- Hong Kong

- /

- Real Estate

- /

- SEHK:1995

Top 3 Undervalued Small Caps With Insider Buys In Hong Kong August 2024

Reviewed by Simply Wall St

The Hong Kong market has seen a mixed performance recently, with the Hang Seng Index declining slightly amid weak manufacturing data. Despite broader market challenges, opportunities still exist within the small-cap sector, particularly those showing signs of insider buying. In this environment, identifying undervalued small-cap stocks with significant insider activity can be a strategic approach for investors looking to capitalize on potential growth and resilience in the face of economic headwinds.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Ever Sunshine Services Group | 5.6x | 0.4x | 36.66% | ★★★★★☆ |

| Lee & Man Paper Manufacturing | 6.6x | 0.4x | 36.87% | ★★★★★☆ |

| Wasion Holdings | 11.0x | 0.8x | 42.13% | ★★★★☆☆ |

| Kinetic Development Group | 4.2x | 1.8x | 26.35% | ★★★★☆☆ |

| iDreamSky Technology Holdings | NA | 1.8x | 46.86% | ★★★★☆☆ |

| FriendTimes | NA | 0.9x | 14.69% | ★★★★☆☆ |

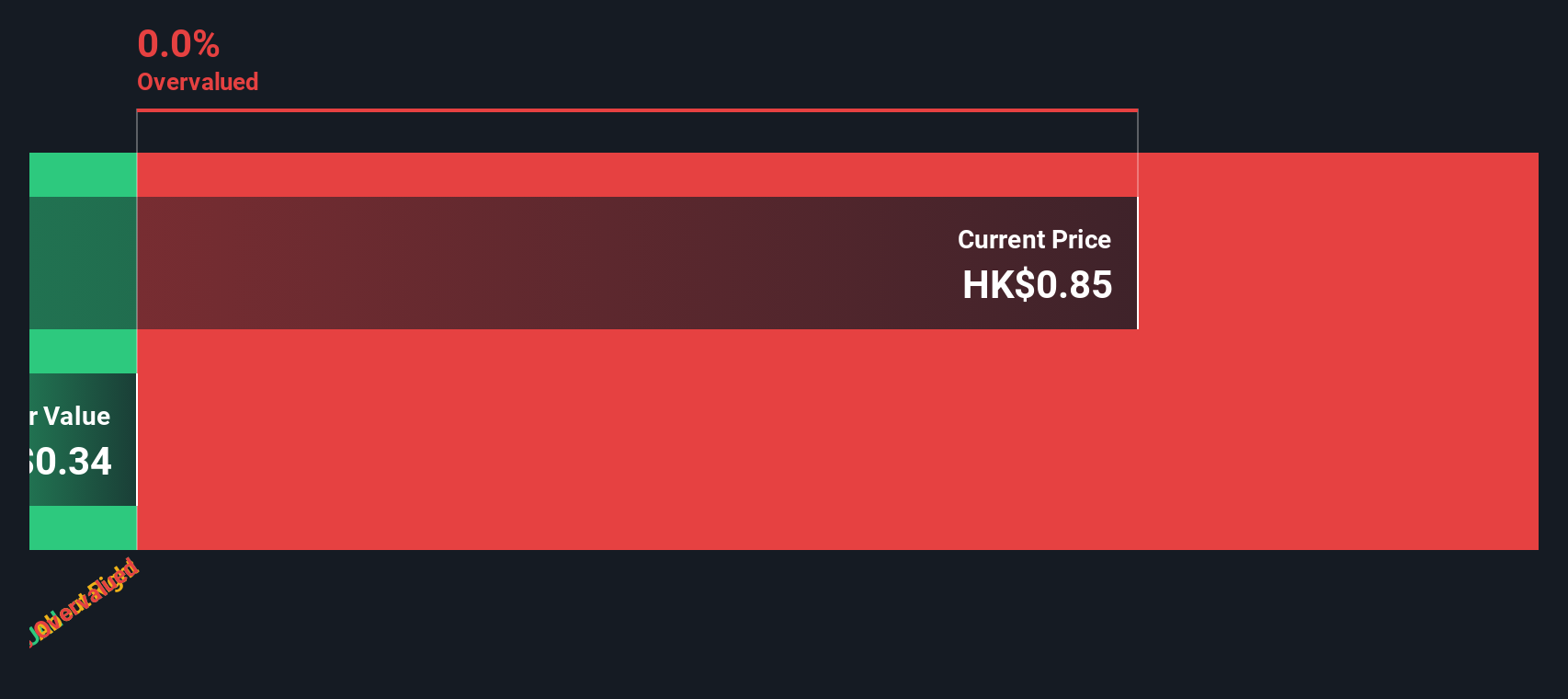

| Skyworth Group | 5.3x | 0.1x | -237.02% | ★★★☆☆☆ |

| Nissin Foods | 13.5x | 1.2x | 42.27% | ★★★☆☆☆ |

| China Leon Inspection Holding | 9.6x | 0.7x | 37.53% | ★★★☆☆☆ |

| Truly International Holdings | 11.9x | 0.2x | 40.70% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

iDreamSky Technology Holdings (SEHK:1119)

Simply Wall St Value Rating: ★★★★☆☆

Overview: iDreamSky Technology Holdings is a company engaged in game and information services, including SaaS and other related services, with a market cap of approximately CN¥2.50 billion.

Operations: iDreamSky Technology Holdings generates revenue primarily from Game and Information Services, including SaaS and other related services. As of December 31, 2023, the company reported a gross profit margin of 35.14%.

PE: -7.6x

iDreamSky Technology Holdings, a small cap in Hong Kong, recently completed a follow-on equity offering worth HK$257.68 million on July 31, 2024. This move follows insider confidence shown by Xiangyu Chen's purchase of 1.08 million shares for approximately HK$2.97 million earlier this year, reflecting potential growth prospects. Earnings are forecasted to grow over 104% annually despite the higher risk from external borrowing and past shareholder dilution. The company's strategic maneuvers and projected earnings growth indicate promising future potential within its industry context.

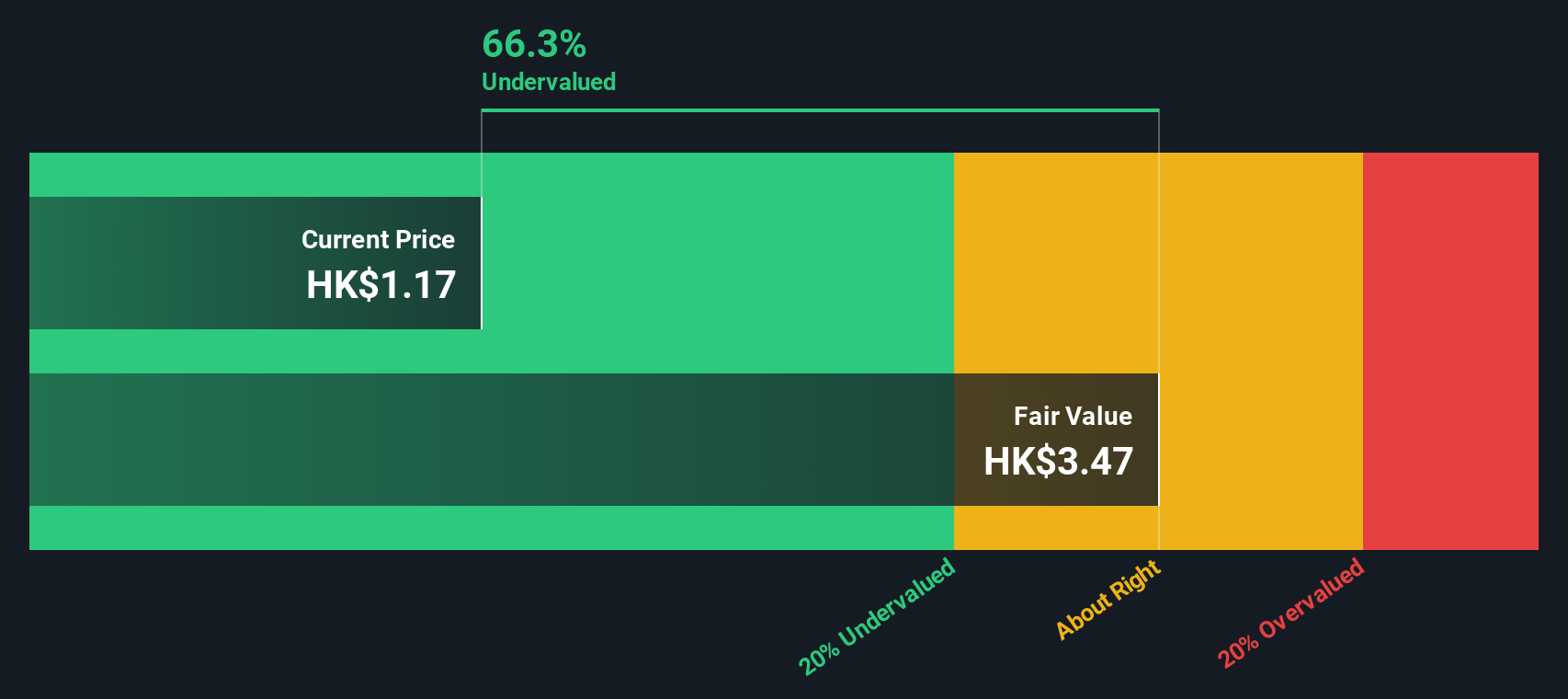

Kinetic Development Group (SEHK:1277)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Kinetic Development Group is an investment holding company engaged in the development, sale, and leasing of properties with a market cap of CN¥2.35 billion.

Operations: Kinetic Development Group primarily generates revenue through its core business operations, with a notable trend in its gross profit margin reaching 0.67349% as of March 31, 2022. The company’s cost of goods sold (COGS) and operating expenses are significant factors impacting profitability, with COGS consistently representing a substantial portion of total revenue.

PE: 4.2x

Kinetic Development Group, a small cap in Hong Kong, has caught attention for its undervalued status. Recent insider confidence is evident with significant share purchases by key executives over the past six months. The company focuses on innovative technology solutions and has shown resilience despite market volatility. With external borrowing as their primary funding source, they face higher risk but also potential high rewards if their strategic initiatives succeed. Future growth hinges on successful execution of these strategies amidst competitive pressures.

- Click here and access our complete valuation analysis report to understand the dynamics of Kinetic Development Group.

Understand Kinetic Development Group's track record by examining our Past report.

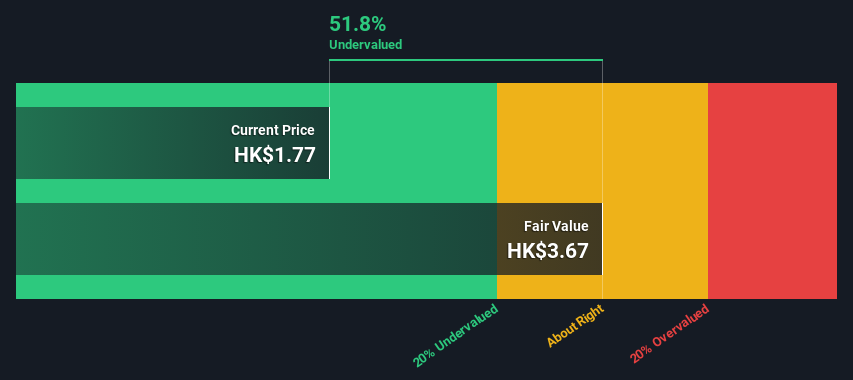

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ever Sunshine Services Group provides property management services and has a market cap of approximately CN¥14.56 billion.

Operations: Ever Sunshine Services Group generates revenue primarily from property management services, with recent figures showing CN¥6.54 billion in revenue. The company's net profit margin has shown variability, most recently at 6.65%.

PE: 5.6x

Ever Sunshine Services Group is gaining attention as an undervalued stock in Hong Kong's market. President Hongbin Zhou's recent insider confidence, demonstrated by purchasing 2.5 million shares for HK$3.39 million, signals strong belief in the company's potential. The firm has commenced a share repurchase program authorized to buy back up to 174.9 million shares, aiming to enhance net asset value and earnings per share. Additionally, the company declared a final dividend of HK$0.0914 per share for 2023 at its June AGM.

- Get an in-depth perspective on Ever Sunshine Services Group's performance by reading our valuation report here.

Learn about Ever Sunshine Services Group's historical performance.

Turning Ideas Into Actions

- Access the full spectrum of 13 Undervalued SEHK Small Caps With Insider Buying by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ever Sunshine Services Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1995

Ever Sunshine Services Group

An investment holding company, provides property management services in the People's Republic of China.

Flawless balance sheet, undervalued and pays a dividend.