Global markets have recently experienced a surge, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, driven by domestic policy shifts and geopolitical developments. Amidst these broader market movements, penny stocks remain an intriguing investment area for those seeking opportunities in smaller or less-established companies. While the term "penny stock" may seem outdated, it still signifies potential value in companies with strong financials and growth prospects.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.49 | MYR2.41B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.785 | A$143.12M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.40 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.90 | MYR290.45M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.23 | £840.18M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.96 | HK$43.83B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.58 | A$69.75M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £4.405 | £438.1M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £3.58 | £68.28M | ★★★★☆☆ |

Click here to see the full list of 5,692 stocks from our Penny Stocks screener.

We'll examine a selection from our screener results.

Meitu (SEHK:1357)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Meitu, Inc., an investment holding company with a market cap of HK$12.97 billion, develops products to streamline image, video, and design production through beauty-related solutions in China and internationally.

Operations: The company's revenue is primarily derived from its Internet Business segment, which generated CN¥3.06 billion.

Market Cap: HK$12.97B

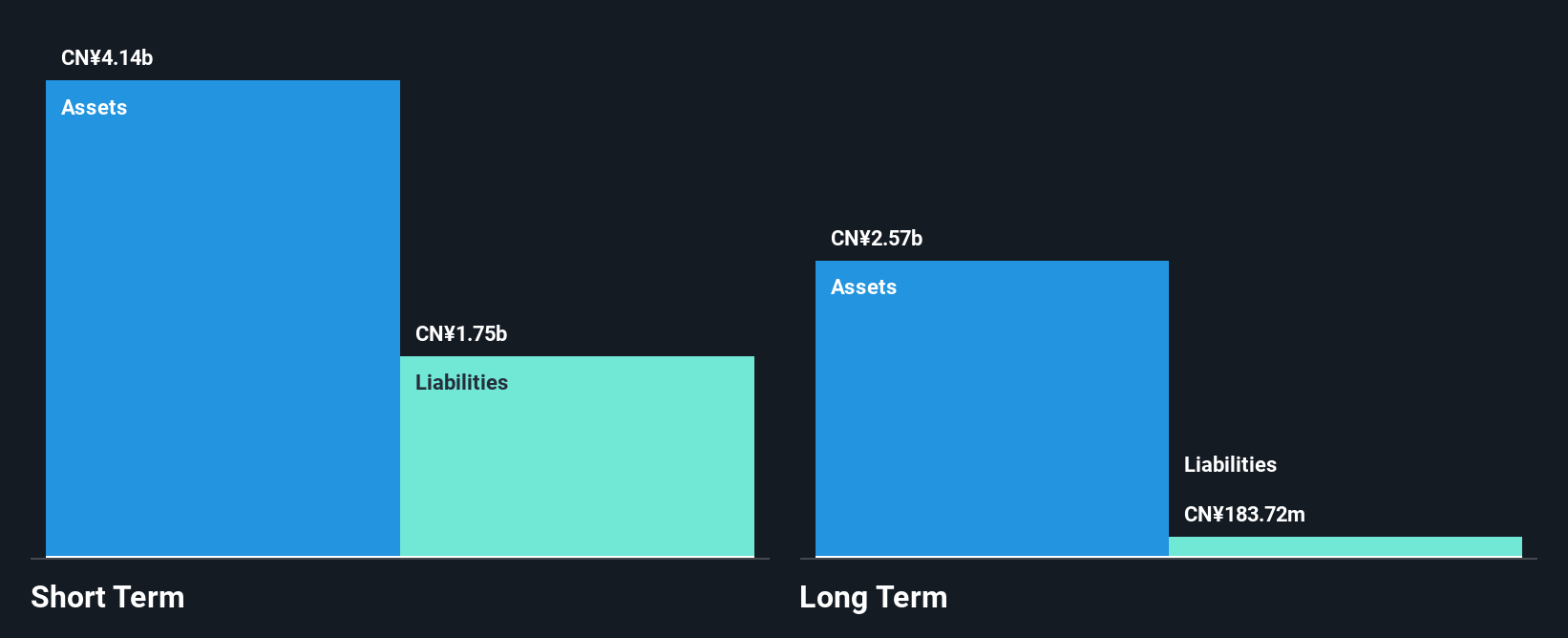

Meitu, Inc. has seen a decline in net profit margins from 24.8% to 14.9% over the past year, reflecting challenges despite its profitability over the last five years with earnings growing at an impressive rate of 73.5% annually. The company maintains strong financial health with more cash than debt and short-term assets exceeding liabilities, ensuring liquidity stability. Although insider selling was significant recently, Meitu's seasoned management and board offer stability amidst market volatility (11%). Analysts anticipate a stock price increase of about 34%, supported by forecasts of earnings growth at approximately 31.64% per year. A special dividend announcement further underscores shareholder value focus.

- Jump into the full analysis health report here for a deeper understanding of Meitu.

- Explore Meitu's analyst forecasts in our growth report.

IGG (SEHK:799)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IGG Inc is an investment holding company that develops and operates mobile and online games across Asia, North America, Europe, and internationally, with a market cap of HK$4.30 billion.

Operations: The company generates revenue of HK$5.50 billion from its development and operation of online games.

