- Hong Kong

- /

- Basic Materials

- /

- SEHK:695

Some Shareholders May Object To A Pay Rise For Dongwu Cement International Limited's (HKG:695) CEO This Year

Key Insights

- Dongwu Cement International's Annual General Meeting to take place on 22nd of May

- CEO Junxian Wu's total compensation includes salary of HK$442.0k

- The overall pay is 63% below the industry average

- Dongwu Cement International's EPS declined by 73% over the past three years while total shareholder loss over the past three years was 48%

The disappointing performance at Dongwu Cement International Limited (HKG:695) will make some shareholders rather disheartened. At the upcoming AGM on 22nd of May, shareholders may have the opportunity to influence management to turn the performance around by voting on resolutions such as executive remuneration and other matters. From our analysis below, we think CEO compensation looks appropriate for now.

Check out our latest analysis for Dongwu Cement International

How Does Total Compensation For Junxian Wu Compare With Other Companies In The Industry?

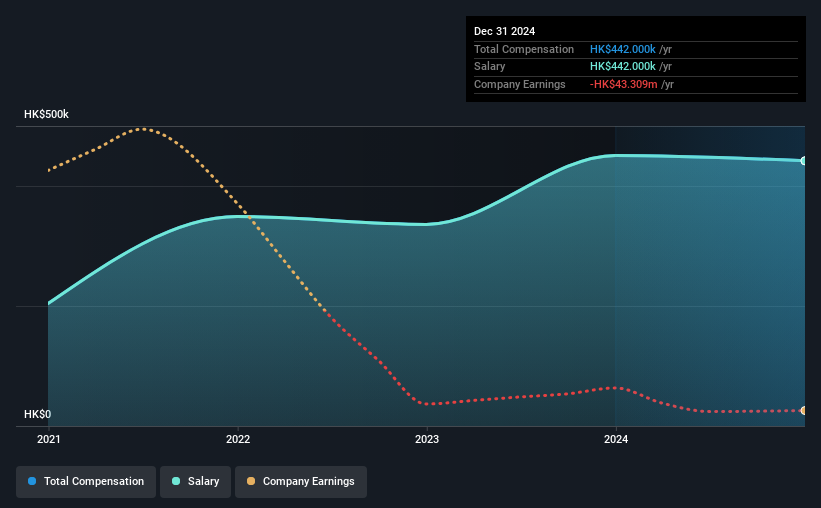

According to our data, Dongwu Cement International Limited has a market capitalization of HK$1.2b, and paid its CEO total annual compensation worth HK$442k over the year to December 2024. That's mostly flat as compared to the prior year's compensation. Notably, the salary of HK$442k is the entirety of the CEO compensation.

In comparison with other companies in the Hong Kong Basic Materials industry with market capitalizations ranging from HK$781m to HK$3.1b, the reported median CEO total compensation was HK$1.2m. That is to say, Junxian Wu is paid under the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | HK$442k | HK$451k | 100% |

| Other | - | - | - |

| Total Compensation | HK$442k | HK$451k | 100% |

On an industry level, around 83% of total compensation represents salary and 17% is other remuneration. At the company level, Dongwu Cement International pays Junxian Wu solely through a salary, preferring to go down a conventional route. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Dongwu Cement International Limited's Growth

Over the last three years, Dongwu Cement International Limited has shrunk its earnings per share by 73% per year. In the last year, its revenue is down 27%.

Overall this is not a very positive result for shareholders. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Dongwu Cement International Limited Been A Good Investment?

Few Dongwu Cement International Limited shareholders would feel satisfied with the return of -48% over three years. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Dongwu Cement International pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Dongwu Cement International that investors should think about before committing capital to this stock.

Switching gears from Dongwu Cement International, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:695

Dongwu Cement International

An investment holding company, engages in production and sale of cement under the Dongwu brand name in the People’s Republic of China.

Mediocre balance sheet with minimal risk.

Market Insights

Community Narratives