company, engages in the provision of events operation and marketing services in the People’s Republic of China.

Slight with mediocre balance sheet.