Market Cap: HK$4.3B

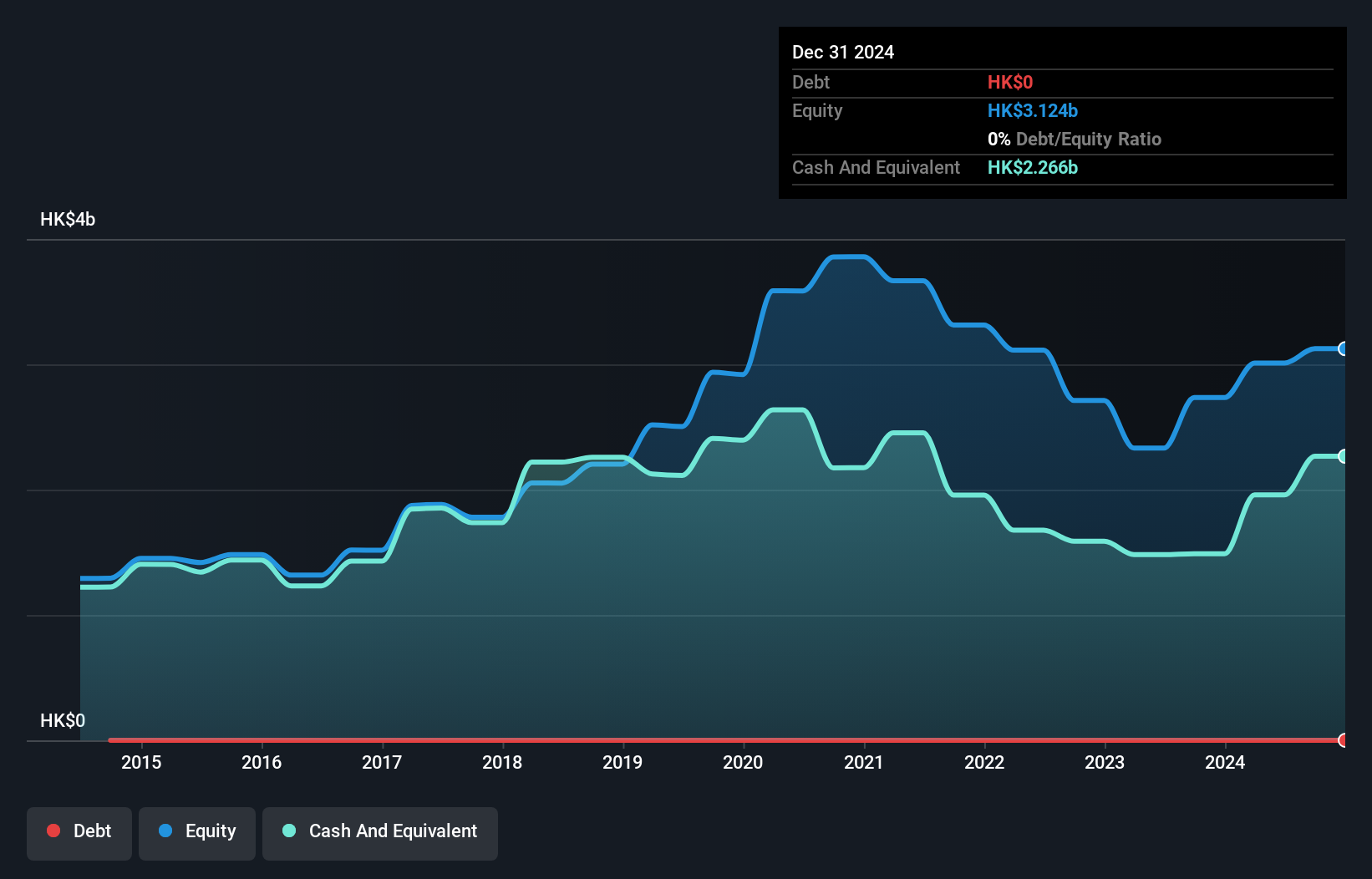

IGG Inc has achieved profitability this year, marking a significant turnaround as it previously experienced a 45.8% annual decline in earnings over the past five years. The company is trading at a substantial discount to its estimated fair value and maintains strong financial health with no debt and short-term assets exceeding both long-term and short-term liabilities. Recent share repurchase activities, authorized up to 10% of its issued capital, aim to enhance net asset value per share. Despite an unstable dividend track record, IGG's high return on equity reflects efficient use of shareholder funds.

- Dive into the specifics of IGG here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into IGG's future.

Hong Leong Asia (SGX:H22)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Hong Leong Asia Ltd. is an investment holding company engaged in manufacturing and distributing powertrain solutions, building materials, and rigid packaging products across China, Singapore, Malaysia, and internationally with a market cap of SGD613.34 million.

Operations: The company's revenue is primarily derived from Powertrain Solutions at SGD3.57 billion and Building Materials at SGD665.81 million.

Market Cap: SGD613.34M

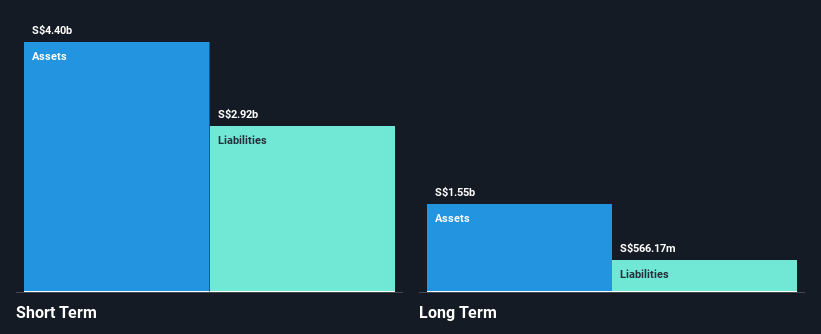

Hong Leong Asia Ltd. demonstrates a solid financial position with short-term assets of SGD4.4 billion surpassing both its long-term liabilities of SGD566.2 million and short-term liabilities of SGD2.9 billion, indicating robust liquidity management. The company has more cash than total debt, and its interest payments are well covered by EBIT. Earnings have grown significantly by 94.4% over the past year, outpacing the industry average, and profit margins have improved from 1.1% to 2%. While trading at a good value relative to peers, Hong Leong Asia's return on equity remains low at 6%, suggesting room for improvement in capital efficiency.

- Unlock comprehensive insights into our analysis of Hong Leong Asia stock in this financial health report.

- Gain insights into Hong Leong Asia's future direction by reviewing our growth report.

Make It Happen

- Unlock our comprehensive list of 5,692 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hong Leong Asia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H22

Hong Leong Asia

An investment holding company, manufactures and distributes powertrain solutions and related products, building materials, and rigid packaging products in the People’s Republic of China, Singapore, Malaysia, and internationally.

Undervalued with solid track record.