- Hong Kong

- /

- Metals and Mining

- /

- SEHK:826

Tiangong International's (HKG:826) Dividend Will Be Reduced To CN¥0.04

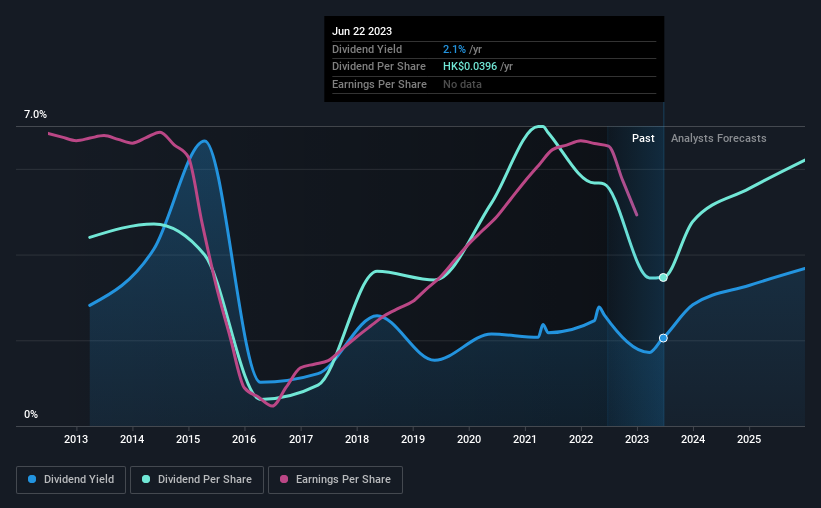

Tiangong International Company Limited's (HKG:826) dividend is being reduced from last year's payment covering the same period to CN¥0.04 on the 14th of July. Based on this payment, the dividend yield will be 2.1%, which is lower than the average for the industry.

Check out our latest analysis for Tiangong International

Tiangong International's Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Tiangong International is quite easily earning enough to cover the dividend, however it is being let down by weak cash flows. With the company not bringing in any cash, paying out to shareholders is bound to become difficult at some point.

The next year is set to see EPS grow by 78.9%. If the dividend continues on this path, the payout ratio could be 13% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the dividend has gone from CN¥0.0461 total annually to CN¥0.0363. Doing the maths, this is a decline of about 2.4% per year. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Dividend Looks Likely To Grow

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. We are encouraged to see that Tiangong International has grown earnings per share at 19% per year over the past five years. With a decent amount of growth and a low payout ratio, we think this bodes well for Tiangong International's prospects of growing its dividend payments in the future.

In Summary

Overall, the dividend looks like it may have been a bit high, which explains why it has now been cut. While Tiangong International is earning enough to cover the payments, the cash flows are lacking. We would probably look elsewhere for an income investment.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. Now, if you want to look closer, it would be worth checking out our free research on Tiangong International management tenure, salary, and performance. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Tiangong International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:826

Tiangong International

Manufactures and sells alloy steel, cutting tools, titanium alloys, and related products.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives