- Hong Kong

- /

- Basic Materials

- /

- SEHK:6193

Tailam Tech Construction Holdings Limited's (HKG:6193) 31% Share Price Plunge Could Signal Some Risk

Unfortunately for some shareholders, the Tailam Tech Construction Holdings Limited (HKG:6193) share price has dived 31% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 35% share price drop.

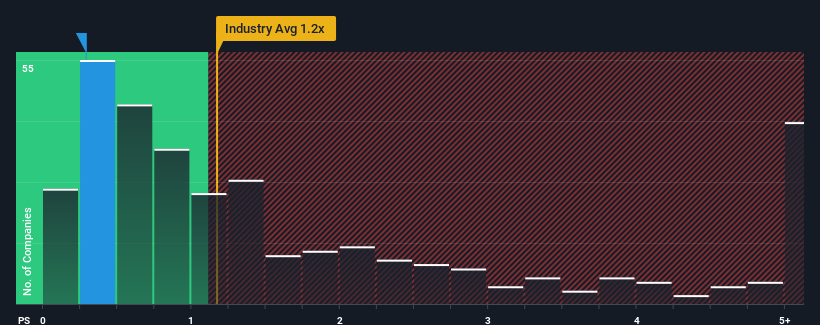

In spite of the heavy fall in price, there still wouldn't be many who think Tailam Tech Construction Holdings' price-to-sales (or "P/S") ratio of 0.3x is worth a mention when it essentially matches the median P/S in Hong Kong's Basic Materials industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Tailam Tech Construction Holdings

How Has Tailam Tech Construction Holdings Performed Recently?

For instance, Tailam Tech Construction Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tailam Tech Construction Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

In order to justify its P/S ratio, Tailam Tech Construction Holdings would need to produce growth that's similar to the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 25%. This means it has also seen a slide in revenue over the longer-term as revenue is down 43% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 0.7% shows the industry is more attractive on an annualised basis regardless.

With this information, it's perhaps strange that Tailam Tech Construction Holdings is trading at a fairly similar P/S in comparison. With revenue going quickly in reverse, it's not guaranteed that the P/S has found a floor yet. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

Tailam Tech Construction Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Tailam Tech Construction Holdings revealed its sharp three-year contraction in revenue isn't impacting its P/S as much as we would have predicted, given the industry is set to shrink less severely. When we see below average revenue, we suspect the share price is at risk of declining, sending the moderate P/S lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader industry turmoil. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Before you settle on your opinion, we've discovered 3 warning signs for Tailam Tech Construction Holdings (2 don't sit too well with us!) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Tailam Tech Construction Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6193

Tailam Tech Construction Holdings

An investment holding company, engages in the manufacture and sale of pre-stressed high-strength concrete piles, commercial concrete, and ceramsite concrete blocks in the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives