- Hong Kong

- /

- Interactive Media and Services

- /

- SEHK:1357

Asian Market Stocks That May Be Trading Below Estimated Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed economic signals and geopolitical developments, the Asian market remains a focal point for investors seeking opportunities amid shifting trade dynamics and monetary policies. In this environment, identifying stocks that may be trading below their estimated intrinsic value can offer potential avenues for growth, especially as regional economies adjust to evolving global conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimicron Technology (TWSE:3037) | NT$178.50 | NT$356.20 | 49.9% |

| Tibet Tianlu (SHSE:600326) | CN¥12.46 | CN¥24.52 | 49.2% |

| TESEC (TSE:6337) | ¥2101.00 | ¥4157.22 | 49.5% |

| TaewoongLtd (KOSDAQ:A044490) | ₩30150.00 | ₩60215.53 | 49.9% |

| Selvas AI (KOSDAQ:A108860) | ₩14560.00 | ₩28707.45 | 49.3% |

| Mobvista (SEHK:1860) | HK$18.92 | HK$37.79 | 49.9% |

| Meitu (SEHK:1357) | HK$9.23 | HK$18.23 | 49.4% |

| DuChemBIOLtd (KOSDAQ:A176750) | ₩8990.00 | ₩17681.61 | 49.2% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥64.24 | CN¥128.02 | 49.8% |

| Andes Technology (TWSE:6533) | NT$266.50 | NT$528.49 | 49.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

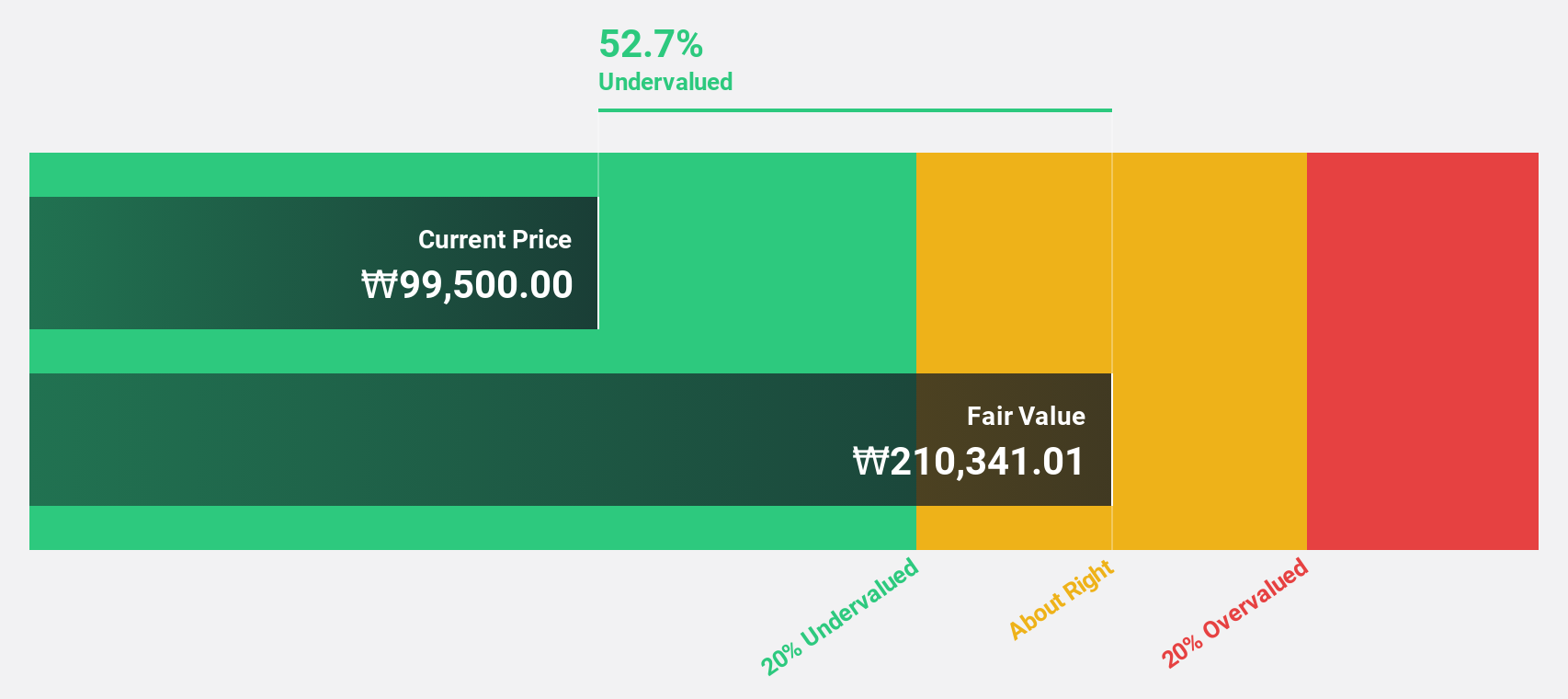

Samsung Electronics (KOSE:A005930)

Overview: Samsung Electronics Co., Ltd. operates globally in consumer electronics, information technology and mobile communications, and device solutions, with a market cap of approximately ₩723.16 trillion.

Operations: The company's revenue segments include SDC at ₩28.52 billion, Harman at ₩15.12 billion, and Device Solutions (DS) at ₩116.20 billion.

Estimated Discount To Fair Value: 42.3%

Samsung Electronics appears undervalued, trading at 42.3% below its estimated fair value of ₩192,426.57, despite forecasted annual earnings growth of 27.94%. Recent strategic alliances with NVIDIA for AI-driven semiconductor manufacturing may enhance operational efficiency and cash flows. However, the company faces legal challenges with a $191.4 million patent infringement verdict against it and other substantial liabilities totaling $524 million from previous cases, which could impact future cash flow stability.

- Our expertly prepared growth report on Samsung Electronics implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Samsung Electronics with our comprehensive financial health report here.

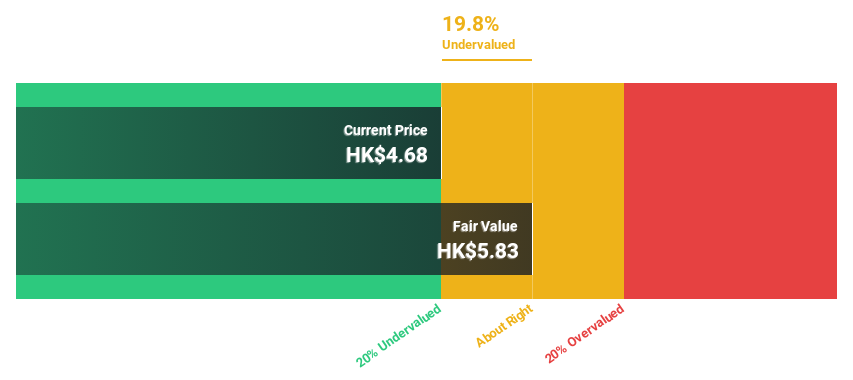

Meitu (SEHK:1357)

Overview: Meitu, Inc. is an investment holding company that develops and provides photo, video, and design products along with other AI-powered solutions in Mainland China and internationally, with a market cap of approximately HK$42.15 billion.

Operations: The company's revenue primarily comes from its Internet Business segment, generating approximately CN¥3.54 billion.

Estimated Discount To Fair Value: 49.4%

Meitu, Inc. is trading at HK$9.23, significantly below its estimated fair value of HK$18.23, presenting a potential undervaluation based on discounted cash flows. The company's earnings are expected to grow substantially over the next three years, outpacing the Hong Kong market's growth rate. Recent inclusion in the FTSE All-World Index and consistent revenue growth further bolster investor confidence despite a low projected return on equity and large one-off items affecting financial results.

- Upon reviewing our latest growth report, Meitu's projected financial performance appears quite optimistic.

- Dive into the specifics of Meitu here with our thorough financial health report.

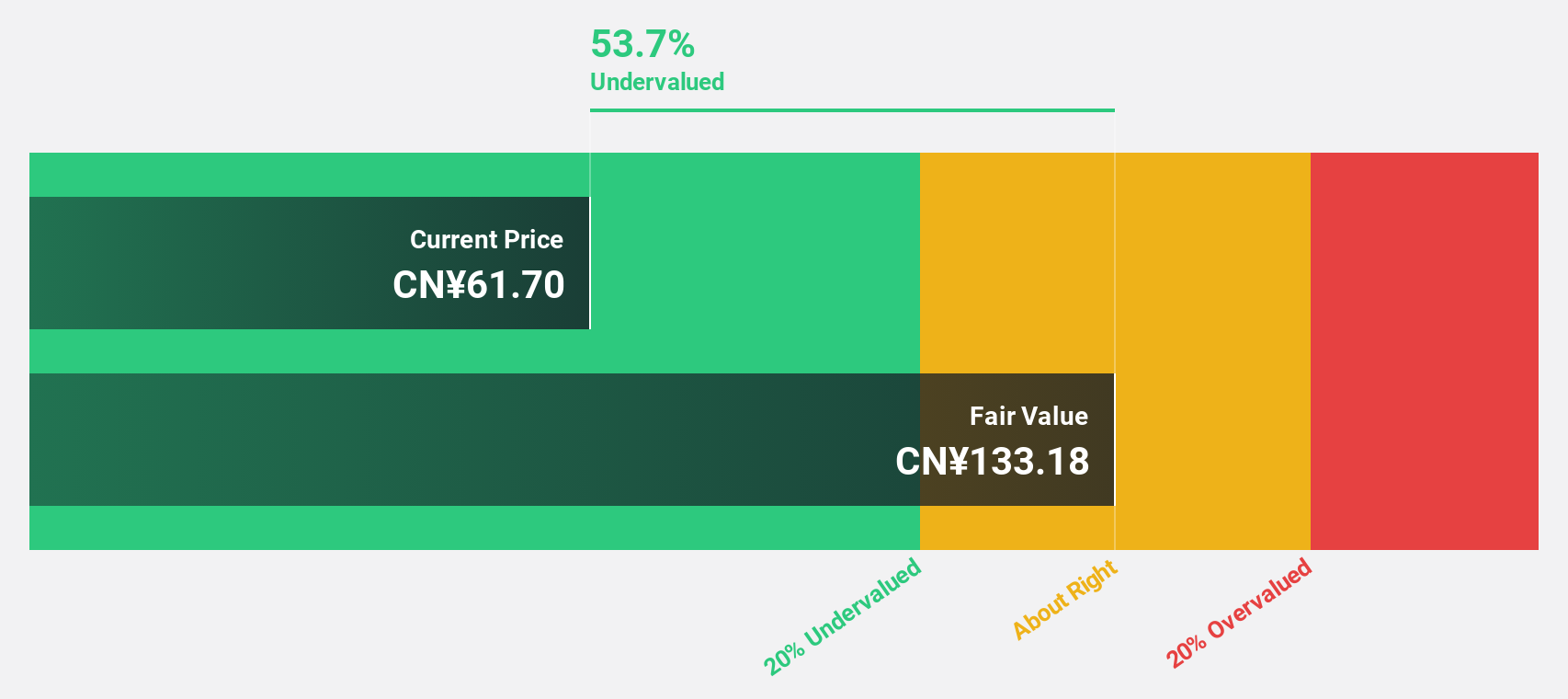

Dizal (Jiangsu) Pharmaceutical (SHSE:688192)

Overview: Dizal (Jiangsu) Pharmaceutical Co., Ltd. focuses on discovering, developing, and commercializing medicines for cancer and immunological diseases, with a market cap of CN¥29.51 billion.

Operations: Dizal (Jiangsu) Pharmaceutical Co., Ltd. generates its revenue from the discovery, development, and commercialization of medicines targeting cancer and immunological diseases.

Estimated Discount To Fair Value: 49.8%

Dizal (Jiangsu) Pharmaceutical is trading at CN¥64.24, significantly below its estimated fair value of CN¥128.02, highlighting potential undervaluation based on discounted cash flows. The company's revenue is forecast to grow 38.4% annually, outpacing the broader Chinese market and indicating strong future prospects despite current net losses. Recent FDA approvals for key drugs like ZEGFROVY® enhance its growth potential, although profitability remains a challenge in the short term.

- According our earnings growth report, there's an indication that Dizal (Jiangsu) Pharmaceutical might be ready to expand.

- Get an in-depth perspective on Dizal (Jiangsu) Pharmaceutical's balance sheet by reading our health report here.

Where To Now?

- Discover the full array of 270 Undervalued Asian Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1357

Meitu

An investment holding company, engages in the development and provision of products that streamline the production of photo, video, and design with other AI-powered products in Mainland China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives