- Hong Kong

- /

- Metals and Mining

- /

- SEHK:769

Shareholders in China Rare Earth Holdings (HKG:769) have lost 61%, as stock drops 13% this past week

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term China Rare Earth Holdings Limited (HKG:769) shareholders have had a particularly rough ride in the last three year. Sadly for them, the share price is down 61% in that time. And more recent buyers are having a tough time too, with a drop of 48% in the last year. Furthermore, it's down 25% in about a quarter. That's not much fun for holders.

With the stock having lost 13% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for China Rare Earth Holdings

China Rare Earth Holdings isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, China Rare Earth Holdings' revenue dropped 11% per year. That is not a good result. With revenue in decline, and profit but a dream, we can understand why the share price has been declining at 17% per year. Of course, it's the future that will determine whether today's price is a good one. We'd be pretty wary of this one until it makes a profit, because we don't specialize in finding turnaround situations.

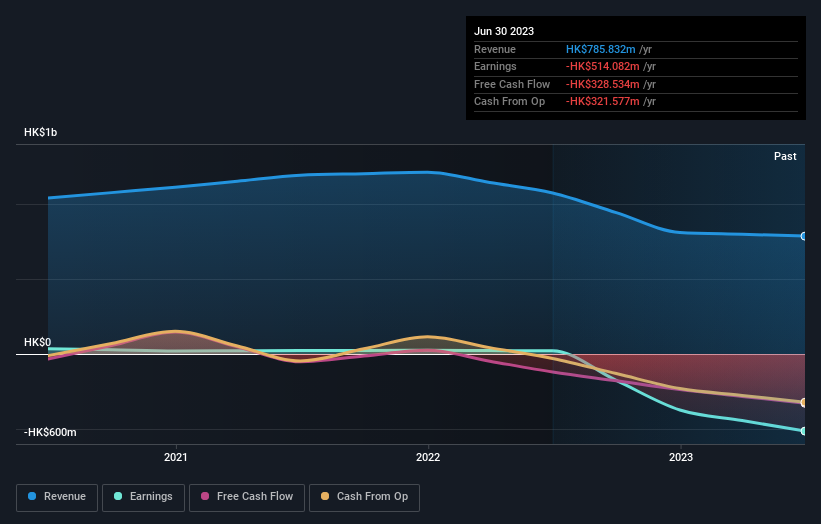

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of China Rare Earth Holdings' earnings, revenue and cash flow.

A Different Perspective

We regret to report that China Rare Earth Holdings shareholders are down 48% for the year. Unfortunately, that's worse than the broader market decline of 21%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 1.6% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for China Rare Earth Holdings you should be aware of, and 1 of them makes us a bit uncomfortable.

We will like China Rare Earth Holdings better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:769

China Rare Earth Holdings

An investment holding company, engages in manufacturing and selling rare earth products and refractory products in the People’s Republic of China, Japan, Europe, and internationally.

Flawless balance sheet very low.