Is Changmao Biochemical Engineering Company Limited's (HKG:954) P/E Ratio Really That Good?

This article is for investors who would like to improve their understanding of price to earnings ratios (P/E ratios). We'll apply a basic P/E ratio analysis to Changmao Biochemical Engineering Company Limited's (HKG:954), to help you decide if the stock is worth further research. Changmao Biochemical Engineering has a P/E ratio of 5.2, based on the last twelve months. That is equivalent to an earnings yield of about 19%.

Check out our latest analysis for Changmao Biochemical Engineering

How Do I Calculate A Price To Earnings Ratio?

The formula for price to earnings is:

Price to Earnings Ratio = Share Price (in reporting currency) ÷ Earnings per Share (EPS)

Or for Changmao Biochemical Engineering:

P/E of 5.2 = CN¥0.77 (Note: this is the share price in the reporting currency, namely, CNY ) ÷ CN¥0.15 (Based on the year to June 2019.)

Is A High P/E Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each HK$1 the company has earned over the last year. That is not a good or a bad thing per se, but a high P/E does imply buyers are optimistic about the future.

How Does Changmao Biochemical Engineering's P/E Ratio Compare To Its Peers?

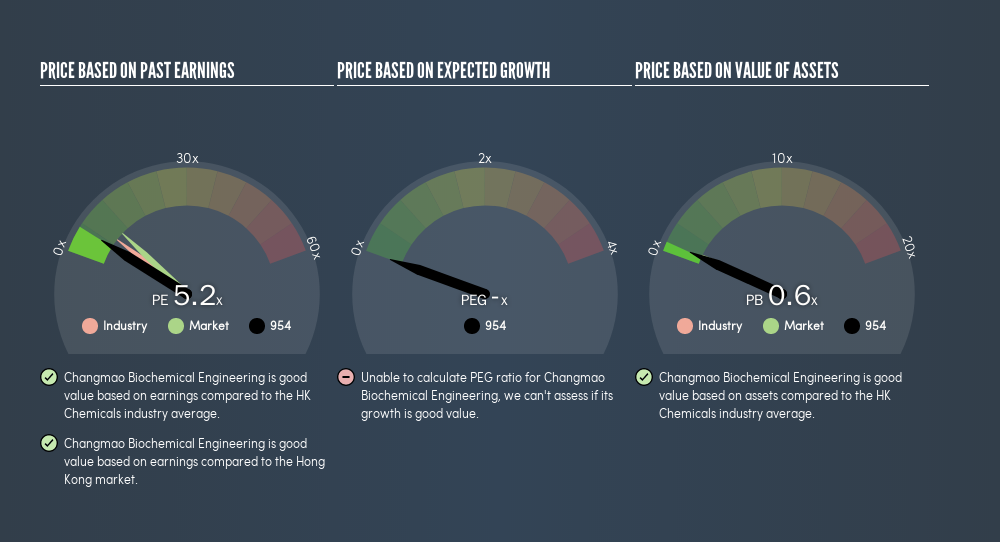

One good way to get a quick read on what market participants expect of a company is to look at its P/E ratio. We can see in the image below that the average P/E (7.7) for companies in the chemicals industry is higher than Changmao Biochemical Engineering's P/E.

Changmao Biochemical Engineering's P/E tells us that market participants think it will not fare as well as its peers in the same industry.

How Growth Rates Impact P/E Ratios

Probably the most important factor in determining what P/E a company trades on is the earnings growth. Earnings growth means that in the future the 'E' will be higher. That means unless the share price increases, the P/E will reduce in a few years. A lower P/E should indicate the stock is cheap relative to others -- and that may attract buyers.

Changmao Biochemical Engineering's earnings made like a rocket, taking off 365% last year. Even better, EPS is up 16% per year over three years. So you might say it really deserves to have an above-average P/E ratio.

A Limitation: P/E Ratios Ignore Debt and Cash In The Bank

The 'Price' in P/E reflects the market capitalization of the company. That means it doesn't take debt or cash into account. Theoretically, a business can improve its earnings (and produce a lower P/E in the future) by investing in growth. That means taking on debt (or spending its cash).

Such spending might be good or bad, overall, but the key point here is that you need to look at debt to understand the P/E ratio in context.

So What Does Changmao Biochemical Engineering's Balance Sheet Tell Us?

Changmao Biochemical Engineering has net cash of CN¥96m. This is fairly high at 23% of its market capitalization. That might mean balance sheet strength is important to the business, but should also help push the P/E a bit higher than it would otherwise be.

The Bottom Line On Changmao Biochemical Engineering's P/E Ratio

Changmao Biochemical Engineering's P/E is 5.2 which is below average (9.9) in the HK market. It grew its EPS nicely over the last year, and the healthy balance sheet implies there is more potential for growth. The below average P/E ratio suggests that market participants don't believe the strong growth will continue.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. We don't have analyst forecasts, but shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Of course you might be able to find a better stock than Changmao Biochemical Engineering. So you may wish to see this free collection of other companies that have grown earnings strongly.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:954

Changmao Biochemical Engineering

Produces and sells organic acids for food additive, chemical, and pharmaceutical industries in Mainland China, Europe, the Asia Pacific, the United States, and internationally.

Low and slightly overvalued.

Market Insights

Community Narratives