- Hong Kong

- /

- Metals and Mining

- /

- SEHK:639

Getting In Cheap On Shougang Fushan Resources Group Limited (HKG:639) Is Unlikely

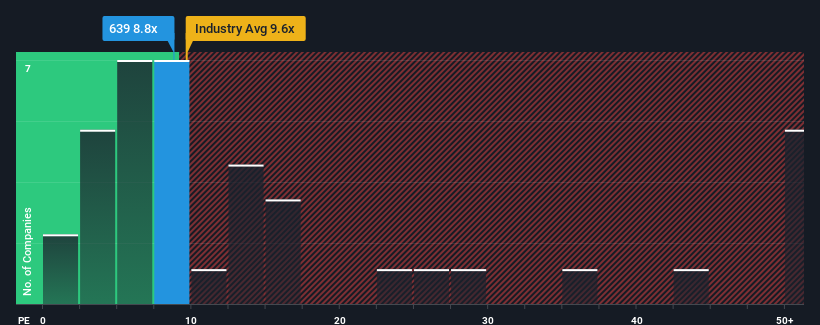

There wouldn't be many who think Shougang Fushan Resources Group Limited's (HKG:639) price-to-earnings (or "P/E") ratio of 8.8x is worth a mention when the median P/E in Hong Kong is similar at about 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, Shougang Fushan Resources Group's earnings have gone into reverse gear, which is not great. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Shougang Fushan Resources Group

Does Growth Match The P/E?

In order to justify its P/E ratio, Shougang Fushan Resources Group would need to produce growth that's similar to the market.

Retrospectively, the last year delivered a frustrating 35% decrease to the company's bottom line. Regardless, EPS has managed to lift by a handy 25% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the four analysts covering the company suggest earnings growth is heading into negative territory, declining 4.8% per year over the next three years. That's not great when the rest of the market is expected to grow by 12% per year.

In light of this, it's somewhat alarming that Shougang Fushan Resources Group's P/E sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the negative growth outlook.

The Bottom Line On Shougang Fushan Resources Group's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Shougang Fushan Resources Group currently trades on a higher than expected P/E for a company whose earnings are forecast to decline. When we see a poor outlook with earnings heading backwards, we suspect share price is at risk of declining, sending the moderate P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for Shougang Fushan Resources Group (1 makes us a bit uncomfortable!) that you should be aware of.

If these risks are making you reconsider your opinion on Shougang Fushan Resources Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:639

Shougang Fushan Resources Group

An investment holding company, engages in the business of coking coal mining and production and sales of coking coal products in the People's Republic of China.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives